Photo: Domenico Loia

By Tom Twardzik

Sometimes, the difference between a successful day of work and a frustrating one is a set of efficient, uncomplicated tools. For someone working from home or otherwise away from the office, the primary tool set is often a computer. A standard word processor, a default email client and the desktop sticky notes might be enough to complete your tasks, but a more personalized and powerful desktop will boost your productivity and overhaul your creative process. The Mac apps below highlight the best ways to upgrade your tool set for a more efficient home or remote office.

Basic productivity

What are some of the most basic actions you perform on your computer? Copy-and-paste and resizing and arranging windows. Saving a fraction of a second every time you perform these actions adds up quickly, and several apps will help you do that.

Magnet.

Magnet.

Magnet has been at the top of the paid apps chart for months. This $0.99 utility gives your desktop more than a dozen shortcuts for resizing and arranging the windows on your screen. Whether you’re on an 11″ laptop or a 27″ iMac, Magnet snaps any window into size and position with a number of keyboard shortcuts. It makes decluttering your digital workspace much simpler than decluttering your desk will ever be.

iPaste is another must-have utility that lives in the background and automatically stores your recent clipboard. It saves what you ask it to save and makes it available in a pop-up menu through a keyboard shortcut. And it does it for free. So you can copy three separate sentences of an article and paste them separately instead of flipping back and forth between windows, copying and pasting three times.

It’s the little things.

Idea-sketching and planning

There are hundreds of brainstorming, note-taking and to-do list apps available on and off the app store, but there are few standouts who do it all in one. Fed up with Evernote’s subscription model but still willing to pay? Try Notability, the Mac version of iPad’s ultimate idea space. Type, draw, annotate, record audio, add photos and PDFs—it does everything. For $10 and no subscription, it’ll quickly replace all of Evernote’s functionalities.

