With constant technological changes, even the most qualified of candidates can fall behind. A potential employee will value people they don’t have to spend too much time training on new software as it becomes available. Expanding your skills regularly will make you much more valuable in the job marketplace.

But how do you stay on top of all the new software as it comes out? The internet has a few resources for you.

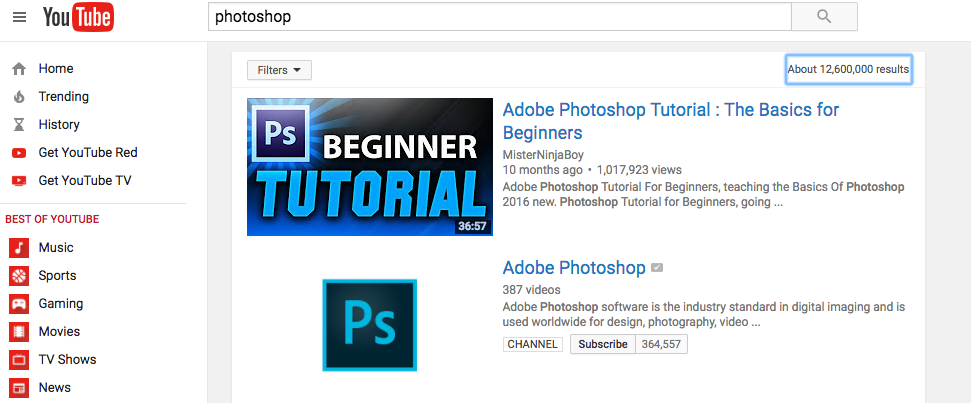

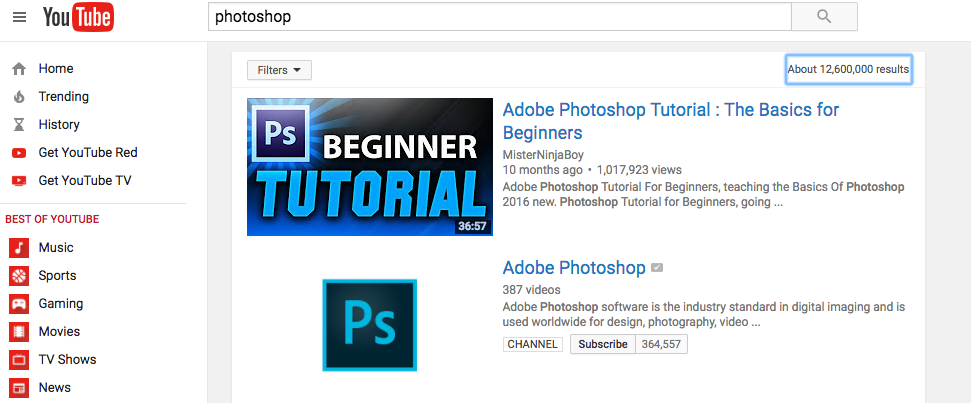

1. YouTube

1. YouTube

YouTube is the most popular video-sharing platform. You can search for almost anything and there will probably be a video about it. This is an easy and completely free way to learn Photoshop or any other program you desire. There are also plenty of videos to buff up your interview skills or learn about public speaking. YouTube isn’t just for cat videos. It is also an unlimited treasure trove of knowledge that can help you grow your skillset.

However, there is a downside to using YouTube. Having videos uploaded by literally anyone about almost anything can be a great resource, but this also means you might find a lot of poorly produced videos. You can still learn quite a bit from whatever you find, but they probably won’t be as easy to understand or follow as other paid training programs. YouTube is most useful as a brushup on skills you already have or to quickly fill in the gaps of your basic knowledge.

YouTube.com

2. Lynda.com

2. Lynda.com

Lynda.com is a paid online service that features tutorials and training on a wide variety of subjects and programs. However, many libraries purchase subscriptions that are available to use at no cost to you. Every single course is professionally produced with clear lessons and tasks. If you already know something, you can just skip that section. The courses are taught by verified industry experts so you don’t have to wonder if you’re learning things the wrong way. You can also watch courses on any of your devices at any time.

Unfortunately, if your local library doesn’t purchase a subscription to Lynda.com, you’ll have to pay for access yourself. You’ll definitely be paying for quality, but this isn’t always an option for everyone. But if you have one or two courses in mind, the 30 day free trial might be enough to learn a few things.

