Entrepreneurial Highlight: Kevin Delgado

Jul 27 | 2017

In this series we will be highlighting burgeoning entrepreneurs in the modern era. These are folks who have taken the risk of quitting or working double to quit their conventional jobs in pursuit of their passions. This is a difficult road that many never find the courage to venture upon, but the rewards are so worth it, and as you know, no risk, no reward, know risk, know reward.

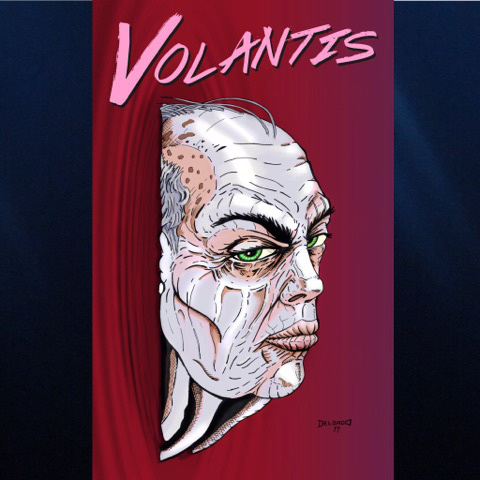

This episode highlights Kevin Delgado, author, illustrator and independent publisher of the renewed forward-thinking comic book series “Volantis”. Kevin turned his passion for drawing and his natural eye for design, fueled by a lifelong dream and is venturing out to make it all come to fruition in a major way. Kevin shares what it takes to balance time between being creative and taking care of business, being a dad and being a boss, and a turning your passion into a career.

From Volantis #2Kevin Delgado

From Volantis #2Kevin Delgado

Tell Me A Little More About What You Do And How You Got Into It

My name is Kevin Delgado and right now I am writing, illustrating, coloring, and lettering my own comic book called “Volantis”. I have taken art seriously my entire life. I even went to the Art Institute of Pittsburgh and got a degree in Graphic Design, which I also do for a living. I had always wanted to draw comics, but put it on the back burner to pursue a career in music. I got back into after a near fatal incident that left me incapacitated for months. It was during that time that I really started making more art and putting it out there and getting great response.

Do you Remember Your First Day? What Were You Feeling? What Were You Doing Before? Why Made You Want To Try Something New?

Like I mentioned earlier, I had pursued a professional career in music under the stage name “Frigid Giant”, both as an emcee and producer. I still make music and perform live steadily. I think all musicians are artists and vice versa, its a different way to express yourself. My artistic direction shifts constantly. If i feel like making music, I make music. If I feel like drawing, I draw. I never force myself to do either.

How Do You Balance Your Time?

The hardest part about life is time management. I try my best to eliminate needless distraction (Phone, internet, games, etc). Its hard, especially considering that i have such a lust for life and adventures. I also try to decrease my alcohol intake as much as possible, I cannot illustrate inebriated, rapping on the other hand….

Tell Me About Your Business?

Solstice Art is my publishing banner. I self produce and publish comic books. I am also open for commissioned Illustration and graphic design. I also provide print services.

How Much Time Per Week Would You Say You Dedicate To Your Work?

I do graphic design 40 hours a week, I probably put an additional 30 hours or so into commissioned work and the comic book series.

What Else Do You Like To Do With Your Free Time?

Travel. I have kids that I am raising as well and a fiance. I really don’t have free time. I am constantly working. I love the hustle.

What’s Next For You?

This comic book is no joke, I have pretty much set it up to be my life’s work. I want to keep making it and hopefully have it adapted for television / movies. I am also interested in real estate, I am in the process of buying some property as we speak.

Any Advice For People Wanting To Follow A Similar Path?

I would say to make sure you are ready to dedicate your life to it. If you are not completely obsessed with it, don’t go for it. Don’t waste your time or anybody elses. I am still very far from where I want to be, but I HAVE to put the leg work in now. All I can hope for is that a publisher sees my dedication and work ethic and decides to pick me up, whether it be for my book or someone elses. That and don’t give up, not much success comes over night.

To learn more about Volantis, Kevin, and how to grab your copy, click here…