Seemingly every day, TikTok excavates a new defining difference between Gen Z and millennials.

Officially, millennials were born between 1981 and 1996, and Gen Z includes anyone born between 1997 and 2012. Though the “Zillennials” born between ’94 and 2000 straddle this divide, the commonly cited factors that distinguish the two include: relationship to technology, use of social media, and memories/experiences of key events like 9/11 and the 2008 recession.

On social media platforms like TikTok and Instagram, more whimsical differences emerge. Social and cultural norms always shift with the times, and certain trends are sure signs of which group a person belongs to.

Popular examples — some of which have caused internet outcries and viral trends (who remembers the “Proud to Be a Millennial” song) — are Gen Z versus Millennial preferences for mom jeans over skinny jeans and middle parts over side parts.

But one thing that unites them: similar attitudes towards money.

Both came (or are coming) of age during various crises — for many millennials, the great recession was a formative experience on their lives and career trajectories, and many Gen Zers have had their emergent professional lives rocked by the pandemic.

Add to all this the crippling load of student loan debt that both carry and the threat of the climate crisis putting a question mark over the task of future planning, learning to manage money is notoriously tricky for both factions — but they’re increasingly empowering themselves using the internet.

According to Kasasa* , both generations are turning to personalized, tailored banking services. No one ever taught them to balance a checkbook (literally … what even is that?), but they’re empowering themselves with digital banking.

“Millennials … seek digital tools to help manage their debt and see their banks as transactional as opposed to relational,” according to Kasasa, and Gen Z are into “learning about personal finance. They have a strong appetite for financial education and are opening savings accounts at younger ages than prior generations.”

With an appetite to learn about and confront the abysmal financial foundations, they have been handed, digital banking tools are attractive to both Gen Z and Millennials — bonus points if they are easy to use with a no-nonsense interface.

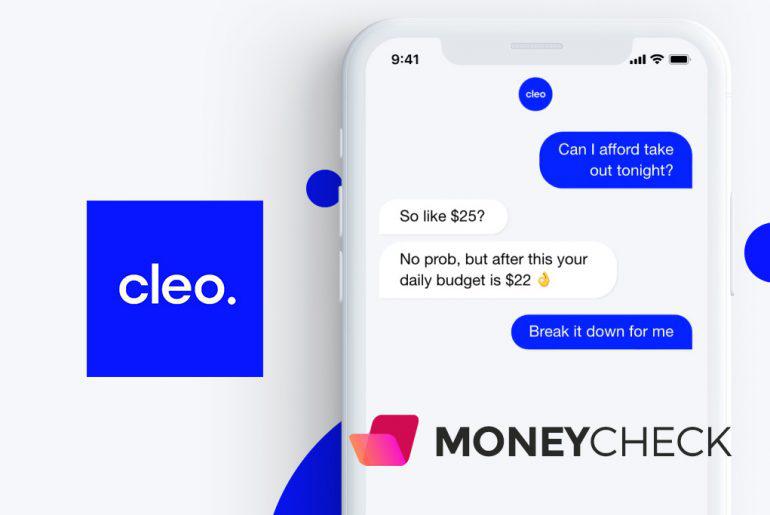

According to their website, Cleo is an app which integrates all your accounts and, like a really financially savvy and brutally honest friend, tells you what’s going on in your wallet.

Cleo is like the coolest finance major you’ll ever meet. You can text her all your questions about your spending, your habits, and your current balances, and she’ll give it to you straight.

She’ll also tell you when you’re running low — like when you should probably skip that Starbucks stop so you’ll have money left for the subway home — and keeps you on track of your goals.

Here are some of our favorite features of Cleo that make her universally likable:

1. It’s like talking to a friend

Above anything, Cleo is accessible. Anyone can (and everyone should) talk to her about money to demystify their finances. Cleo answers questions in a super easy-to-understand vernacular and talks to you like a friend — the kind of friend who isn’t afraid to roast you when you’re being shortsighted.

