Got a stuffed closet? Want to refresh and renew your wardrobe without feeling like you wasted money on all those clothes? Then consider reselling your clothes instead of donating. There are a lot of great ways to get some money back on your pre-owned closet.

To start the process you have to look at your clothes! Make 3 piles; throw out, donate, and sell. Throw out anything that is too defected, ripped, and stained to be worth saving. Donation is best for the fast fashion clothes that can make up part of your wardrobe. Anything that wasn’t worth much when you bought it probably won’t be worth much when you resell it. Finally the sell pile is what you’re looking to make a profit off of. This means it’s fashionable, in good shape, and comes from a desirable brand. You won’t have much luck selling cheaper, stained, or ripped old gear but if you have something with potential then here’s what to do.

Once you have your sell pile, you can decide what to do next! Certain websites will want you to take pictures of the clothes you’re donating. This can be a crucial step for successful selling. Make sure the photo is well lit and the focus is on the article of clothing. Arrange is against a solid background and make sure you’re not casting a shadow. Hanging something up in front of a closet door is always a good starting point. If you’re wearing it for the photo then make it as fashionable as possible while still focusing on that particular item.

These are some great resources for selling clothes!

Consignment Shops

buffaloexchange

buffaloexchange

The oldest method is to search your area for consignment shops. There are different kinds so while you might be tempted to just dump stuff off at your local Goodwill, consider looking for more high-end shops. Stores like Buffalo exchange will give you store credit which can be great if you’re looking for a wardrobe refresh. High-end vintage and consignment stores might be looking for more fashionable clothes; no gap or forever 21 shirts from last year and no prom dresses from the 80s. This means physically going to the store which might not be worth it for you if you’re busy.

Thredup

thredup

thredup

ThredUp is great for someone on the go. I’m looking at busy women who are looking to get rid of their kid’s clothes or their own. They work with a clean out kit. You send them your clothes, they evaluate them, and they are either accepted or rejected. Acceptance means you can get paid immediately ‘up front’ and they’re posted up on their website, or it could mean waiting awhile for a more unique ‘consignment’ item to sell. Rejection means they don’t have much interest and you can choose to leave those clothes behind or get them returned. You can choose store credit or a pay pal money transfer.

