Why You Should Join Workers From Amazon, Walmart, and FedEx in the May 1st General Strike

Apr 29 | 2020

genstrike.org

According to a report published in The Intercept on Tuesday, essential workers at major companies like Amazon, Walmart, Instacart, Target, Whole Foods, and FedEx are planning a walkout as part of a May Day general strike, fighting for workers’ rights.

A lot of Americans probably don’t know the history of May Day, or the fact that May 1st is known as International Workers’ Day—or Labour Day—in much of the world. That ignorance, and the fact that we have our own Labor Day in September, can best be understood as part of a deliberate effort to undermine class consciousness and solidarity in the US, and is all the more reason why more workers need to participate in Friday’s strike.

The power structures of our country have long maintained a hostile relationship toward labor and have successfully suppressed unionization and other efforts by workers to agitate for their rights. But this May 1st is the perfect time to correct that tendency and join the world in celebrating workers–because the historic event that International Workers’ Day commemorates took place here in America in 1886, and it upset the established hierarchy in a way that should serve as inspiration for people currently struggling to make ends meet.

Prior to 1886, May Day had traditionally been celebrated in European cultures with a variety of festivals celebrating spring, but that year American workers took the occasion as an opportunity to fight for their rights. A massive, nationwide work stoppage began on May 1st and continued for several days, with thousands of striking workers demonstrating in every major city. At the time, workers were often made to work long hours in dangerous conditions, and they were fighting for the eight-hour workday—so if you’ve ever gotten overtime pay, or just enjoyed clocking out at 5:00, then you have them to thank.

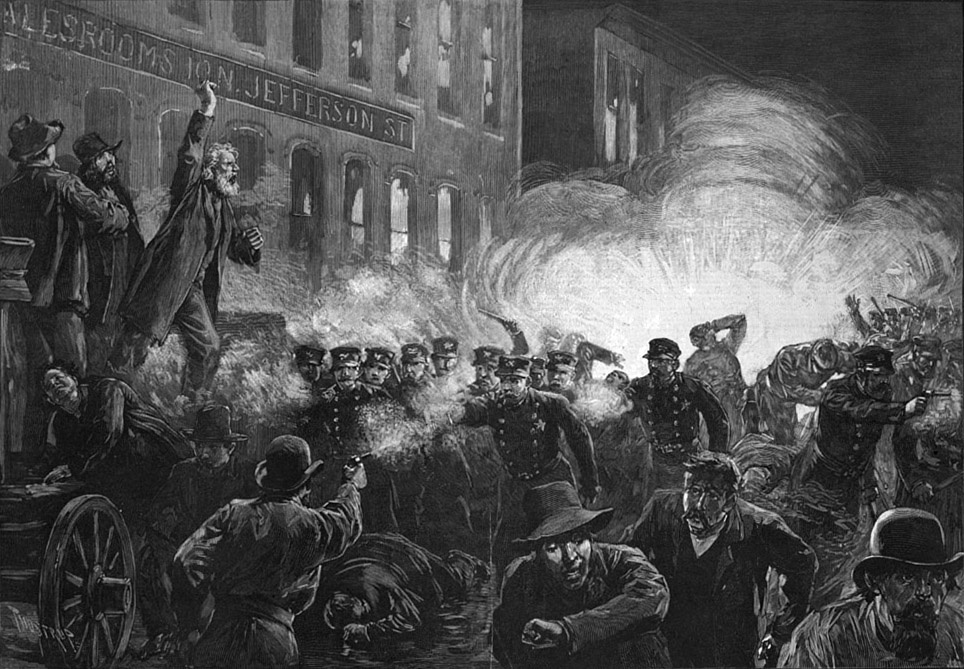

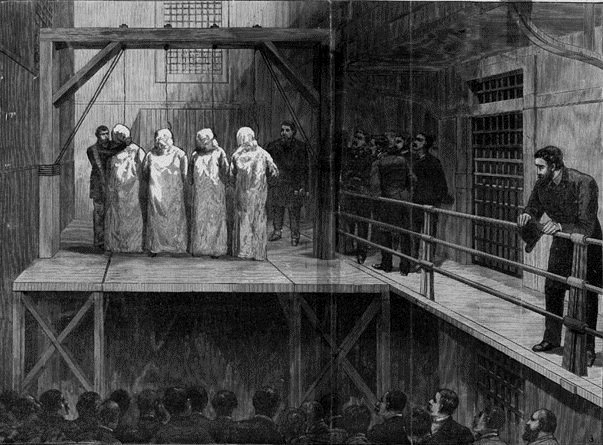

On May 3rd police efforts to quash the protests in Chicago resulted in at least one death and several injuries. The next day an unknown assailant came prepared. When police once more attempted to disperse the crowd in Haymarket Square with violent tactics, that person threw a dynamite bomb. The explosion and the ensuing gunfire killed seven police officers and at least four civilians. Dozens more were badly hurt. Police then rounded up hundreds of organizers, and four men—none of whom had thrown the bomb—were hanged after a lengthy, internationally publicized trial.

It would take another 30 years of fighting before a federal law established an eight-hour workday for any private industry—and even longer before FDR’s administration made it standard across most types of work. But those four men became martyrs for the cause of workers’ rights and galvanized people around the world to take action. According to historian William J. Adelman, “No single event has influenced the history of labor in Illinois, the United States, and even the world, more than the Chicago Haymarket Affair,” yet few Americans are aware of these events or the holiday they spawned. While the violence and death that took place back then was obviously regrettable—and no one should be hoping for its recurrence—we are about due for another turning point in labor history.

The cracks in our system are being exposed like never before, and millions are falling through. Tens of millions of Americans find themselves suddenly unemployed or underemployed. Shockingly few have been able to sign up for unemployment benefits, and the federal government’s $1,200 checks are being treated as a long-term cure-all. People aren’t making money, yet most of them are still expected to pay their rent in full, and many have lost their health insurance amid a viral pandemic. It’s no wonder people are protesting for their states to reopen; but seeing as that would plainly backfire (and is a push being secretly driven by wealthy backers who won’t have to risk their lives), we need to direct that energy toward measures that would help.

ABC

ABC

Meanwhile, many of the people who never stopped working—in healthcare, retail, food service, and other industries deemed “essential”—are being asked to risk their lives working without safety equipment, hazard pay, or even adequate sick leave. These conditions would be unacceptable at the best of times, but now—at the worst of times—we have no choice but to fight back and demand immediate relief and lasting reforms.

A rent strike is a good start, but a general strike—in which workers across industries and around the country participate—sends a real message. So if it’s at all possible for you to join the general strike on Friday, May 1st, and/or participate in a (safe, socially-distant) demonstration, consider what you’d be fighting for: A rent and mortgage freeze; liveable stimulus payments; guaranteed healthcare; and hazard pay, sick leave, and PPE for all essential workers.

These are the absolute bare minimum measures that can get us all through this crisis, and if we don’t demonstrate the collective power of the American working class—to drive or shut down the economy—we will continue to be deprived of even these. It’s time to stand up.