Do you use LinkedIn or are you planning to set up a professional profile? Before you hop on board, be aware of what you shouldn’t use the business platform for and other ‘no-nos’ that could jeopardize your credibility or professionalism. Here are four ‘nots’ to look out for:

Using an Unprofessional Photo

This will not help your causetalgroupinc.files.wordpress.com

(adsbygoogle = window.adsbygoogle || []).push({});

Just like most social media platforms, LinkedIn is about image. But this isn’t the place for your oiled-up beach bikini shots (unless you’re a Sports Illustrated model) or feeding llamas at the petting zoo with the kids. You want colleagues and connections (past, present, and future) to see who you are, but the LinkedIn visual is a certain side of what is surely a multi-faceted you.

AsWisebread recommends, “Make sure the photo is clear, professional, and relatively recent.” For tips on taking a professional photo for LinkedIn, The Balance Careers has a photo rundown to follow, everything from size to simplicity…even selfies.

Post Updates Meant for Other Social Media Platforms

Glad it was nice, but this stuff should never go on LinkedIncdn.dribbble.com

Politics, puppies, gossip, and grief are fine for Facebook and Twitter, but leave personal perspectives off LinkedIn. Unless you are sharing work or industry-related content, nearly anything else you post can come off as inappropriate, even offensive to those in your field – some of whom may shy away from employing you or working with you in the future. “Don’t use (LinkedIn) for a casual social interaction,” warns Wisebread.

LinkedIn suggests, “Share content, advice, and opinions that boost your professional credentials. It’s all about relevancy.”

