How to Get a Better Job That Pays You More

Jun 03 | 2025

Jobs don't have to be miserable!

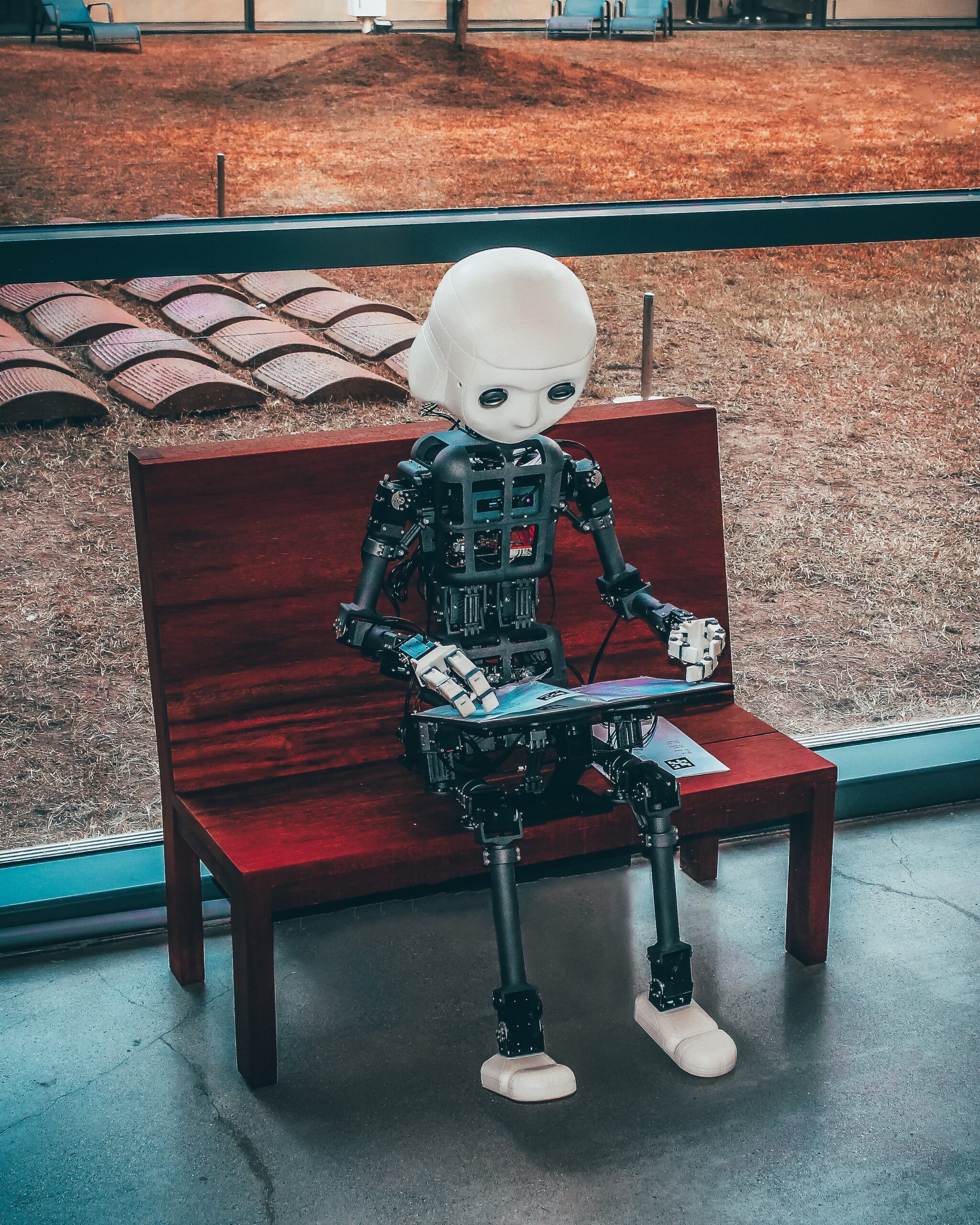

Photo by Charles Deluvio (unsplash)

Though the wave of tech layoffs and the threat of a recession has overshadowed yesteryear’s news of the great recession, everywhere you look, employees are asking for more — and getting it. Though this time of uncertainty could have given employers back the power, it’s still in the hands of the workforce. From Gen-Z’s boundary