You’ve seen the offers: promises of untold riches for just a few moments spent filling out a brief online survey. You’ve probably never bothered to click these ads, assuming they’re too good to be true. The truth is, while online surveys won’t bump you into a higher tax bracket, they aren’t a bad way to make a few extra bucks—as long as you make sure you sign up with trustworthy sites. To make your quest for extra cash a little bit easier, we’ve compiled a list of the best-paid survey sites.

Swagbucks

Swagbucks

Swagbucks is a popular site for making extra money. It offers a variety of ways to earn cash beyond taking surveys, like watching videos and playing games. The site also occasionally hands out free rewards points (they’re called SBs) just for being a member. You’ll get these SBs for each survey you participate in, and you can redeem them for cash via PayPal or gift cards. You also get $5 just for signing up and taking your first survey!

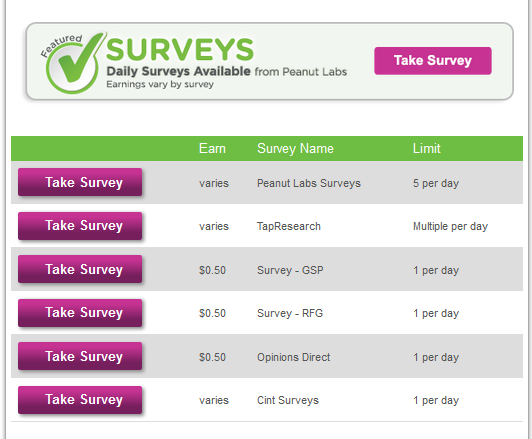

VIP Voice

VIP Voice

VIP Voice offers a wide variety of surveys that tend not to be as time-consuming as other sites, and like Swagbucks, they reward you with points you can redeem for cash or gift cards. Penny Hoarder reports that with VIP Voice, “You’ll have no trouble earning an extra $30 this month with almost no work.”

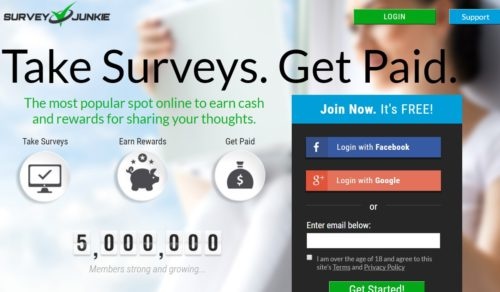

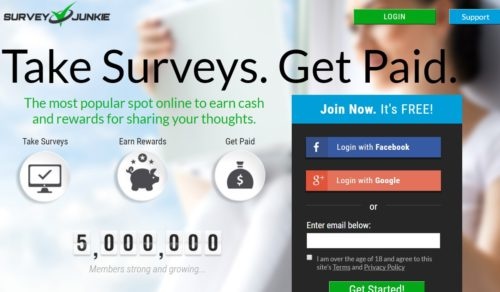

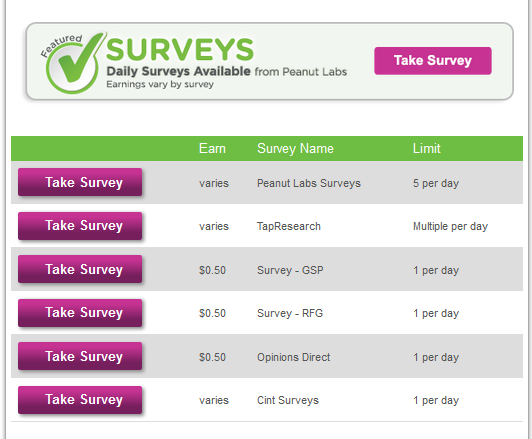

Survey Junkie

Survey Junkie

Survey Junkie offers a well-designed, efficient website. The “cashout wheel” keeps you updated on your earnings and keeps you motivated to keep taking surveys. The surveys don’t take long to complete and reward you with points. Once you earn 1,000 points, which is equivalent to $10, you can cash out.

Ipsos i-Say

Ipsos i-Say

Ipsos is one of the world’s largest market research companies. They often partner with Reuters to assemble surveys about Congress, the sitting president, and other aspects of U.S. politics. Ipsos i-Say is the company’s online survey rewards sector, where you can earn points for answering surveys. Unlike some of the others on this list, Ipsos i-Say only does surveys and market research.

Inbox Dollars

Inbox Dollars

Inbox Dollars is a little bit different than your classic survey site, offering opportunities to earn cash (no confusing point systems) by shopping online, watching videos, answering surveys, fulfilling offers, and clicking on links in emails (you don’t have to sign up for anything, but you earn more if you do).

With some paid survey sites, your earnings are as small as a penny per email clicked or a dollar per 20-minute survey, but if you routinely visit these sites—maybe while watching TV or during downtime at work — the earnings can add up and help supplement your monthly income.

string(4026) "

You've seen the offers: promises of untold riches for just a few moments spent filling out a brief online survey. You've probably never bothered to click these ads, assuming they're too good to be true. The truth is, while online surveys won't bump you into a higher tax bracket, they aren't a bad way to make a few extra bucks—as long as you make sure you sign up with trustworthy sites. To make your quest for extra cash a little bit easier, we've compiled a list of the best-paid survey sites.

Swagbucks

SwagbucksSwagbucks is a popular site for making extra money. It offers a variety of ways to earn cash beyond taking surveys, like watching videos and playing games. The site also occasionally hands out free rewards points (they're called SBs) just for being a member. You'll get these SBs for each survey you participate in, and you can redeem them for cash via PayPal or gift cards. You also get $5 just for signing up and taking your first survey!

VIP Voice

VIP Voice VIP Voice offers a wide variety of surveys that tend not to be as time-consuming as other sites, and like Swagbucks, they reward you with points you can redeem for cash or gift cards. Penny Hoarder reports that with VIP Voice, "You'll have no trouble earning an extra $30 this month with almost no work."

Survey Junkie

Survey JunkieSurvey Junkie offers a well-designed, efficient website. The "cashout wheel" keeps you updated on your earnings and keeps you motivated to keep taking surveys. The surveys don't take long to complete and reward you with points. Once you earn 1,000 points, which is equivalent to $10, you can cash out.

[shortcode-112-mobile-banner]

Ipsos i-Say

Ipsos i-SayIpsos is one of the world's largest market research companies. They often partner with Reuters to assemble surveys about Congress, the sitting president, and other aspects of U.S. politics. Ipsos i-Say is the company's online survey rewards sector, where you can earn points for answering surveys. Unlike some of the others on this list, Ipsos i-Say only does surveys and market research.

Inbox Dollars

Inbox Dollars

Inbox Dollars is a little bit different than your classic survey site, offering opportunities to earn cash (no confusing point systems) by shopping online, watching videos, answering surveys, fulfilling offers, and clicking on links in emails (you don't have to sign up for anything, but you earn more if you do).

With some paid survey sites, your earnings are as small as a penny per email clicked or a dollar per 20-minute survey, but if you routinely visit these sites—maybe while watching TV or during downtime at work — the earnings can add up and help supplement your monthly income.

"

Swagbucks

Swagbucks VIP Voice

VIP Voice  Survey Junkie

Survey Junkie Ipsos i-Say

Ipsos i-Say Inbox Dollars

Inbox Dollars