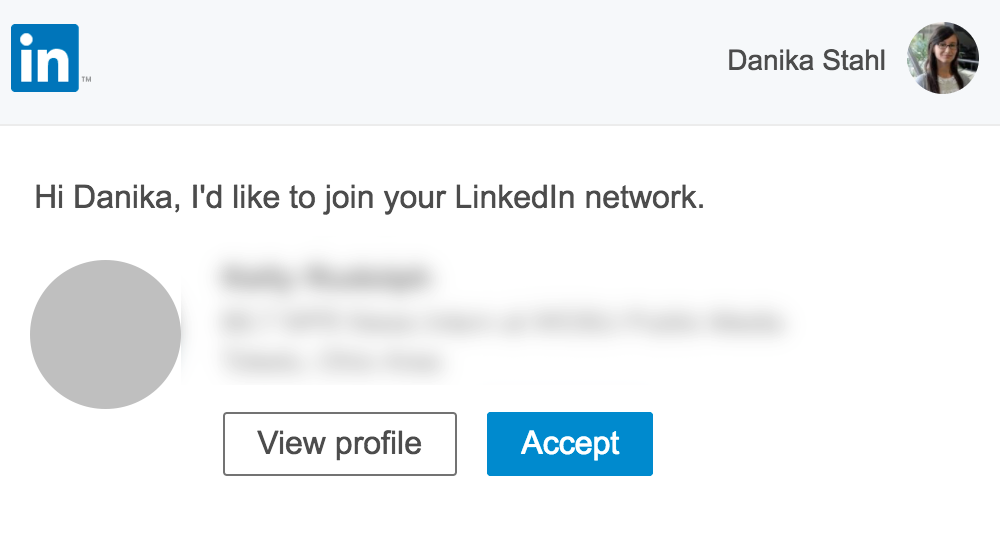

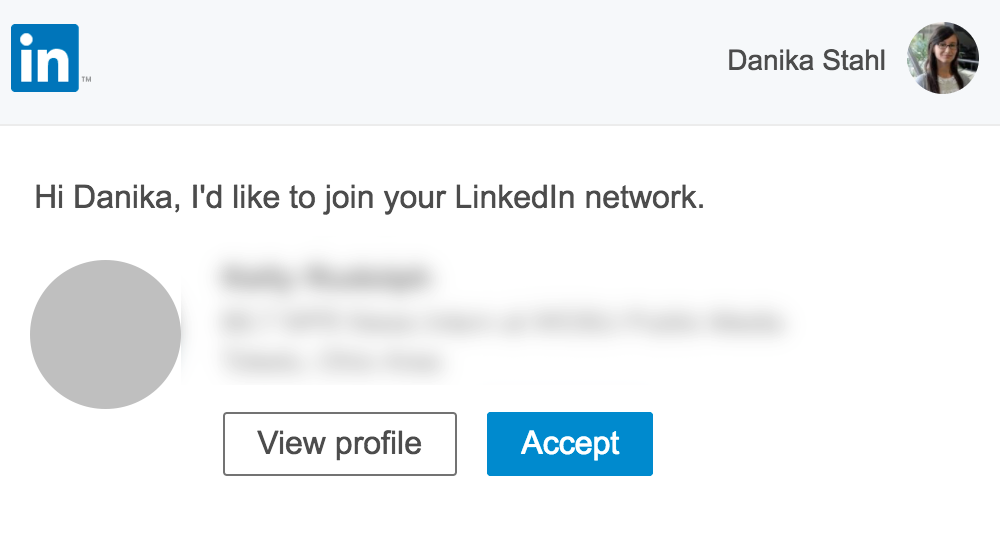

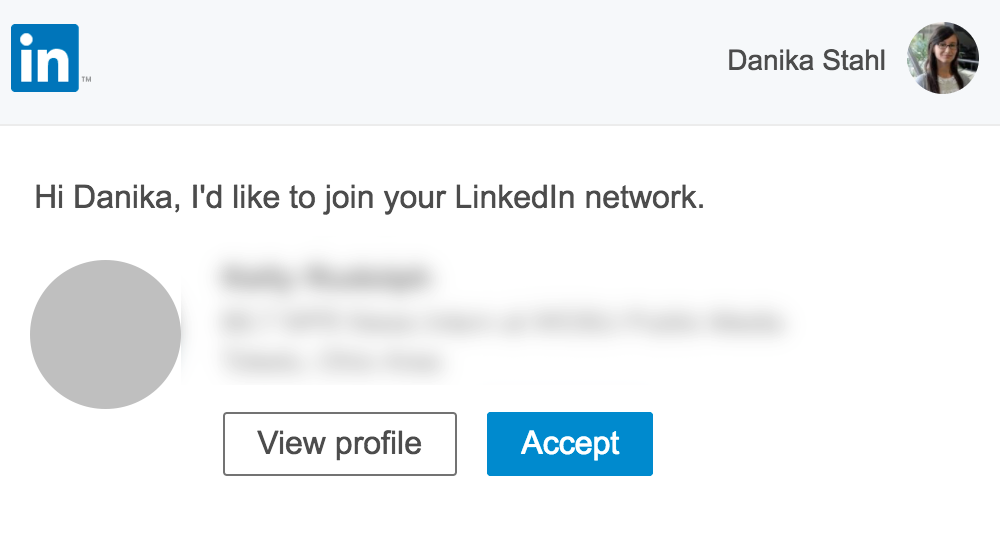

Connect with People Just to Get a Job

Do you really want to connect, or use her connections?mindsetdigital.com

Do you really want to connect, or use her connections?mindsetdigital.com

You may be out of work and you’re hoping new LinkedIn connections can hook you up with the right people, but this is not the best way to go about it. You cansearch for jobs on the platform yourself and apply in the manner companies require. Unless you are already connected to someone who can introduce you to a colleague who is hiring, asking relative strangers to do you a favor is just in bad taste.

Alison Doyle, a Career and Job Search Expert writes for LinkedIn, “I am always a little annoyed when someone I don’t know well asks me for a referral or recommendation. If I don’t know you well enough to be able to attest personally to your value, I’m not going to jeopardize my relationships with my connections by referring or recommending you.”

As Forbes explains, “Never send someone a connection invitation and then, the minute they join your network, send them a request for them to introduce you to someone they know. There is no better way to signal ‘You’re just a means to my end!'”

[shortcode-1-In-Article-Banner-728×60]

Neglect Your Resume

When was the last time you gave yours a once-over?e8189c6175d75089a765-c71906071e65887d4f10e044d8aad7ab.ssl.cf2.rackcdn.com

If you posted your resume when you first joined LinkedIn (which could have been years ago) and haven’t looked at it since you may be limiting yourself from reaching the right people. Take a look at what you currently have listed and tweak/update accordingly. As LinkedIn recommends, “Don’t raise any red flags by having a LinkedIn profile that doesn’t match your resume. Double check job titles, employer names and dates of employment.”

