If you own a small business, one of the first major milestones is getting customers to like and pay for your product or service. But a one-time hit is not what will keep the business afloat. You need repeat customers who want to stick around as much as you want them to.

To keep customers coming back time and time again takes a plan, not just a prayer. These important strategies will let your customers know you care about their overall satisfaction and value their time and money. The customer may always be right, but they’ll know you’re doing right by them too.

Get Down to a Personal Level

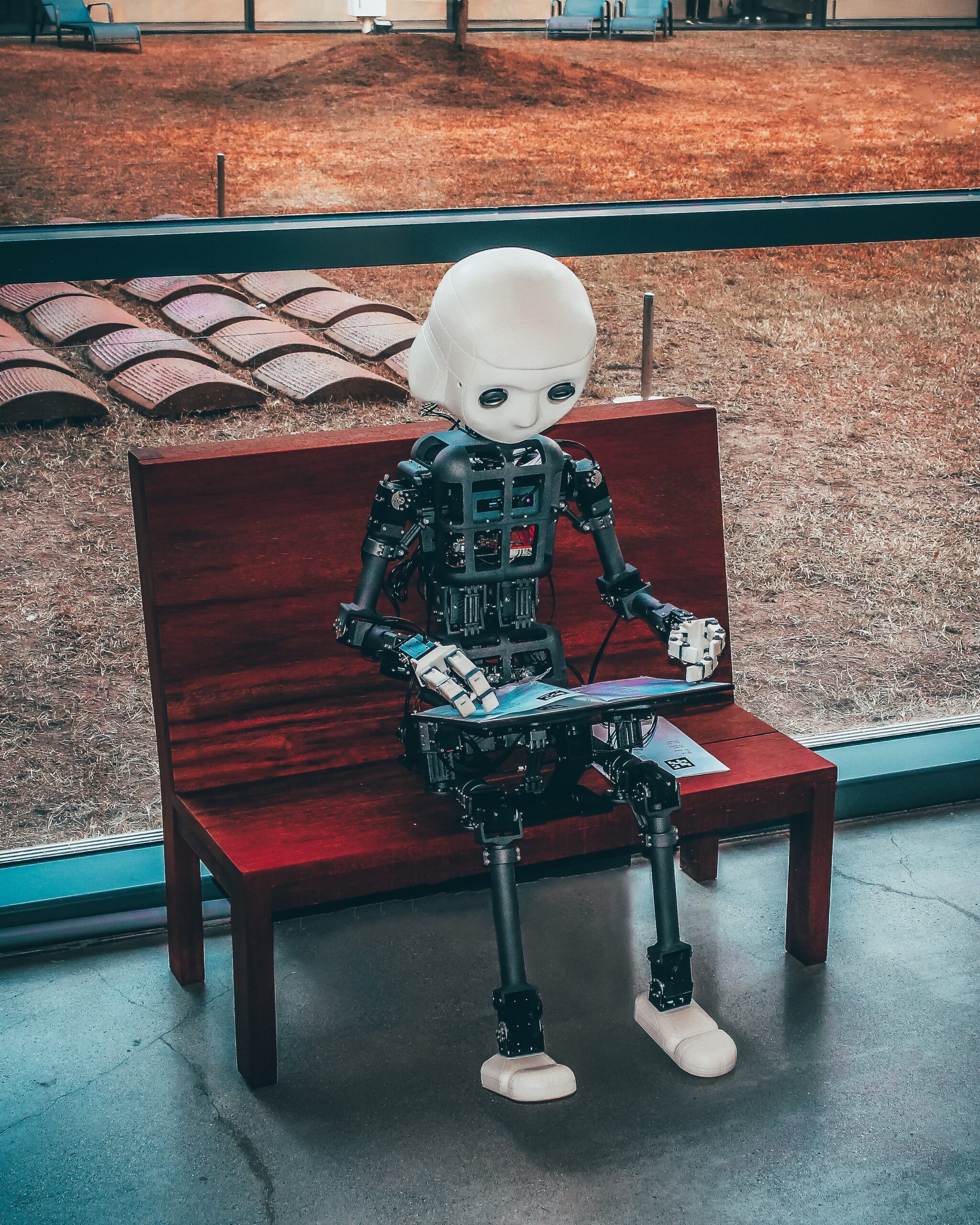

Customers want to feel important. Otherwise, why should they choose your company over a competitor’s? In this age of computers and robots, a human connection pulls at the heartstrings. As Small Business Computing notes, “When customers receive a more personal customer experience they can develop a hard to break emotional attachment to the business.” And Entrepreneur says, “Companies need to see their customers as people not data points.”

