Exclusive Interview with Founder and CEO of Ignite Mind and Body Supplements, Jake Bernstein

Mar 22 | 2017

I recently had the pleasure to interview the Founder and CEO of Ignite Mind and Body Supplements, University of Massachusetts Amherst college senior (yes, you read that right), Jake Bernstein, who hails from Long Island, NY.

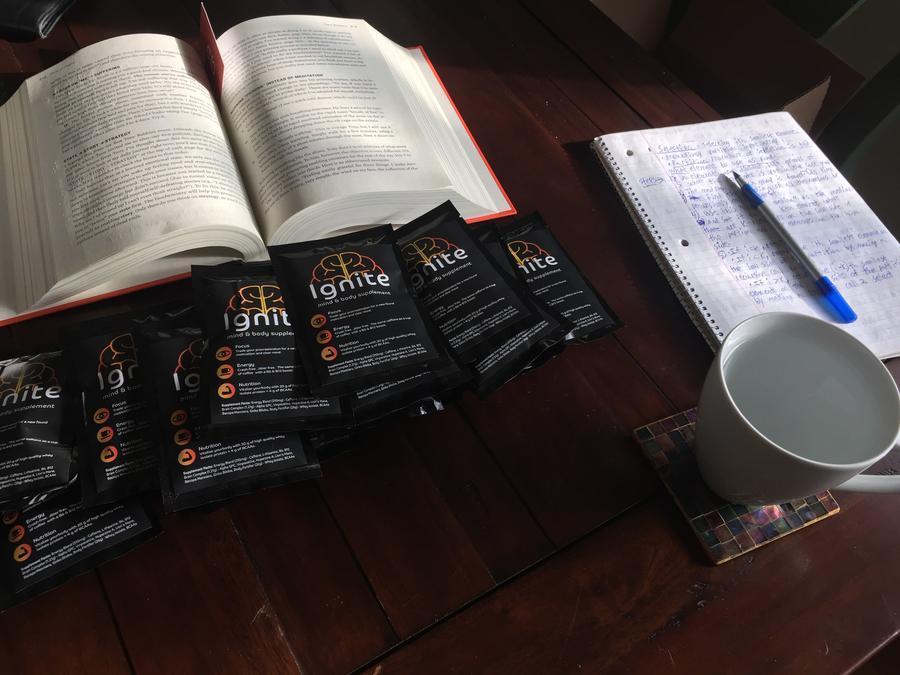

Ignite Power Packs are tasty chocolate powder supplements that provide a constant flow of steady energy, aid with focus and memory, improve our mood, and give long-lasting, all-day stamina for whatever it is we need to tackle.

His entrepreneurial spirit, determination to create a unique product, and overall business savvy make this young man one to watch. Here we discuss his personal journey, the inspiration behind Ignite, and what’s next for this soon-to-be-graduate. What were you doing at 22-years-old?

Jake teaching college students his own age about business.

Jake teaching college students his own age about business.

Q: When did you first want to be an entrepreneur and what was your first endeavor?

A: I’ve always been my most productive and motivated when working towards my own goals and on my own schedule. I started to realize this in high school while running a freelance development business where I built websites and web applications for clients. It was really rewarding to see the results that a little hard work and discipline could get me. From there, it seemed like a natural path to do more of that until it eventually took over all my free time.

Q: How did the idea for Ignite Power Packs come about?

A: The idea for Ignite Power Packs came to me early last summer (2016). I would wake up at 5:00am every other day to work out before going to work. By the time I got to work, I was exhausted, and no amount of coffee I chugged would help me focus on the software I had to program. Not to mention, my workout would be worthless if I didn’t eat enough food to give my body the nutrition it needed. After enough frustration, the idea finally came to me. Why not combine things that solve my problems separately into a delicious and convenient solution? Our Power Packs are just that. A tasty chocolate drink mix that combines the energy of caffeine and B vitamins, the nutrition of a protein shake, and the focus and clarity that are derived from commonly used plants known as nootropics.

Q: What has been your biggest challenge with the product/company thus far?