Not only should your information be accurate, concise, and compelling, but it should be written well also. Wisebread notes, “Even though it’s a social media site, grammatical errors on LinkedIn can immediately cast you in bad light. Proofread every word you write.”

You know the ‘nots,’ now get on with using LinkedIn in a professional and purposeful way. Make networking work for you!

string(6069) "

Do you use LinkedIn or are you planning to set up a professional profile? Before you hop on board, be aware of what you shouldn't use the business platform for and other 'no-nos' that could jeopardize your credibility or professionalism. Here are four 'nots' to look out for:

Using an Unprofessional Photo

This will not help your causetalgroupinc.files.wordpress.com

(adsbygoogle = window.adsbygoogle || []).push({});

Just like most social media platforms, LinkedIn is about image. But this isn't the place for your oiled-up beach bikini shots (unless you're a Sports Illustrated model) or feeding llamas at the petting zoo with the kids. You want colleagues and connections (past, present, and future) to see who you are, but the LinkedIn visual is a certain side of what is surely a multi-faceted you.

AsWisebread recommends, "Make sure the photo is clear, professional, and relatively recent." For tips on taking a professional photo for LinkedIn, The Balance Careers has a photo rundown to follow, everything from size to simplicity…even selfies.

Post Updates Meant for Other Social Media Platforms

Glad it was nice, but this stuff should never go on LinkedIncdn.dribbble.com

[shortcode-8-GO-TO-responsive-in-article]

Politics, puppies, gossip, and grief are fine for Facebook and Twitter, but leave personal perspectives off LinkedIn. Unless you are sharing work or industry-related content, nearly anything else you post can come off as inappropriate, even offensive to those in your field – some of whom may shy away from employing you or working with you in the future. "Don't use (LinkedIn) for a casual social interaction," warns Wisebread.

LinkedIn suggests, "Share content, advice, and opinions that boost your professional credentials. It's all about relevancy."

Connect with People Just to Get a Job

Do you really want to connect, or use her connections?mindsetdigital.com

Do you really want to connect, or use her connections?mindsetdigital.com

You may be out of work and you're hoping new LinkedIn connections can hook you up with the right people, but this is not the best way to go about it. You cansearch for jobs on the platform yourself and apply in the manner companies require. Unless you are already connected to someone who can introduce you to a colleague who is hiring, asking relative strangers to do you a favor is just in bad taste.

Alison Doyle, a Career and Job Search Expert writes for LinkedIn, "I am always a little annoyed when someone I don't know well asks me for a referral or recommendation. If I don't know you well enough to be able to attest personally to your value, I'm not going to jeopardize my relationships with my connections by referring or recommending you."

As Forbes explains, "Never send someone a connection invitation and then, the minute they join your network, send them a request for them to introduce you to someone they know. There is no better way to signal 'You're just a means to my end!'"

[shortcode-1-In-Article-Banner-728x60]

Neglect Your Resume

When was the last time you gave yours a once-over?e8189c6175d75089a765-c71906071e65887d4f10e044d8aad7ab.ssl.cf2.rackcdn.com

If you posted your resume when you first joined LinkedIn (which could have been years ago) and haven't looked at it since you may be limiting yourself from reaching the right people. Take a look at what you currently have listed and tweak/update accordingly. As LinkedIn recommends, "Don't raise any red flags by having a LinkedIn profile that doesn't match your resume. Double check job titles, employer names and dates of employment."

Not only should your information be accurate, concise, and compelling, but it should be written well also. Wisebread notes, "Even though it's a social media site, grammatical errors on LinkedIn can immediately cast you in bad light. Proofread every word you write."

You know the 'nots,' now get on with using LinkedIn in a professional and purposeful way. Make networking work for you!

[shortcode-8-GO-TO-responsive-in-article]

"

Do you really want to connect, or use her connections?mindsetdigital.com

Do you really want to connect, or use her connections?mindsetdigital.com