This can be a money-maker for the business. Along with the repeat customer, you may find this customer willing to spend more with you too. Small Business Computing posted a study from the Journal of Applied Social Psychology that found, “Waiters were able to increase their tips by 23 percent by carrying out a simple act of returning to a table with a second set of mints. This left the customer satisfied enough to leave a bigger tip.” The personal care and attention made all the difference.

American Express reminds small business owners to treat everybody as individuals. “In a small shop, you can go as far as keeping notes about a customer’s likes, dislikes and family so you can ask about them the next time you see the customer. Something as simple as keeping track of how long they’ve been your customer—and mentioning it with a thank you—shows you view them as more than just a note in your profit-and-loss report.”

Customizing and tailoring to a customer’s desires is imperative as well. Entrepreneur notes that “A 2013 Bain & Co. survey found that 25-30 percent of consumers want to customize their purchases. If 25 percent of online sales of footwear were customized, that would equate to a market of $2 billion per year.”

Not to mention, allowing a customer to customize gives new ideas to a company that can increase sales from other consumers who also become fond of the product or service addition. Allow your customers to work for you in a sense!

Get Feedback

Your customers’ response to your business is everything. Whether the feedback is positive or negative, constructive or potentially destructive, you need to know what’s on their minds in order to keep chugging along with the good stuff and make changes where there’s room for improvement.

Vertical Response notes, “Asking for feedback about a customer’s experience or product quality shows that you’re engaged in your business and looking for ways to improve. You should consider sending a satisfaction survey directly to your customers. Not only will you get valuable feedback to help you make improvements to your business, but it keeps your business top of mind with customers.” In addition, be sure to keep on top of review sites where customers can leave comments about your business. A social media or communications employee should comb such pages daily and respond promptly to show your company is on the ball and available to help.

Even if you think you’re doing a good job getting your customers’ point of view, there’s always room for more feedback. All perspectives are valid and can only help your business better itself. In fact, as per American Express, “A recent Harvard Management survey found that 80 percent of companies believed they offered above-average customer service. Just 8 percent of customers of those companies agreed. The last thing you want is a good customer who’s silently seething over something you don’t know about. Be prepared to handle any complaints you find quickly and in good faith.”

Feedback keeps a business on its toes and shows the customer you care about their wants and needs. If customers offer advice and it’s ignored, they’ll find another company to do business with. Simple as that.

Stay Connected

Just because the customer has left the shop, made an online purchase, or utilized your service doesn’t mean the transaction is over. You want a repeat customer, not a “one and done” relationship. That’s why keeping connected regularly is the way to keep customers engaged.

“Reach out to your customers on a regular basis. Whether it’s a newsletter, coupon, or an event invitation, customers want to hear from you about new products, services, discounts or events,” notes Vertical Response. Stay on top of your social media pages as well with updates about the business, sales, new products, and even entertaining posts to keep your fans interested in checking in on your pages just for fun.

Small Business Computing adds, “Digital marketing represents a greater chunk of the market now, and the unrelenting popularity of smartphones means that people are more likely to get their information from a mobile device. Collecting customer information lets you continue to nurture the customer relationship long after the first sale.”

This means texting special offers and emailing with a smartphone interface in mind to keep your business on your customers’ minds even when they’re not making a purchase at the moment. Even a call to check in, depending on the nature of your business, is appreciated. Huffington Post reminds us, “Business relationships are just like any other relationship. They require effort to maintain and they must be mutually beneficial. And don’t just call about business; ask about vacation plans and the kids. Be willing to give, share and support, not just try to go in for the up-sell.” This non-salesy approach puts a customer at ease and they won’t dread that every point of contact is a push to purchase. The true relationship builds trust, and when it is time for them to spend money, your company will be the first choice.

Keep things fresh, loyal, unique, and honest. Customers know when they are being taken for granted and when they are truly appreciated. Simple steps like these not only put a smile on the faces of your customers, but they will have them returning again and again – putting a smile on your face too!

string(6993) "

If you own a small business, one of the first major milestones is getting customers to like and pay for your product or service. But a one-time hit is not what will keep the business afloat. You need repeat customers who want to stick around as much as you want them to.