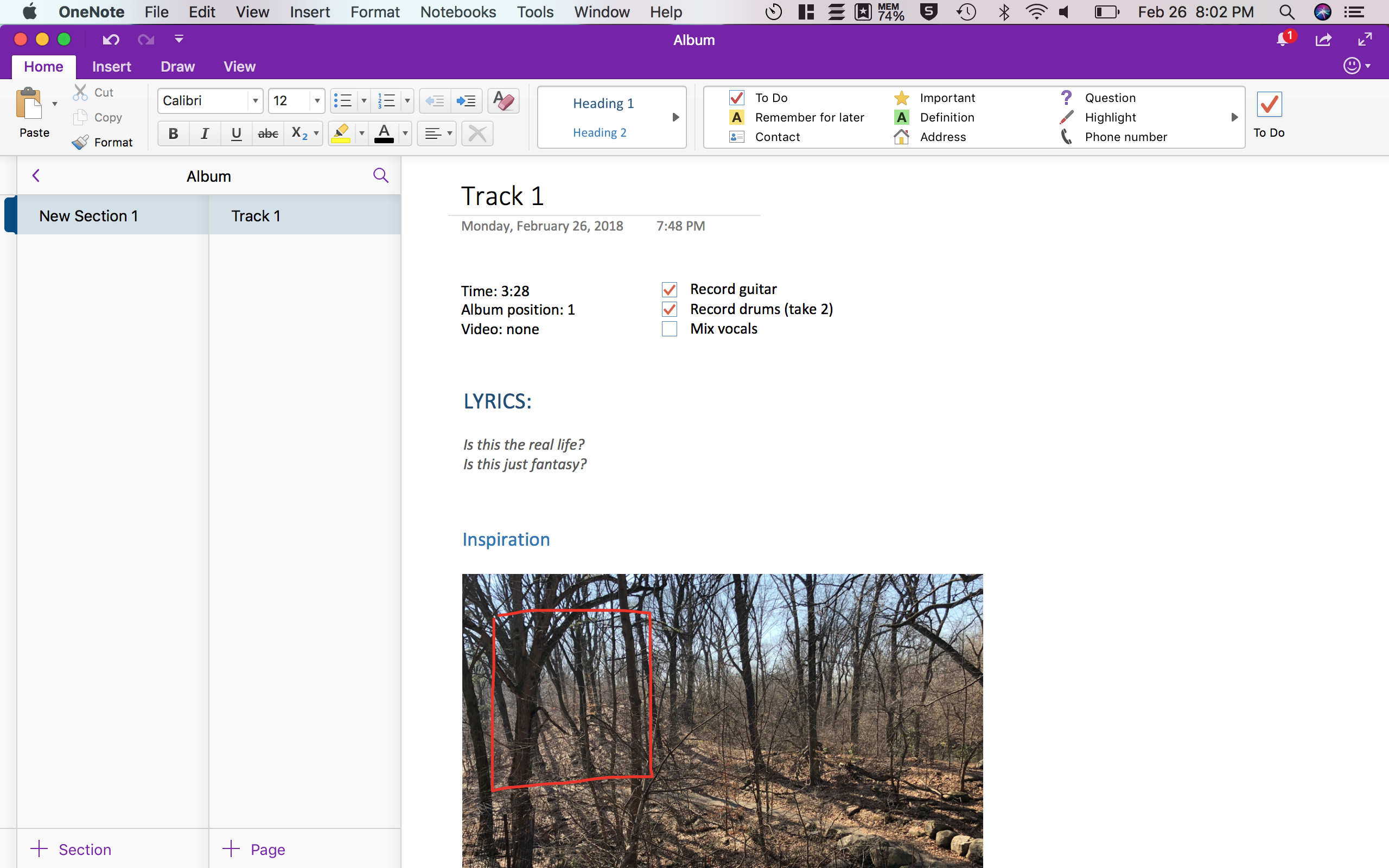

OneNote

OneNote

Or, for a free alternative, go for Microsoft’s OneNote. The only catch here is that you’ll have to create a (free) Microsoft account. OneNote offers a toolset similar to Notability (if a bit less polished and more… Microsoft). It offers a powerful notation space, especially for anyone already in the Microsoft ecosystem.

