You’ve filed an extension, now what?

Apr 29 | 2024

Apr 29 | 2024

Venmo v Cash App

Simon Kuflik

Taxes are a confusing topic in any year, but collecting unemployment ads an entirely new layer.

"Taxes Key" by Got Credit is licensed under CC BY 2.0

Tens of millions of Americans collected unemployment last year, many for the first time. You may be doing taxes after collecting unemployment insurance for the first time, and it is important to note that the process is different in a few key ways from traditional employment. When you start a new job, your employer will

Trying to save money can be overwhelming. It’s difficult to navigate which expenses of your daily routine can be eliminated for financial gain and which are necessities. Many people believe that in order to accumulate savings, sacrifices must be made. And while simple sacrifices such as minimizing your takeout purchases and online shopping habits may

Feb 05 | 2021

Tax deductions can be tricky to understand if you’re new to the finance world. One of the biggest sources of confusion is knowing what you can and can’t deduct from your taxes. Deductions can be a massive financial boon for a lot of people, yet not everyone files for them correctly. This causes people to

Jan 25 | 2021

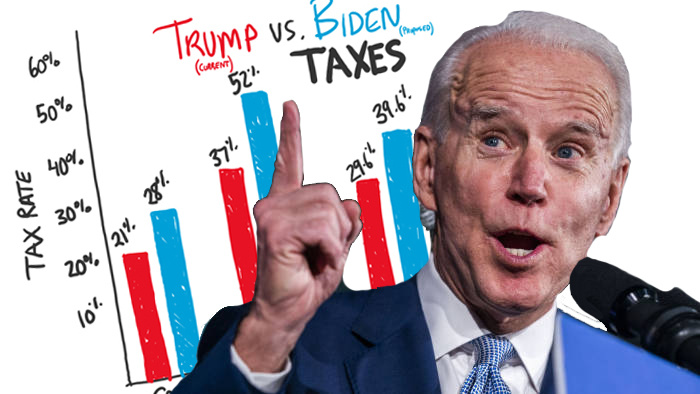

Some have alleged taxes will be going up in 2021. Are they right?

"IRS 1040 Tax Form Being Filled Out" by kenteegardin is licensed under CC BY-SA 2.0

The Tax Cuts and Jobs Act of 2017 (TCJA) is the hallmark legislation of the Trump administration, and no American taxpayer was unaffected. But was this legislation a Trojan horse that could lead to you paying higher taxes starting in 2021? The Joint Committee on Taxation released a chart indicating that federal taxes for those

clark.com

During open enrollment or when you start a new job, you may find that your company offers the chance to enroll in a Flexible Spending Account (FSA – registered trademark). It might seem annoying to have money deducted from your paycheck at first, but it can actually save you money on health care expenses in

abacuswealth.com

The Tax Cuts and Jobs Act of 2017 raised the standard deduction for US taxpayers and capped the state and local tax deduction at $10,000. This greatly reduced the number of taxpayers who itemize on their tax return and caused a major reduction in charitable giving. Taxpayers who itemize can reduce their income by the

Nov 10 | 2020

With the election of Joe Biden to the Presidency, you’re probably here seeking to understand how much your taxes are going to go up. The answer: most people will see no tax increases. The tax plan that Joe Biden has rolled out is targeted at individuals making more than $400,000 a year, less than 1%

Nov 06 | 2018

Tax Relief

Tax debt can become a major source of stress. Wouldn’t it be great to just make one payment and have all your tax debt disappear? With an offer in compromise (OIC), that’s possible. Whether you have major debt, are just getting started in your career, or are in another situation that has made it difficult