2. Autosave makes saving easy

Budgeting doesn’t have to be boring. Saving money should be fun. After all, you’re stacking up cash to live an awesome life — whether it’s a sick vacation you want to take and post all over Instagram or a house in your dream neighborhood — so shouldn’t you be excited about it? Well, it can be hard to drum up any verve for putting your money away, but Cleo uses autosave so you don’t see the money it’s saving for you until you’ve reached your goals

3. She breaks it down super simply

The key to getting good with money is looking at the big picture. Cleo categorizes your spending into parts so you know how much is going where. And it doesn’t have to be intimidating. Sometimes all you need is a calculator and Cleo.

* https://www.kasasa.com/articles/generations/gen-x-…

string(5688) "

Seemingly every day, TikTok excavates a new defining difference between Gen Z and millennials.

Officially, millennials were born between 1981 and 1996, and Gen Z includes anyone born between 1997 and 2012. Though the "Zillennials" born between '94 and 2000 straddle this divide, the commonly cited factors that distinguish the two include: relationship to technology, use of social media, and memories/experiences of key events like 9/11 and the 2008 recession.

On social media platforms like TikTok and Instagram, more whimsical differences emerge. Social and cultural norms always shift with the times, and certain trends are sure signs of which group a person belongs to.

Popular examples — some of which have caused internet outcries and viral trends (who remembers the "Proud to Be a Millennial" song) — are Gen Z versus Millennial preferences for mom jeans over skinny jeans and middle parts over side parts.

But one thing that unites them: similar attitudes towards money.

Both came (or are coming) of age during various crises — for many millennials, the great recession was a formative experience on their lives and career trajectories, and many Gen Zers have had their emergent professional lives rocked by the pandemic.

Add to all this the crippling load of student loan debt that both carry and the threat of the climate crisis putting a question mark over the task of future planning, learning to manage money is notoriously tricky for both factions — but they're increasingly empowering themselves using the internet.

According to Kasasa* , both generations are turning to personalized, tailored banking services. No one ever taught them to balance a checkbook (literally … what even is that?), but they're empowering themselves with digital banking.

"Millennials … seek digital tools to help manage their debt and see their banks as transactional as opposed to relational," according to Kasasa, and Gen Z are into "learning about personal finance. They have a strong appetite for financial education and are opening savings accounts at younger ages than prior generations."

With an appetite to learn about and confront the abysmal financial foundations, they have been handed, digital banking tools are attractive to both Gen Z and Millennials — bonus points if they are easy to use with a no-nonsense interface.

According to their website, Cleo is an app which integrates all your accounts and, like a really financially savvy and brutally honest friend, tells you what's going on in your wallet.

Cleo is like the coolest finance major you'll ever meet. You can text her all your questions about your spending, your habits, and your current balances, and she'll give it to you straight.

She'll also tell you when you're running low — like when you should probably skip that Starbucks stop so you'll have money left for the subway home — and keeps you on track of your goals.

Here are some of our favorite features of Cleo that make her universally likable:

1. It's like talking to a friend

Above anything, Cleo is accessible. Anyone can (and everyone should) talk to her about money to demystify their finances. Cleo answers questions in a super easy-to-understand vernacular and talks to you like a friend — the kind of friend who isn't afraid to roast you when you're being shortsighted.

2. Autosave makes saving easy

Budgeting doesn't have to be boring. Saving money should be fun. After all, you're stacking up cash to live an awesome life — whether it's a sick vacation you want to take and post all over Instagram or a house in your dream neighborhood — so shouldn't you be excited about it? Well, it can be hard to drum up any verve for putting your money away, but Cleo uses autosave so you don't see the money it's saving for you until you've reached your goals

3. She breaks it down super simply

The key to getting good with money is looking at the big picture. Cleo categorizes your spending into parts so you know how much is going where. And it doesn't have to be intimidating. Sometimes all you need is a calculator and Cleo.

* https://www.kasasa.com/articles/generations/gen-x-...

"