Instagram

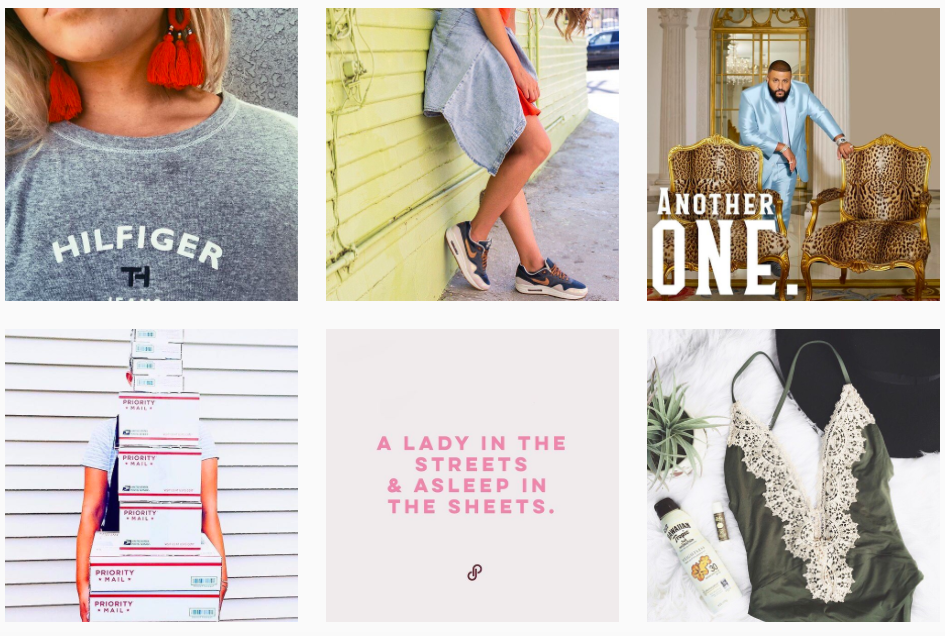

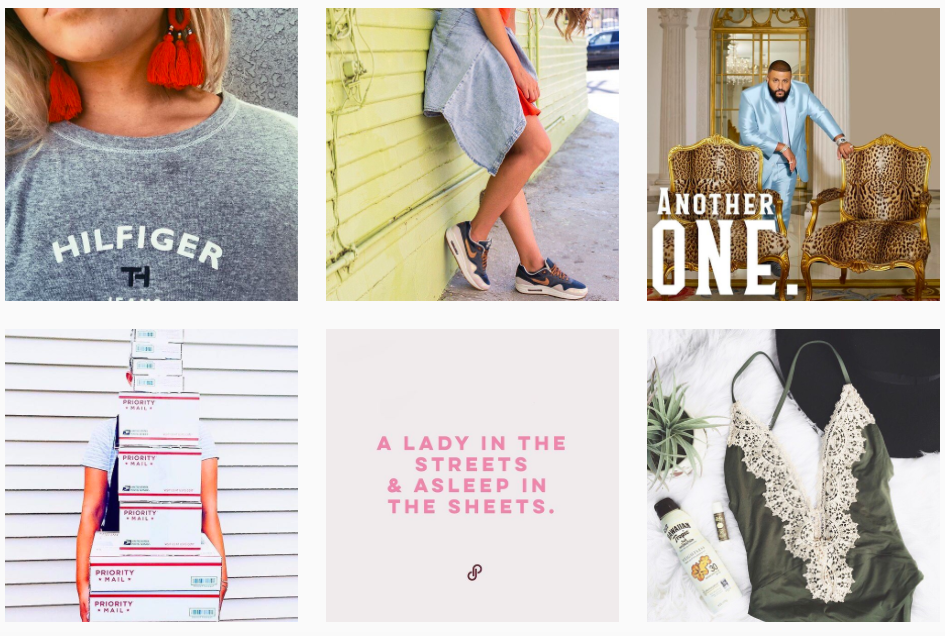

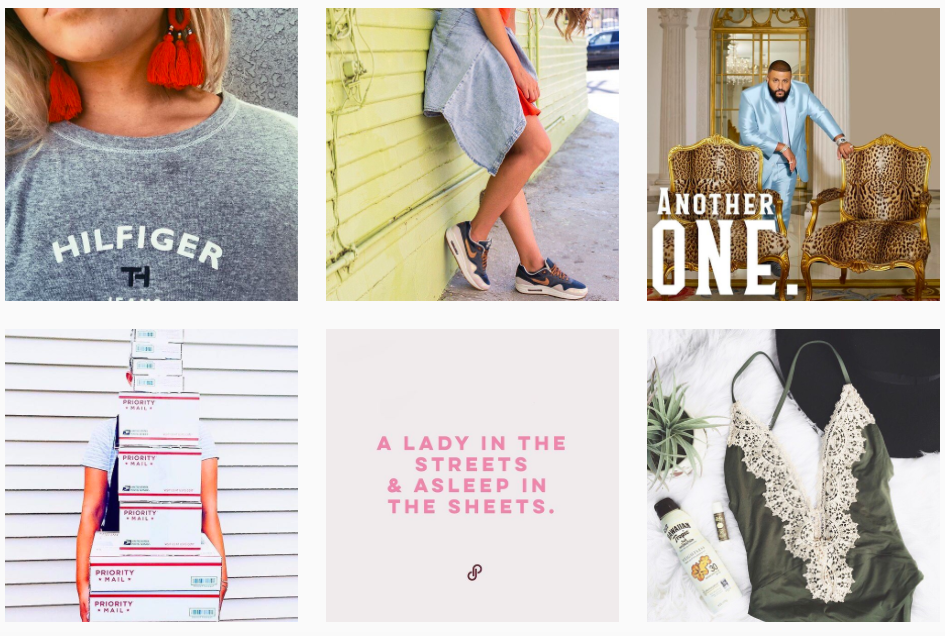

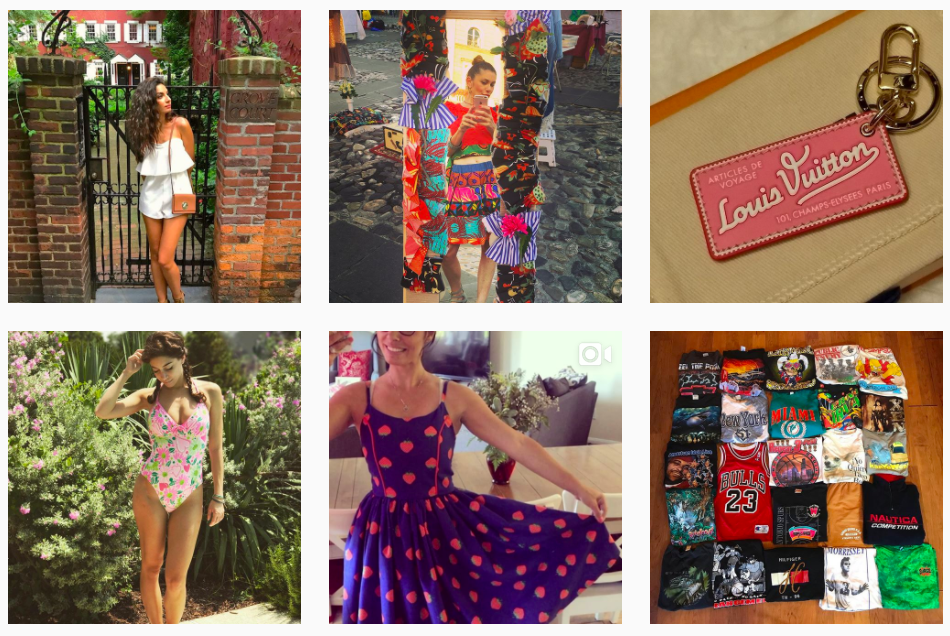

#shopmycloset

#shopmycloset

Do it yourself with the hashtag #shopmycloset. There are tons of people using this hashtag to skip the retailers fees by cutting out the middleman. Take bids in the comments and negotiate via direct message. For security use a secure money transfer like paypal. Just be careful and be smart. Take good pictures and you can be in for a great payday.

