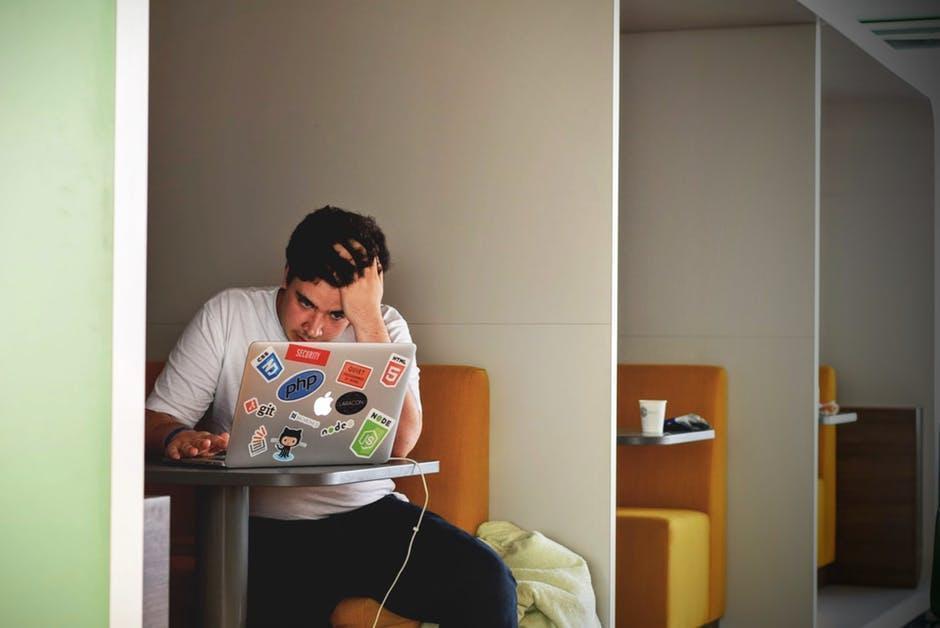

Procrastination is the bane of almost everyone’s existence. It detracts from productivity, creates unneeded stress, and can lead to missed deadlines. It’s just bad all around. However, not many people know the cause of procrastination or how to beat it. But there is a one-step solution that will work for everyone struggling with procrastination.

The common misconception is that procrastination is a sign of laziness or disorganization. That’s not quite true. Procrastinating doesn’t mean you’re less productive than your coworkers, although that can be the effect. Procrastination is simply a sign of seeking instant gratification. Would you rather start on that report or watch a cute cat video? In the moment, that choice is pretty simple. Cats are cute and much less boring than typing up a report. You might be aware that starting on the report is better in the long run, but in that second, it is much, much easier to open YouTube.

Because procrastination hinges on instant gratification, people of all kinds can suffer from it. It’s not just lazy or unfocused people who fall prey to it. Anyone who would rather watch an adorable dog video than do work can end up procrastinating. But the good news is: there’s a simple solution. Just start.

The fastest and most effective way to overcome the procrastination hurdle is to just start working. Give yourself five minutes to get started. After those five minutes, you can take a break and watch all the adorable animal videos you want. But most likely, you’ll probably end up finishing whatever you’re working on before going back to YouTube.

Simply starting your work will push you past the procrastination barrier. Once you have begun, you’ll probably see that the assignment isn’t quite as complicated or involved as you imagined it would be. The stress over the project goes away and you can just focus on the work. And if you find it is more involved and complicated, you have time to compose a plan of attack — rather than scrambling at the last minute. Giving yourself even just five minutes to get started creates a psychological chain reaction that pushes you to finish the job.

So next time you find yourself procrastinating, close out of your web browser and open your work. Suck it up for five minutes and you’ll probably have that assignment finished in no time.

string(2442) "

Procrastination is the bane of almost everyone's existence. It detracts from productivity, creates unneeded stress, and can lead to missed deadlines. It's just bad all around. However, not many people know the cause of procrastination or how to beat it. But there is a one-step solution that will work for everyone struggling with procrastination.

The common misconception is that procrastination is a sign of laziness or disorganization. That's not quite true. Procrastinating doesn't mean you're less productive than your coworkers, although that can be the effect. Procrastination is simply a sign of seeking instant gratification. Would you rather start on that report or watch a cute cat video? In the moment, that choice is pretty simple. Cats are cute and much less boring than typing up a report. You might be aware that starting on the report is better in the long run, but in that second, it is much, much easier to open YouTube.

Because procrastination hinges on instant gratification, people of all kinds can suffer from it. It's not just lazy or unfocused people who fall prey to it. Anyone who would rather watch an adorable dog video than do work can end up procrastinating. But the good news is: there's a simple solution. Just start.

The fastest and most effective way to overcome the procrastination hurdle is to just start working. Give yourself five minutes to get started. After those five minutes, you can take a break and watch all the adorable animal videos you want. But most likely, you'll probably end up finishing whatever you're working on before going back to YouTube.

Simply starting your work will push you past the procrastination barrier. Once you have begun, you'll probably see that the assignment isn't quite as complicated or involved as you imagined it would be. The stress over the project goes away and you can just focus on the work. And if you find it is more involved and complicated, you have time to compose a plan of attack — rather than scrambling at the last minute. Giving yourself even just five minutes to get started creates a psychological chain reaction that pushes you to finish the job.

So next time you find yourself procrastinating, close out of your web browser and open your work. Suck it up for five minutes and you'll probably have that assignment finished in no time.

"