No Santa to bail you out this year, it's all you

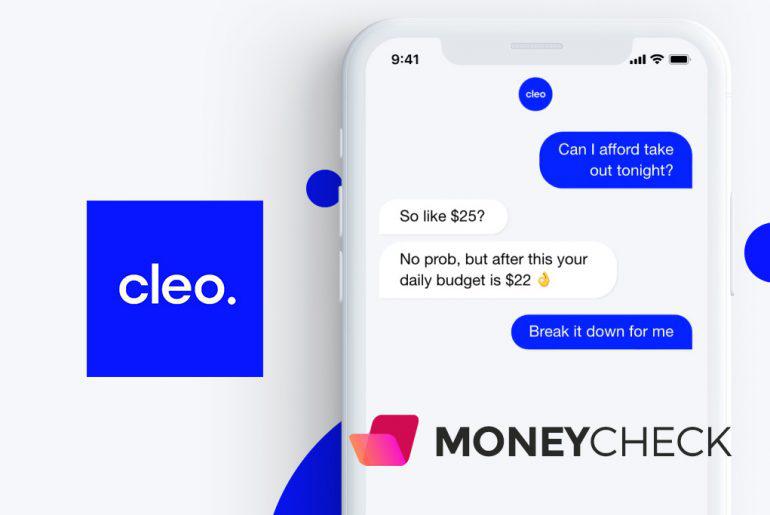

via Cleo

Ah yes, ’tis finally the giving season! As someone whose love-language is gift giving, I relish most opportunities to spoil my friends with sweet tokens of appreciation. I am the queen of spontaneous gifts. When I’m puttering around the city, doing my silly little tasks, I always perk up when I find some small trinket