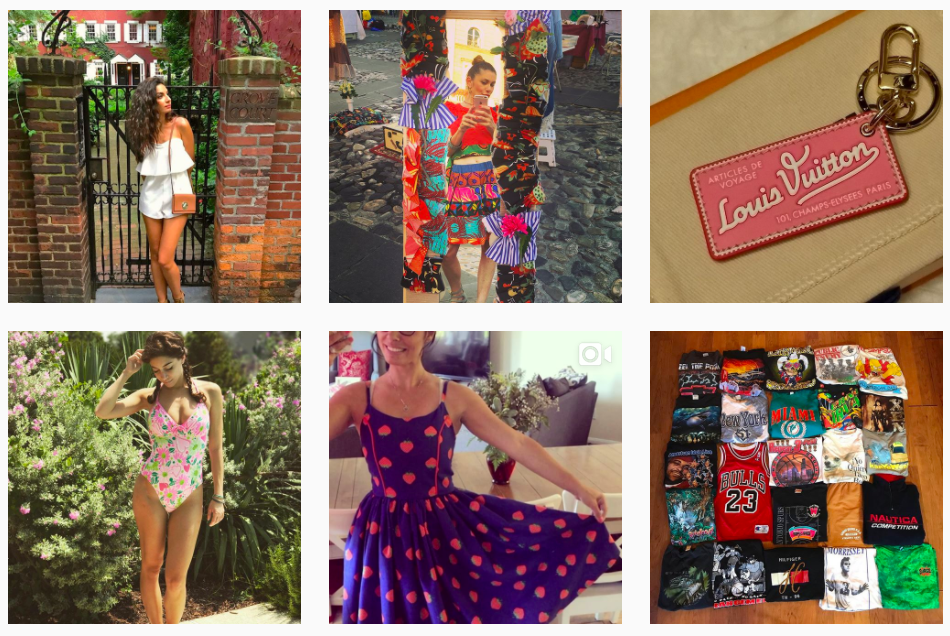

Etsy

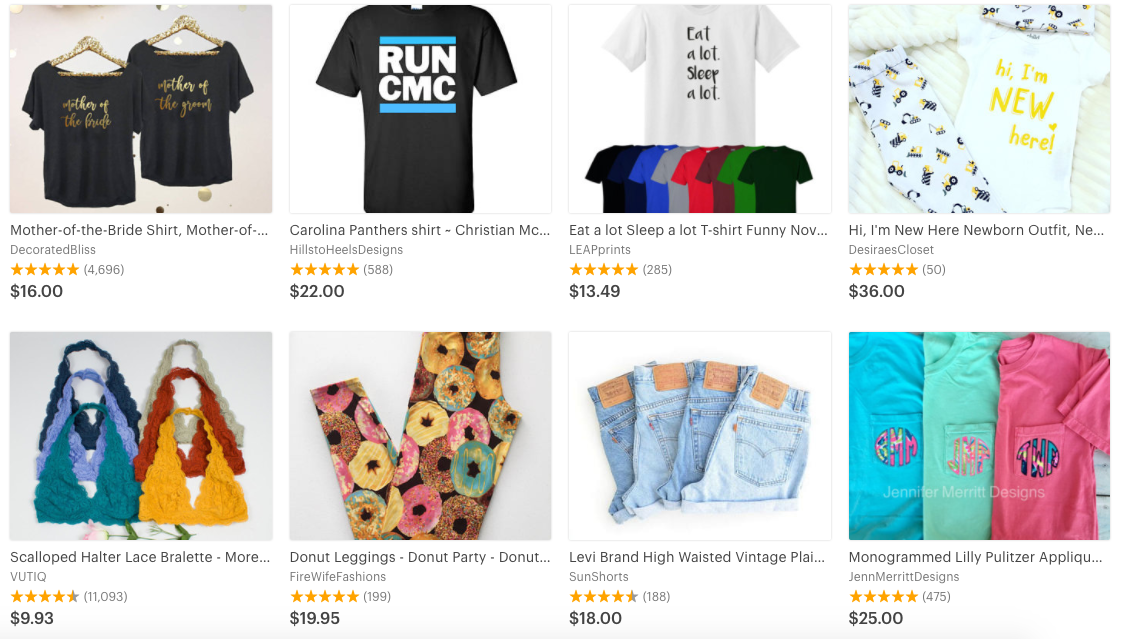

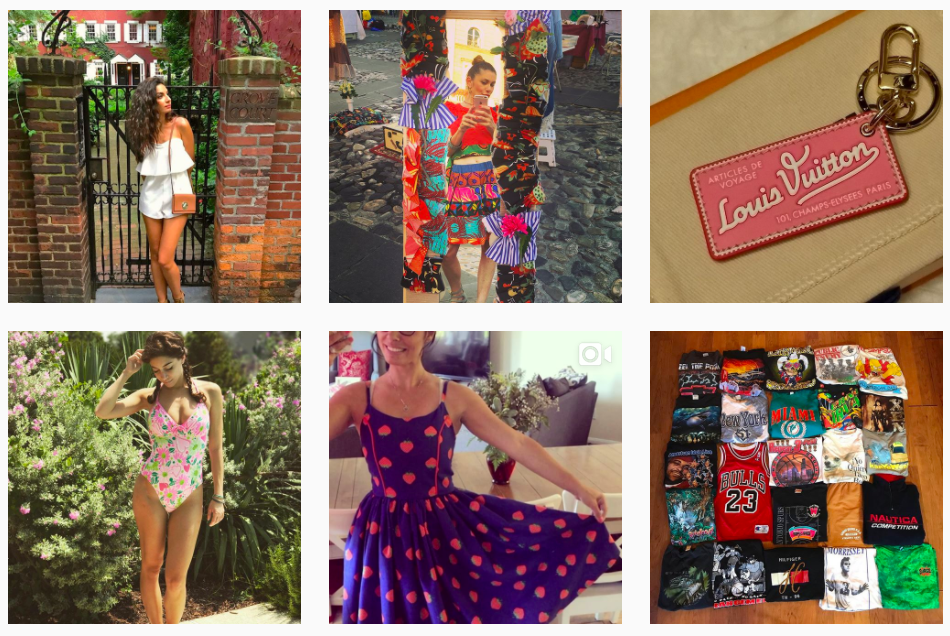

If you’ve got something funky, vintage, or homemade then start an Etsy account! People like to buy something with a more unique flavor on Etsy. This means vintage clothes and unique items. Get creative with your clothes and the sky’s the limit.