To keep customers coming back time and time again takes a plan, not just a prayer. These important strategies will let your customers know you care about their overall satisfaction and value their time and money. The customer may always be right, but they'll know you're doing right by them too.

Get Down to a Personal Level

Customers want to feel important. Otherwise, why should they choose your company over a competitor's? In this age of computers and robots, a human connection pulls at the heartstrings. As Small Business Computing notes, "When customers receive a more personal customer experience they can develop a hard to break emotional attachment to the business." And Entrepreneur says, "Companies need to see their customers as people not data points."

This can be a money-maker for the business. Along with the repeat customer, you may find this customer willing to spend more with you too. Small Business Computing posted a study from the Journal of Applied Social Psychology that found, "Waiters were able to increase their tips by 23 percent by carrying out a simple act of returning to a table with a second set of mints. This left the customer satisfied enough to leave a bigger tip." The personal care and attention made all the difference.

American Express reminds small business owners to treat everybody as individuals. "In a small shop, you can go as far as keeping notes about a customer's likes, dislikes and family so you can ask about them the next time you see the customer. Something as simple as keeping track of how long they've been your customer—and mentioning it with a thank you—shows you view them as more than just a note in your profit-and-loss report."

Customizing and tailoring to a customer's desires is imperative as well. Entrepreneur notes that "A 2013 Bain & Co. survey found that 25-30 percent of consumers want to customize their purchases. If 25 percent of online sales of footwear were customized, that would equate to a market of $2 billion per year."

Not to mention, allowing a customer to customize gives new ideas to a company that can increase sales from other consumers who also become fond of the product or service addition. Allow your customers to work for you in a sense!

Get Feedback

Your customers' response to your business is everything. Whether the feedback is positive or negative, constructive or potentially destructive, you need to know what's on their minds in order to keep chugging along with the good stuff and make changes where there's room for improvement.

Vertical Response notes, "Asking for feedback about a customer's experience or product quality shows that you're engaged in your business and looking for ways to improve. You should consider sending a satisfaction survey directly to your customers. Not only will you get valuable feedback to help you make improvements to your business, but it keeps your business top of mind with customers." In addition, be sure to keep on top of review sites where customers can leave comments about your business. A social media or communications employee should comb such pages daily and respond promptly to show your company is on the ball and available to help.

Even if you think you're doing a good job getting your customers' point of view, there's always room for more feedback. All perspectives are valid and can only help your business better itself. In fact, as per American Express, "A recent Harvard Management survey found that 80 percent of companies believed they offered above-average customer service. Just 8 percent of customers of those companies agreed. The last thing you want is a good customer who's silently seething over something you don't know about. Be prepared to handle any complaints you find quickly and in good faith."

Feedback keeps a business on its toes and shows the customer you care about their wants and needs. If customers offer advice and it's ignored, they'll find another company to do business with. Simple as that.

Stay Connected

Just because the customer has left the shop, made an online purchase, or utilized your service doesn't mean the transaction is over. You want a repeat customer, not a "one and done" relationship. That's why keeping connected regularly is the way to keep customers engaged.

"Reach out to your customers on a regular basis. Whether it's a newsletter, coupon, or an event invitation, customers want to hear from you about new products, services, discounts or events," notes Vertical Response. Stay on top of your social media pages as well with updates about the business, sales, new products, and even entertaining posts to keep your fans interested in checking in on your pages just for fun.

Small Business Computing adds, "Digital marketing represents a greater chunk of the market now, and the unrelenting popularity of smartphones means that people are more likely to get their information from a mobile device. Collecting customer information lets you continue to nurture the customer relationship long after the first sale."

This means texting special offers and emailing with a smartphone interface in mind to keep your business on your customers' minds even when they're not making a purchase at the moment. Even a call to check in, depending on the nature of your business, is appreciated. Huffington Post reminds us, "Business relationships are just like any other relationship. They require effort to maintain and they must be mutually beneficial. And don't just call about business; ask about vacation plans and the kids. Be willing to give, share and support, not just try to go in for the up-sell." This non-salesy approach puts a customer at ease and they won't dread that every point of contact is a push to purchase. The true relationship builds trust, and when it is time for them to spend money, your company will be the first choice.

Keep things fresh, loyal, unique, and honest. Customers know when they are being taken for granted and when they are truly appreciated. Simple steps like these not only put a smile on the faces of your customers, but they will have them returning again and again – putting a smile on your face too!

"