A: Our biggest challenge so far has been deciding which areas are the best to spend our capital most effectively. A big part of running our startup is bootstrapping and being smart with the funding that we do have. If we can keep doing this, it’ll be a lot easier to make sure Ignite stays around and that we can keep growing and providing people with products that help them get more done and get more enjoyment out of their day.

Q: What has been the most rewarding experience throughout the process of bringing Ignite Power Packs to the market?

A: The most rewarding experience is hearing positive reviews from happy customers. The supplement industry is one that isn’t the most regulated, and because of that, can be seen as shady. At Ignite Mind and Body, we aim to be on the opposite side of the spectrum, and be fully transparent with our customers. It’s nice to hear from them and know that we’re giving them the results they want and maintain the trust and honesty the customers deserve.

Q: What is different about Ignite Power Packs compared to other products in its category?

A: For us, the health of our customers is important – not just the effects they feel. Because of this, we only use nootropics that are completely plant-based. We want our customers to stay healthy and be able to use our Power Packs whenever they need to without having to worry about what’s inside. Not to mention, our formula doesn’t just give you a mental edge, it also helps you out physically, which many of our competitors’ products don’t do.

Q: Where can people purchase Ignite Power Packs?

A: People can get Ignite Power Packs right on our website, https://subscription.ignitemindandbody.com. We want you to experience the results for yourself, so there’s even an option to get 3 FREE Power Packs on us. If you’ve ever felt like there’s not enough time in the day or that you know you can get more done but just can’t seem to reach your full potential, take us up on our free power packs and feel the difference we can bring.

Q: Where do you see the brand going in the future?

A: At the end of the day, Ignite Mind and Body is more than just a supplement company. We want to work together with our customers to help them become the best versions of themselves that they know they can be. Ignite Mind and Body is about reaching your full potential, and that means we’ll be providing you with the right content, the right products, and the right community to help you do just that. 10 years down the road, we hope for Ignite Mind and Body to be a household name that’s associated with growth, success, and honesty.

Q: What advice would you give a budding entrepreneur seeking to launch a new product or service?

A: Start today. No matter how small a step you take, any step will help you build momentum and get you on the right path. A lot of us have this inner fear that our work won’t be good enough – myself included. But the truth is, you have to start sucking at something today if you want to be awesome at it a few years from now. Force yourself to start today. You won’t regret it.

Q: How many people work for the company at this time?

A: Currently just two people work for Ignite. Staying small until it’s necessary to grow helps us move fast, be efficient with our capital, and make decisions more easily. More people will join the team down the road, but we’re holding off until we find it’s the right time.

Q: Sum up Ignite Mind and Body in 3 words:

A: Productivity boosting supplements.

Q: What about your personality makes you a successful entrepreneur?

A: I wouldn’t same I’m a successful entrepreneur just yet when there’s people like Jeff Bezos and Elon Musk out there changing the world. But I think one thing that helps me succeed is the willingness to fail and look foolish. If you want to get things done quickly, you’re going to fail along the way. The important thing is to be OK with this and to focus on learning from your mistakes instead of wasting time worrying about what other people think.

Q: How were you able to finance the development and launch of the brand?

A: There’s a lot of great resources out there if people just take the time to look for them. We’ve found a lot of local entrepreneurship and pitch competitions that are literally handing out money for people who put in enough effort. We’ve also found mentorship programs and accelerators that you can apply to which provide funding if you’re accepted. We’ve actually just been accepted to one and we’re excited to see it help us grow. We also invest the money from our day jobs and savings into the business. It’s nice to have a side stream of income to help us grow, and this helps take out some of the risk and worry about where our money will come from. On top of this, there’s been a lot of bootstrapping and being smart with our money. Luckily, we have a very straightforward business model. We trade useful products for money. So unlike some software companies that might have to rely strictly on funding and can’t profit right away, we’re able to make money up front and reinvest it in the business.

Q: Anything else you’d like to share?

A: If you’re even just the slightest bit curious about starting a business, you should go for it. You can only read so much about a topic. Actually going for it will teach you ten times more. Between the wealth of information online and being able to crowdfund your projects through sites like Kickstarter, there’s really no reason you can’t start your business today.