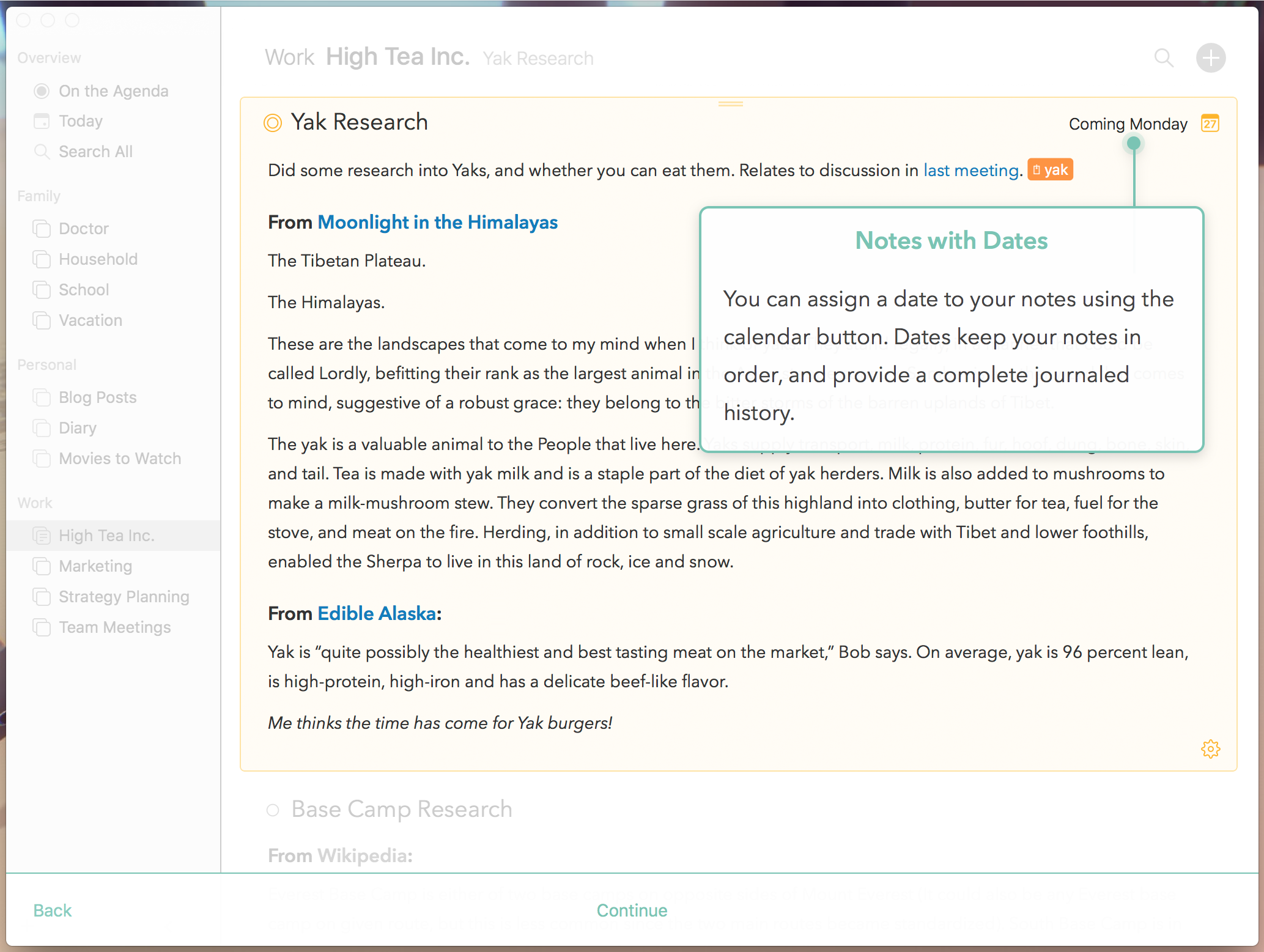

Agenda.

Agenda.

For a more structured planning app, Agenda is a great alternative to Trello. It’s a date-focused notes/journal combination that incorporates your calendar to offer a to-do list, note space and calendar on one screen. Seeing previously completed to-dos and past dates in the same line as future events is surprisingly helpful. It adds temporal context to every glance at your upcoming tasks and notes. $25 gets you all of the synching and exporting features not included in the free app.

Maybe you’re looking for a pure, simple, full-featured, free to-do list to replace Todoist, Things or any of the other paid or subscription-based apps out there. Enter Wunderlist. Not only does it offer all of the features of the others for free (including sync, subtasks and an Apple Watch app), but it has collaboration features, too. Use it to manage all of your projects or set up your coworkers or family with access to shared lists to split up the workload.