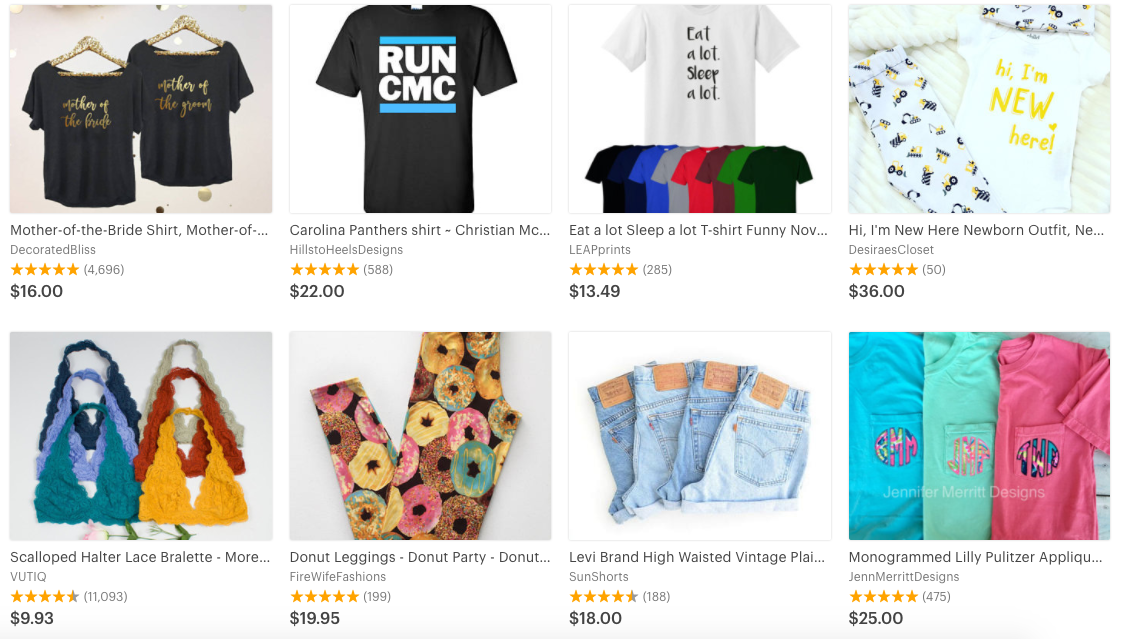

Poshmark

poshmark

poshmark

For the instagram generation there is the Poshmark app. Sell your clothes directly from your phone. Take a photo, upload your item, and throw one of their fashion forward filters on. When your item sells, Poshmark will send you the pre-paid envelope label to send out your clothes and accessories. You can do it all from the comfort of your home so it’s never been easier.

string(5679) "

Got a stuffed closet? Want to refresh and renew your wardrobe without feeling like you wasted money on all those clothes? Then consider reselling your clothes instead of donating. There are a lot of great ways to get some money back on your pre-owned closet.

To start the process you have to look at your clothes! Make 3 piles; throw out, donate, and sell. Throw out anything that is too defected, ripped, and stained to be worth saving. Donation is best for the fast fashion clothes that can make up part of your wardrobe. Anything that wasn't worth much when you bought it probably won't be worth much when you resell it. Finally the sell pile is what you're looking to make a profit off of. This means it's fashionable, in good shape, and comes from a desirable brand. You won't have much luck selling cheaper, stained, or ripped old gear but if you have something with potential then here's what to do.

Once you have your sell pile, you can decide what to do next! Certain websites will want you to take pictures of the clothes you're donating. This can be a crucial step for successful selling. Make sure the photo is well lit and the focus is on the article of clothing. Arrange is against a solid background and make sure you're not casting a shadow. Hanging something up in front of a closet door is always a good starting point. If you're wearing it for the photo then make it as fashionable as possible while still focusing on that particular item.

These are some great resources for selling clothes!

Consignment Shops

buffaloexchange

buffaloexchange

The oldest method is to search your area for consignment shops. There are different kinds so while you might be tempted to just dump stuff off at your local Goodwill, consider looking for more high-end shops. Stores like Buffalo exchange will give you store credit which can be great if you're looking for a wardrobe refresh. High-end vintage and consignment stores might be looking for more fashionable clothes; no gap or forever 21 shirts from last year and no prom dresses from the 80s. This means physically going to the store which might not be worth it for you if you're busy.

Thredup

thredup

thredup

ThredUp is great for someone on the go. I'm looking at busy women who are looking to get rid of their kid's clothes or their own. They work with a clean out kit. You send them your clothes, they evaluate them, and they are either accepted or rejected. Acceptance means you can get paid immediately 'up front' and they're posted up on their website, or it could mean waiting awhile for a more unique 'consignment' item to sell. Rejection means they don't have much interest and you can choose to leave those clothes behind or get them returned. You can choose store credit or a pay pal money transfer.

Instagram

#shopmycloset

#shopmycloset

Do it yourself with the hashtag #shopmycloset. There are tons of people using this hashtag to skip the retailers fees by cutting out the middleman. Take bids in the comments and negotiate via direct message. For security use a secure money transfer like paypal. Just be careful and be smart. Take good pictures and you can be in for a great payday.

Etsy

If you've got something funky, vintage, or homemade then start an Etsy account! People like to buy something with a more unique flavor on Etsy. This means vintage clothes and unique items. Get creative with your clothes and the sky's the limit.

Poshmark

poshmark

poshmark

For the instagram generation there is the Poshmark app. Sell your clothes directly from your phone. Take a photo, upload your item, and throw one of their fashion forward filters on. When your item sells, Poshmark will send you the pre-paid envelope label to send out your clothes and accessories. You can do it all from the comfort of your home so it's never been easier.

"

#shopmycloset

#shopmycloset