But the easy access to TikTok financial advice also promises to help young people actually understand their finances and avoid the many potential pitfalls of being young. After all, we don’t learn personal finance advice in school — even those who study finance as a career aren’t taught about personal finance.

What is FinTok? Why does Gen Z love FinTok?

A 2022 survey by the National Endowment for Financial Education revealed that only 14% of adults claimed to have access to financial education in high school. As a result, young people entering the workforce or trying to take the next steps in their lives and careers, find themselves not knowing how to make their salaries work for them. TikTok democratizes the best financial tips. No gatekeeping, just unfiltered advice. But not all of it is worth taking.

Betterment found that, in 2023, 65% of Gen Z and 55% of millennials get financial advice from social media. These generations have inherited an unpredictable and, frankly, disappointing economy where the benchmarks for success seem further away than ever. The retirement age is slowly getting pushed back, the weight of student loans feels like an inescapable burden, and the American dream of owning a house? Forget about it. Plus the looming threat of climate change and/or societal collapse makes young people wonder if there will even be a future to save for.

In the words of Timothee Chalamet: “It's tough to be alive now. I think societal collapse is in the air — it smells like it.”

Navigating the world of personal finance as a college student or early professional in this landscape seems daunting. It’s much more tempting to throw your hands up and focus on enjoying the moment rather than saving for a future that’s not promised. This might sound morbid, but Gen Z is having fun with it. Hence the rise of trends like “I can get my money back but I’ll never be young again,” or the ubiquity of “girl math” and little treats. While these impulses aren’t bad, when they’re paired with an avoidant relationship to your money, they can spiral into potentially ruinous circumstances. You don’t want to “little treat” yourself into mountains of credit card debt.

That’s why having a baseline understanding of personal finance is a crucial step toward financial independence. Don’t let the arrogant finance bro in your life tell you that you need to be day-trading stocks or investing in crypto. But also, don’t fall into the trap of avoiding looking at your bank account. Finance TikTok, aka FinTok, can offer valuable insights via personal finance videos if you approach it with a healthy dose of skepticism.

What is the benefit of FinTok?

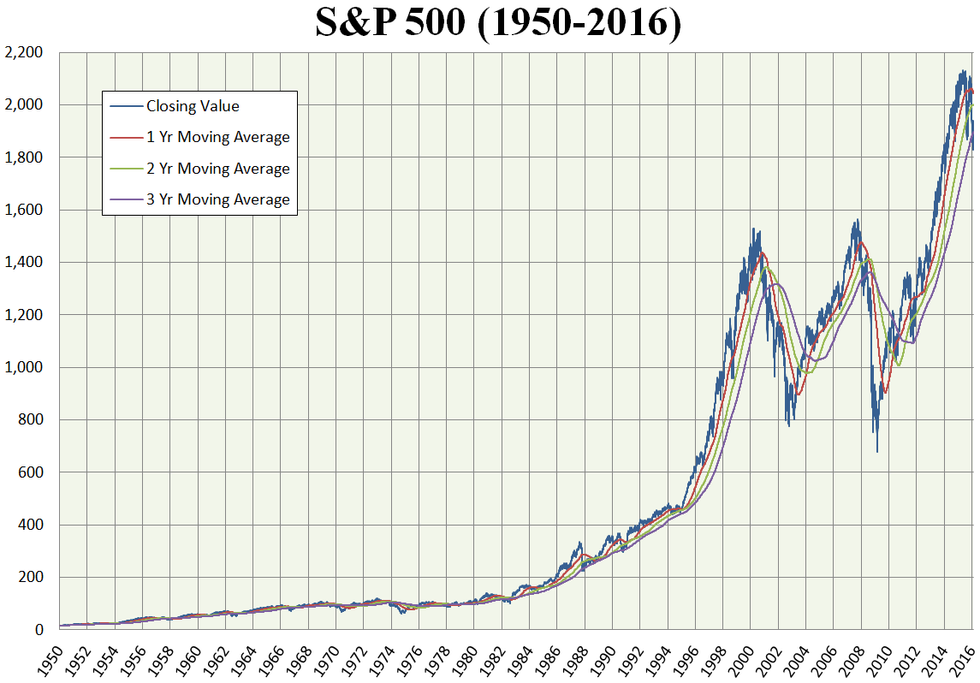

I like to think of FinTok as a launch point. Buzzwords like “HYSA” and “S&P 500” (we’ll get to those later) are quick tips that are most useful when paired with in-depth financial education. Whether you head online to read articles about the concepts TikTok feeds you — and find out which ones might just be MLMs — or you turn to audiobooks and podcasts (anything but Dave Ramsay, PLEASE), FinTok helps demystify your money in an accessible, unintimidating way.

TikTok finance advice also focuses on small steps you can make now to help set you up for your future. Instead of fear-mongering and telling you to cut out all pleasure until you have $100k in the bank, TikTok financial advice often revolves around tips that take less than an hour to complete but can ear you tens of thousands in the long run — seriously.