Collaboration

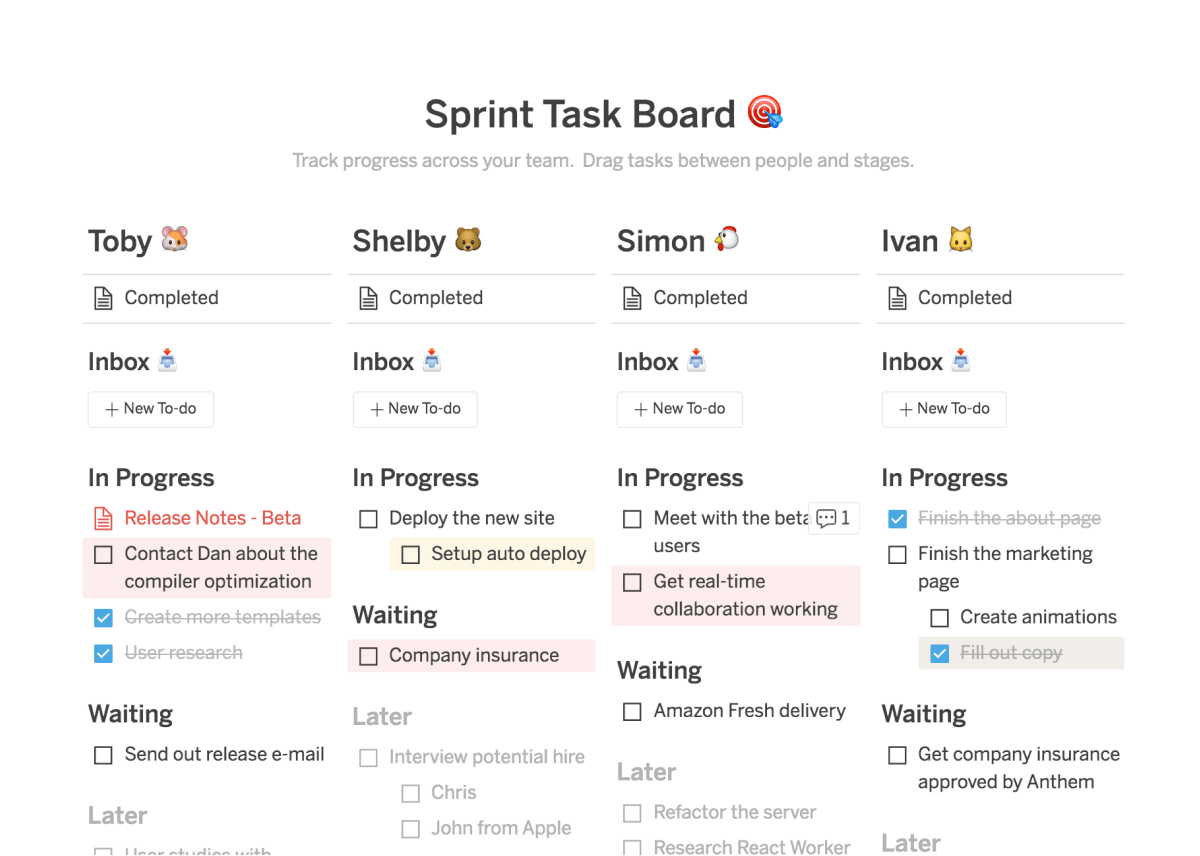

Notion.

Notion.

Speaking of collaborating, you might be searching for a change in routine to boost creativity or energize your team. A new app could be the solution, a replacement for Slack or Trello or Google Drive. Try Notion. It’s a free, universal notes/to-dos/wiki app that works on desktop, mobile or in-browser on any computer. You can work offline, sync between devices, invite your team to workspaces and collaborate in real time. It looks great, too. There is a paid pro tier that removes limits on card numbers and upload sizes, but the free version has plenty of features for a small team.

