Photo by Zhuo Cheng you on Unsplash

We’ve all heard it before. Takeaway is way more tempting than cooking at home night after night after night. But although ordering-in might save you precious time, at the end of the day I’ll bet your wallet takes the hit.

Everyone on the planet resorts to takeout after a long day’s work — and I’m no exception. After a day slouched at my desk tapping on laptop, hopping on and off Zoom calls, I deserve a big fat burrito — extra guac and cheese, please. But it’s never worth the price, and with taxes, app payout, delivery fees & tip, it all adds up.

Plus, I often wonder how much delivery drivers actually receive from my one little order? Does the extra $ that I pay for delivery truly reach the drivers alone?

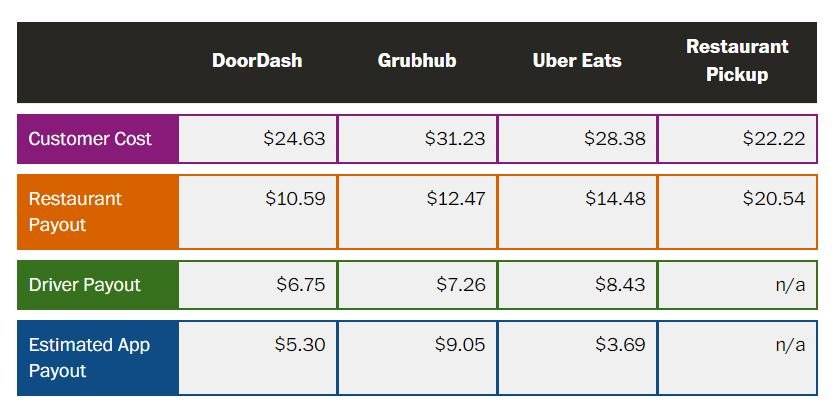

The Washington Post recently conducted an experiment to discover what percentage of the total tab goes to drivers. The Post looked at a variety of food delivery apps vs. restaurant pickup to see how they compare. The exact same order was placed — here are a few of their findings:

Screenshot from The Washington Post article

Disclaimer: “As tips can vary customer-to-customer — from the size of the tip to giving a percentage versus a flat dollar amount — The Post initially removed them to compare the cost of the transactions better. When added in later, they significantly impact driver pay.” — The Washington Post

Driver payout is very close to the estimated app payout, which is a bit unexpected. I imagined that the drivers would receive at least 5-10% of the total and earn a livable wage. But I now see that isn’t it at all…

“Is this money going to the restaurant? Is this money going to the driver? Is this money going to the firm? It’s all so opaque…Customers have been really frustrated when they look at their receipts.” said Veena Dubal, an employment law professor at the University of California College of the Law, San Francisco.

Then suddenly, restaurant owners decided that their prices would vary depending on which platform a customer came through. What-why? Because the apps charge sooo much in commission?

I’m super annoyed that the price of my favorite burger and fries keeps rising. And rising. And rising. People blamed inflation, then it was the fact that people should earn a minimum wage — clearly the drivers weren’t — and now it’s the app commission?

“If the delivery companies didn’t exist, customers would go back to ordering straight from me over the phone or from my website, and I would actually be able to make money on the orders again,” said Artesano owner Douglas Mathieux, 54.

We keep talking about how much restaurants lose, but what about the drivers? They’re the ones who spend hours driving through terrible weather — who would leave their house in the rain, am I right?

Based on The Washington Post study, drivers’ pay is usually calculated based on time and mileage. I highly doubt that this includes the time drivers waste waiting for the bag ‘o grub to be ready. Most apps handle only one order at a time, that way drivers know precisely how much they make. But some apps batch orders together, making it tough to grasp exactly what they earn.

But things are changing… New York was the first city to pass a new bill establishing a minimum wage for anyone who drives or bikes food orders throughout the five boroughs. The law goes into effect on July 12th. Wages will increase to $17.96 per hour (plus tips) with a further boost to $19.96 an hour by April 1, 2025.

New York City Mayor Eric Adams explained on the Gothamist site. “The ones that bring you pizza in the snow and Thai food you like in the rain. This new minimum pay rate will guarantee that these workers and their families can earn a living. They should not be delivering food to your household if they can’t put food on the plate in their household.”

Eric Adams added, “When the rate takes full effect, workers will make three times (my emphasis) as much as they do now. I am proud that our city has fulfilled its promise to provide more stability and protections for 60,000 workers and get them a dignified pay rate.”

Once New York establishes this legendary pay hike, hopefully, this can spread to other cities. And that way restaurants can still receive orders from the app, drivers earn a fair wage, and I get my big fat ooey-gooey burrito. Restaurant owners are happy. The drivers are happy. And I’m thrilled. Boom!