Lynda.com

3. Skillshare

3. Skillshare

Skillshare is another premium video training service like Lynda.com, but it is a little less expensive. Skillshare is tailored more specifically to creative professionals. Still, many of its courses can be applicable across fields. Like Lynda.com, you can access courses made up of set lessons that you can skip around. You can download videos to watch offline on mobile devices as part of your subscription. Lynda.com requires its highest subscription tier to unlock this feature. Many of the courses are taught by experts, but artists can also create their own courses to teach specific skills they have picked up in their own careers. Either way, there is a lot of experience and expertise behind each lesson.

Just like Lynda.com, the drawback is that you have to subscribe to get full access. When you sign up, you also get a 30 day free trial. However, there are many promo codes circulating online that will allow you to get a full two months free. You’re still paying for quality, but that one or two-month free trial might be enough for your short-term needs.

Skillshare.com

string(3875) "

With constant technological changes, even the most qualified of candidates can fall behind. A potential employee will value people they don't have to spend too much time training on new software as it becomes available. Expanding your skills regularly will make you much more valuable in the job marketplace.

But how do you stay on top of all the new software as it comes out? The internet has a few resources for you.

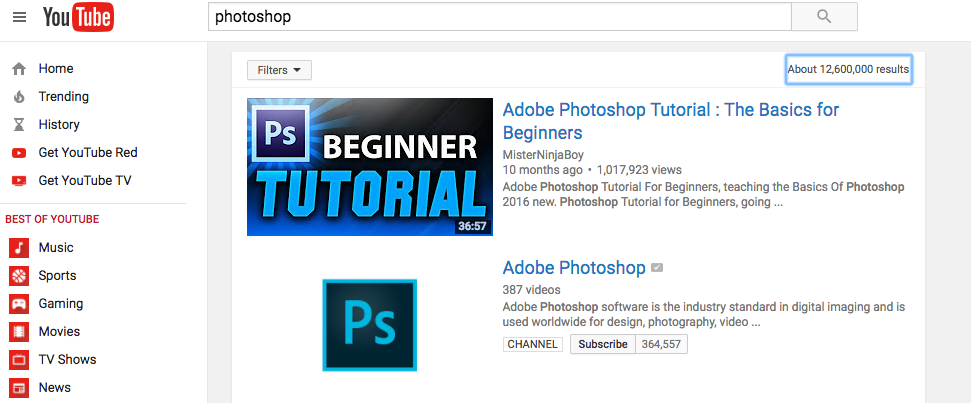

1. YouTube

1. YouTubeYouTube is the most popular video-sharing platform. You can search for almost anything and there will probably be a video about it. This is an easy and completely free way to learn Photoshop or any other program you desire. There are also plenty of videos to buff up your interview skills or learn about public speaking. YouTube isn't just for cat videos. It is also an unlimited treasure trove of knowledge that can help you grow your skillset.

However, there is a downside to using YouTube. Having videos uploaded by literally anyone about almost anything can be a great resource, but this also means you might find a lot of poorly produced videos. You can still learn quite a bit from whatever you find, but they probably won't be as easy to understand or follow as other paid training programs. YouTube is most useful as a brushup on skills you already have or to quickly fill in the gaps of your basic knowledge.

YouTube.com

2. Lynda.com

2. Lynda.comLynda.com is a paid online service that features tutorials and training on a wide variety of subjects and programs. However, many libraries purchase subscriptions that are available to use at no cost to you. Every single course is professionally produced with clear lessons and tasks. If you already know something, you can just skip that section. The courses are taught by verified industry experts so you don't have to wonder if you're learning things the wrong way. You can also watch courses on any of your devices at any time.

Unfortunately, if your local library doesn't purchase a subscription to Lynda.com, you'll have to pay for access yourself. You'll definitely be paying for quality, but this isn't always an option for everyone. But if you have one or two courses in mind, the 30 day free trial might be enough to learn a few things.

Lynda.com

3. Skillshare

3. SkillshareSkillshare is another premium video training service like Lynda.com, but it is a little less expensive. Skillshare is tailored more specifically to creative professionals. Still, many of its courses can be applicable across fields. Like Lynda.com, you can access courses made up of set lessons that you can skip around. You can download videos to watch offline on mobile devices as part of your subscription. Lynda.com requires its highest subscription tier to unlock this feature. Many of the courses are taught by experts, but artists can also create their own courses to teach specific skills they have picked up in their own careers. Either way, there is a lot of experience and expertise behind each lesson.

Just like Lynda.com, the drawback is that you have to subscribe to get full access. When you sign up, you also get a 30 day free trial. However, there are many promo codes circulating online that will allow you to get a full two months free. You're still paying for quality, but that one or two-month free trial might be enough for your short-term needs.

Skillshare.com

"

1. YouTube

1. YouTube 2. Lynda.com

2. Lynda.com 3. Skillshare

3. Skillshare