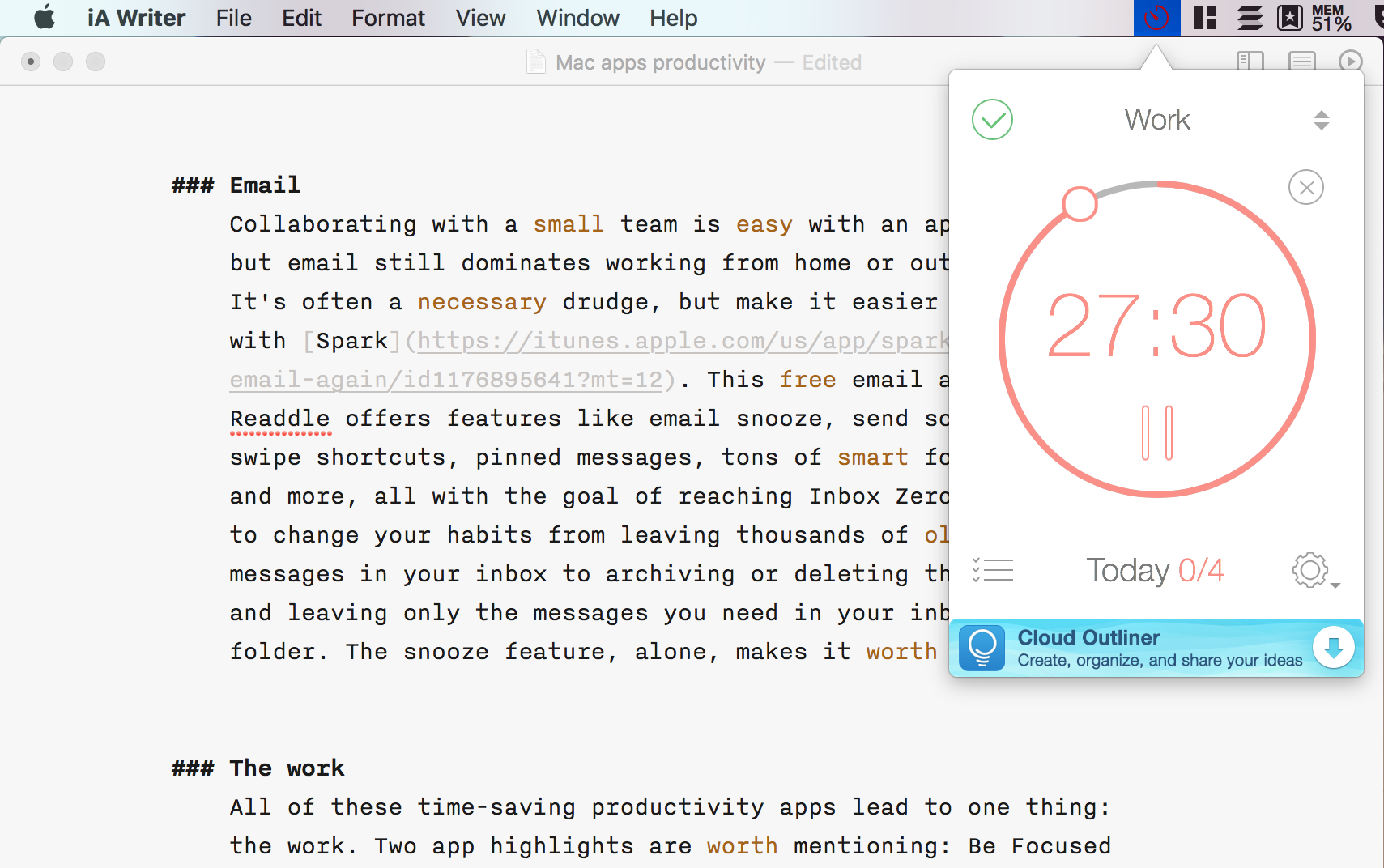

Collaborating with a small team is easy with an app like Notion, but email still dominates working from home or out of office. It’s often a necessary drudge, but make it easier on yourself with Spark. This free email app from Readdle offers features like email snooze, send scheduling, swipe shortcuts, pinned messages, tons of smart folder options and more, all with the goal of reaching Inbox Zero. Spark wants to change your habits from leaving thousands of old, unread messages in your inbox to archiving or deleting those messages and leaving only the messages you need in your inbox or in a folder. The snooze feature, alone, makes it worth downloading.

The work

All of these time-saving productivity apps lead to one thing: the work. Two app highlights are worth mentioning: Be Focused and iA Writer.

Be Focused.

Be Focused.

Be Focused is a tiny timer app that lives in the menu bar as a stopwatch icon. Set the timer and click start, and the app simply counts down. It doesn’t block social media or lock you into a writing screen like other apps. It is not a restriction or a monitor, but a reminder to break up your work into blocks and take short breaks in between those blocks. You’ll see that this psychological trick helps quite a bit.

iA Writer.

iA Writer.

iA Writer is an essential tool for anyone whose work involves a significant amount of writing. It presents a beautiful, simple, powerful, Markdown-compatible writing space and brags a feature called “Focus Mode.” When you enable it, this mode dims all of the text that is not the current sentence (or paragraph, or whatever you choose) so that your eyes remain on the current thought. It drives the work forward by avoiding the editing-while-writing quicksand. iA Writer can also highlight syntax in different colors, revealing your love of adverbs or repetitive verb use. And it has “Night Mode,” a white-on-black theme that saves the eyes during late-night projects.

In the end, the work is up to you. But you can help yourself finish projects more quickly and efficiently with the help of the apps above.

Tom Twardzik is a writer covering personal finance, productivity and investing for Paypath. Follow him on Twitter.