Are Your Taxes Going Up In 2021?

Jan 25 | 2021

Some have alleged taxes will be going up in 2021. Are they right?

"IRS 1040 Tax Form Being Filled Out" by kenteegardin is licensed under CC BY-SA 2.0

The Tax Cuts and Jobs Act of 2017 (TCJA) is the hallmark legislation of the Trump administration, and no American taxpayer was unaffected. But was this legislation a Trojan horse that could lead to you paying higher taxes starting in 2021?

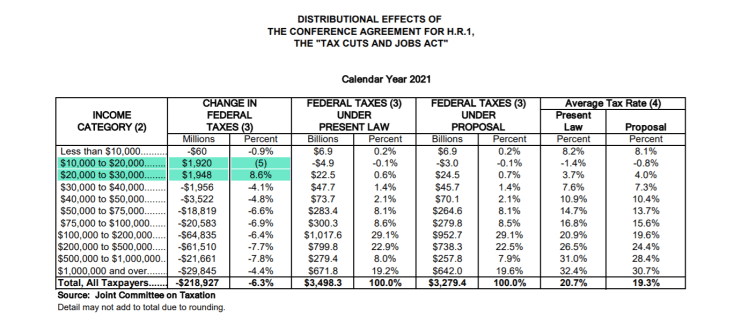

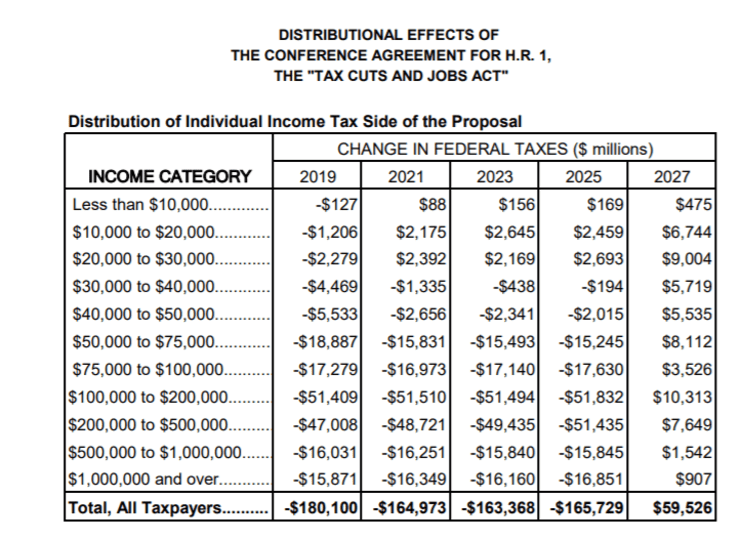

The Joint Committee on Taxation released a chart indicating that federal taxes for those making between $10,000 and $30,000 would go up starting in 2021.

The new tax brackets for 2021 have the same rates, and the only changes are the income brackets that have been adjusted for inflation. What’s driving this higher tax rate for these particular brackets?

That links back to the Republican efforts to repeal the Affordable Care Act. The TCJA lowered the individual mandate penalty, the penalty paid to the government if you do not have a health insurance policy, to zero. This means there will be no tax implications to not carrying an insurance policy.

Under the ACA, individuals within 100% and 400% of the federal poverty level were eligible to receive tax credits to offset the costs of these plans. With no individual mandate penalty, the expectation is that less people will sign up for insurance. Less people signing up for insurance will lead to less people receiving the tax credits, which would lead to an increase in the average tax rate across this group.

That doesn’t mean that you are in the clear if you make above $30,000. Remember how income brackets are adjusted for inflation? The TCJA also changed how inflation is calculated. Tax brackets used to be adjusted off of the Consumer Price Index (CPI), an index that tracks the prices of goods and services across different geographical areas.

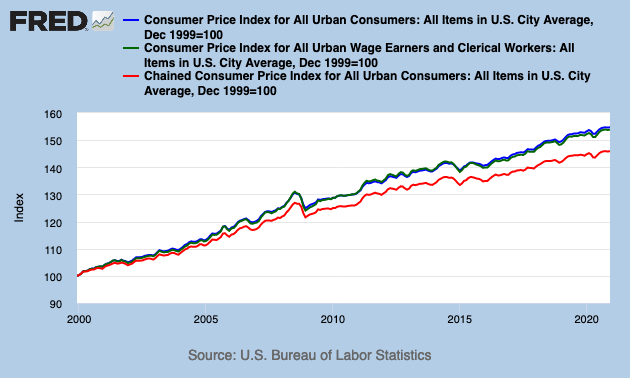

The Consumer Price Index tracks how much more you are paying because of inflation each year. But the IRS now measures inflation against the chained CPI. The idea behind the chained CPI is that if prices rise, customers will change their purchasing habits and substitute goods. For example, if the price of orange juice rises faster than the price of apple juice, chained CPI assumes that people will lower the amount of orange juice that they are buying and substitute that by buying more apple juice. CPI tracks a fixed basket of goods while the basket of goods tracked by chained CPI changes periodically.

Because chained CPI assumes that consumers are going to seek out substitutes for products with rising price tags, it rises more slowly than traditional CPI. Thus, the IRS will adjust tax brackets upward more gradually, and you are likely to move into a higher tax bracket faster than you would under the old calculations.

Chained CPI calculates the cost of everyday goods rising more slowly than calculations based on traditional CPI.Federal Reserve Bank of St. Louis

Chained CPI calculates the cost of everyday goods rising more slowly than calculations based on traditional CPI.Federal Reserve Bank of St. Louis

If the cost of consumer prices rises 2% and you receive a similar 2% raise, normally you would be able to maintain your lifestyle. However, if the tax brackets only increase 1.5% because tax brackets are now tied to chained CPI, you will be paying more in taxes because your income and expenses will be rising faster than the rate the IRS is using. Because the tax rate is being adjusted for 2021 and will be adjusted in future years, this will compound over time, and has led to a slew of recent articles discussing a tax hike starting in 2021.

Congress passed the TCJA through budget reconciliation to avoid a filibuster, but that meant that the law could not increase the long-term budget deficit. As a result, Republicans decided to include a provision to have the individual tax cuts expire in 2025 while making the lower corporate tax rates and the chained CPI method of adjusting tax brackets permanent. The increased standard deduction and the larger child tax credit will also expire at this time. And because of the continued use of the chained CPI method, people will actually be paying higher taxes after the TCJA then they would if it had never been passed in the first place.

Joint Committee on Taxation

Joint Committee on Taxation