Taxes are a confusing topic in any year, but collecting unemployment ads an entirely new layer.

"Taxes Key" by Got Credit is licensed under CC BY 2.0

Tens of millions of Americans collected unemployment last year, many for the first time. You may be doing taxes after collecting unemployment insurance for the first time, and it is important to note that the process is different in a few key ways from traditional employment.

When you start a new job, your employer will typically set up tax withholding, where you pay your taxes out of each paycheck and calculate any refunds or additional payments owed come tax time. Jobless aid is taxed similarly to income but does not usually have taxes automatically taken out. This is likely to lead to millions of Americans facing a surprise tax bill this spring as Goldman Sachs estimates taxes on unemployment insurance received last year could reach $50 billion. 38% of Americans receiving benefits were unaware that unemployment insurance is taxable and could be staring down a major financial shortfall.

If you collected unemployment last year, here’s what you need to know as you prepare your taxes.

1. You don’t need to pay Social Security or Medicare taxes

You will be expected to pay taxes on unemployment benefits, but those taxes will be slightly less than if you had received the same amount from traditional employment. That is because they are exempt from Social Security and Medicare taxes, both of which total 7.65% for a usual worker. This means you may be paying a lower tax rate than you expect.

2. You might not need to pay state taxes

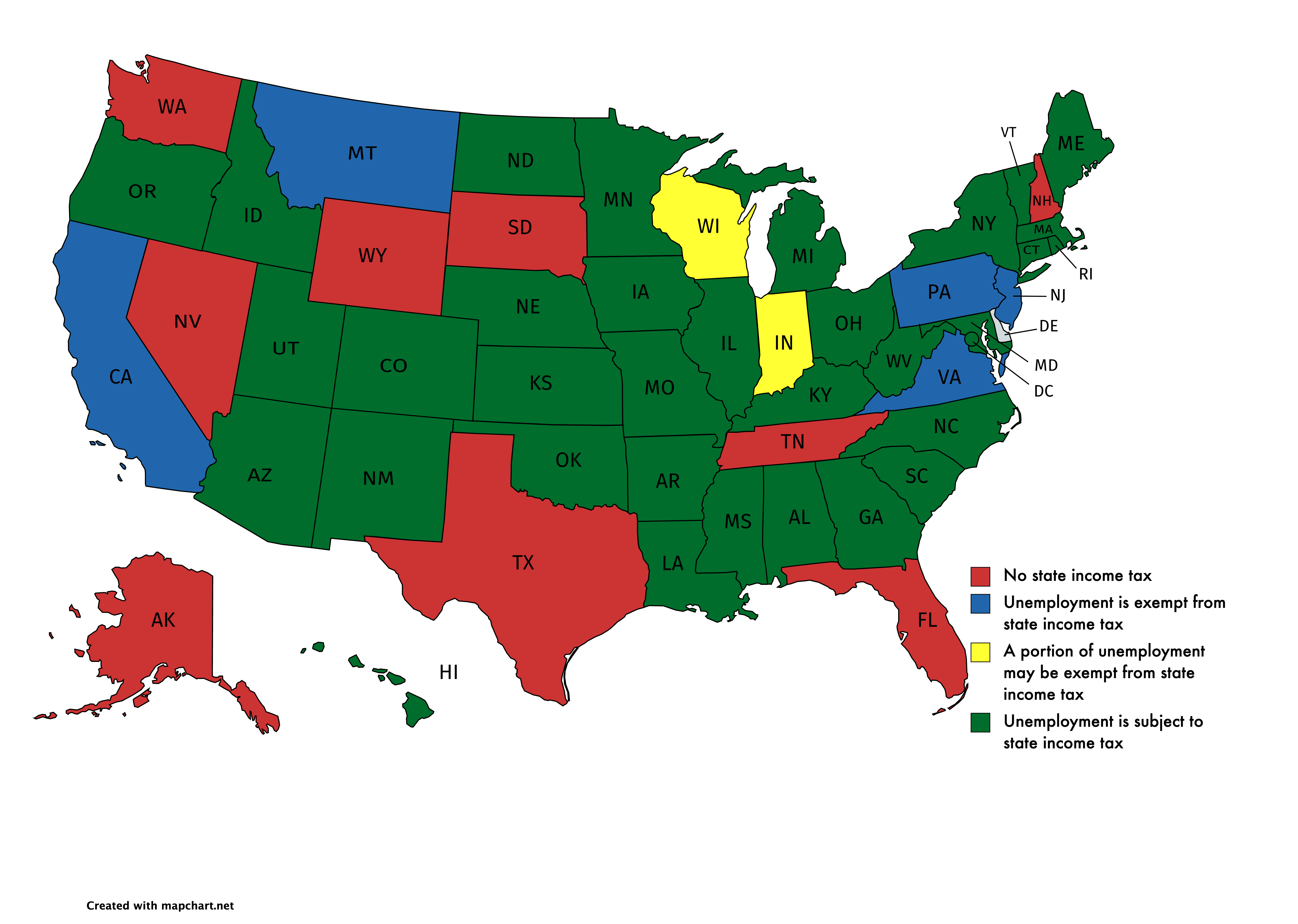

If you live in one of the nine states (Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming) with no state income tax, your unemployment benefits will also not be taxed on the state level. However, five additional states exempt unemployment insurance from taxation. These states are California, Montana, New Jersey, Pennsylvania and Virginia. If you live in one of these states, you only need to worry about federal taxes on your unemployment benefits. You will likely still need to file taxes for any income from regular employment, but this amount will be much less than if your jobless benefits were also taxed at the state level.

However, things get a bit tricky if you live in Indiana or Wisconsin. Both of these states may allow you to exempt a portion of your jobless benefits from taxation, depending on your total income. In both states, you will need to fill out your “Unemployment Compensation Worksheet” to see if you can exclude any portion of the payments you received.

The United States is a patchwork of different tax policies when it comes to unemployment. Know what your state’s policy is.

The United States is a patchwork of different tax policies when it comes to unemployment. Know what your state’s policy is.

3. Your stimulus payments are not taxable

The federal government issued two rounds of stimulus payments last year; one in April and one in December. These economic income payments are not taxable and are separate from your jobless aid.

4. The government still has time to reduce your tax bill