FinTok can also help you create financial goals. Instead of the generic “save more” New Year’s resolution, many creators are making trackers and teaching you how to use tools to get super clear on what your financial life could look like. And since Gen Z values freedom and autonomy more than any other generation, many of these creators are factoring that into their work. Instead of saving for traditional goalposts, they’re teaching you how to travel for free or how to afford designer items without going broke. With goals ranging from paying off student loans and building an emergency fund to dipping toes into the world of investments, FinTok has created a subculture where young people can find creators who have achieved the goals they want to and learn directly from them.

These influencers, often in their 20s or early 30s, share their financial journeys, tips, and pitfalls in a relatable context. Drawing from their lived experiences, popular creators are often self-made millionaires at 30 or savvy savers in their mid-20s. This phenomenon underscores a shift in the traditional paradigm of financial education. It also creates the problem of many creators spouting whatever nonsense that comes to their head — some of it even dubiously legal. So while you shouldn’t start necessarily start house-hacking like the unethical landlords of TikTok or writing off expenses you don’t qualify for on your taxes, TikTok is a great place to get beginner financial advice.

Surprisingly good financial basics popular on TikTok

TikTok helps you acknowledge the gaps in your financial knowledge. After all, you don’t know what you don’t know. Geared for basics and quick tips, the best TikTok financial advice helps you build a solid financial foundation. Lots of accounts end up saying the same thing because the basics are the basics. They’re pretty universal, and when they work, they work. So before you do anything else, try these tips.

Here is some of the best TikTok financial advice to guide your journey:

Budgeting doesn’t have to be boring:

TikTokers are rebranding the budget. Instead of telling you to skip out on everything that makes your life worth living, they are telling you that budgeting is just having a “spending plan” for your money. Think of it this way: most people know about how much money they have coming in, but most people don’t know where it goes. A budget comes in to help you plan how much money you want to allocate to your groceries and how much you want to spend on fun categories like eating out, getting coffee, and shopping. Without the shame of spending on fun and by breaking the stigma of budgeting, you can make a plan to live your life while still setting aside some savings.

Monthly (or weekly) money resets:

TikTok loves a reset. I binge the productive Sunday reset content while rotting in my bed on weekends. But one habit I have implemented is the money reset where I sit down, review my finances, and make a plan for the next month. This one goes hand in hand with budgeting. I review my budget against my purchases, see where I stuck to my guidelines, and make adjustments if necessary. It keeps me accountable and lowkey it gets me excited about reaching my goals. Current savings goal: save up for a luxury wellness vacation this summer.

@breakyourbudget

2023 is the year of financial consistency & routines #personalfinance

Sinking Funds:

I used to save all my money in one big savings account. It was connected to my checking account and I would dip into it more often than I like to admit. However, TikTok taught me about the concept of sinking funds or savings buckets. For example, many of us have different savings goals. We want to save for travel, but we also want to have some rainy-day cash in the bank. All of that money shouldn’t just be lumped together. Sinking funds help you visualize where your money is going. I set up direct deposit transfers to each of my sinking funds from every paycheck so I’m saving for my next holiday in a separate bucket as my pet insurance. They also help make big goals feel more achievable. For example, my goal for my travel sinking fund is $2000. I gave myself 20 weeks and each Friday, I automatically transfer $100 into the account. That way, I don’t spiral into credit card debt when it’s time to book my trip. Another pro tip: use an online bank separate from your checking account to store your sinking funds so it’s harder to dip into on a whim.

Emergency Fund:

Your most important savings account is an Emergency Fund aka a rainy day fund. An emergency fund provides a financial safety net that everyone should have. TikTokers harp on this one for a reason. It’s the difference between living paycheck to paycheck and being financially secure. Most Americans couldn’t cover a $1000 emergency. And in this economy, people lose their jobs in an instant. The pandemic taught us that. Aim to save at least three to six months of living expenses — which includes things like your rent, your grocery budget, and necessary bills, especially if you have dependents — and keep it in a high-yield savings account.

High Yield Saving Accounts (HYSA):

A HYSA is your savings account, but better. Big banks have no incentive to offer you rewards for opening a savings account with them. Smaller banks, usually digital banks, want to convert customers and they do it by offering interest on your savings account. Most big banks give you about 0.01% interest. Meanwhile, you could be earning up to 5% interest just for moving your money to a new bank. And if you have a $10,000 emergency fund earning $500 interest for doing nothing, that adds up.

@deeperthanmoney

No but like I NEED to know, do you have a HYSA???? if not comment “me” below and I will send you a link to a free training!!!

Making Investing Easy:

While investing might sound complex, robo-investing makes it easy. Many new platforms allow you to auto-invest in index funds and ETFs depending on your goals and risk tolerance. You can start with as little as $1. If this still sounds scary, TikTokers can help you understand the merits of investing early and wisely — just don’t take individual stock advice from random people on the internet.