If you collected unemployment last year, you might want to consider waiting a bit longer before filing taxes. That’s because in February of 2021, Sen. Dick Durbin, D-Ill., and Rep. Cindy Axne, D-Iowa, introduced the Coronavirus Unemployment Benefits Tax Relief Act. If passed, this would waive federal income taxes on the first $10,200 of unemployment benefits received in 2020. This would be a larger version of 2009, when lawmakers provided a similar exemption for up to $2,400 in jobless aid. Right now, it is unclear how likely this bill is to pass both chambers. You may want to consider filing closer to the April 15th deadline or prepare to file an amended return if it does become law.

5. There are options if you cannot afford to pay your tax bill right now

If you haven’t set aside enough to pay your tax bill this year, you are not alone and there are other options. The IRS does allow you toapply for a payment plan as well astemporarily delay the collection of your tax debt. Both of these may entail paying interest and fees on top of your tax bill, but this will be much less than if the IRS has to take collection action against you.

If you cannot pay your tax bill by April 15th, contacting the IRS for a payment plan can help you avoid stiff penalties.

If you cannot pay your tax bill by April 15th, contacting the IRS for a payment plan can help you avoid stiff penalties.

6. If you are still on unemployment, set aside money for next year’s tax bill

If you haven’t been setting aside taxes on your unemployment benefits, you may want to start now to avoid a tax headache next year. Log on to your state’s unemployment benefits portal and update your withholding. The federal government will withhold 10 percent of your unemployment income toward your taxes. If you don’t, you are still on the hook for the taxes and must determine and pay quarterly estimates on your unemployment income.

7. You may qualify for new tax deductions and credits

Many people saw their incomes reduced by going on unemployment, and this could open up new opportunities to save on your taxes this year. If you were able to work for part of the year, you may now qualify for the Earned Income Tax Credit (EITC), a credit for working people with low to moderate income. Unemployment is not considered “earned” income in this case, so you will likely only qualify if you earned income from traditional work this year. Your exact qualification will depend on a variety of factors including your dependents, your filing status, and your total earned income.

If you were able to save last year, you may also be able to qualify for the saver’s credit. This would allow you to receive a credit of between 10% to 50% of your contribution to retirement account, depending on your income and filing status. Remember that you still have time to claim this credit as the deadline to contribute to last year’s IRA is not Tax Day this year. If you qualify, you may wish to make a contribution before filing taxes in order to claim the credit.

Your state may have additional credits for you to take advantage of, such as the income-based renter’s credit in thirteen states. Look at the tax credits available in your state to take full advantage of any help available in what may be a lower-earnings year for you.

Disclaimer: Paypath and its affiliates do not provide tax, legal or accounting services. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. If you have any concerns regarding your unique tax situation, you should consult your own tax, legal and accounting advisors.