On December 22, 2017, President Donald Trump signed the Tax Cuts and Jobs Act into law. Most of the new provisions go into effect on 2018’s taxes. So you will file your 2017 taxes with little or no changes.

The new tax plan cuts the corporate tax rate from 35 percent to 21 percent beginning in 2018. Additionally, the top individual tax rate will drop to 37 percent. The law overall cuts income tax rates, doubles the standard deduction, and eliminates personal exemptions. The corporate tax cuts are permanent but the new individual rates will expire at the end of 2025.

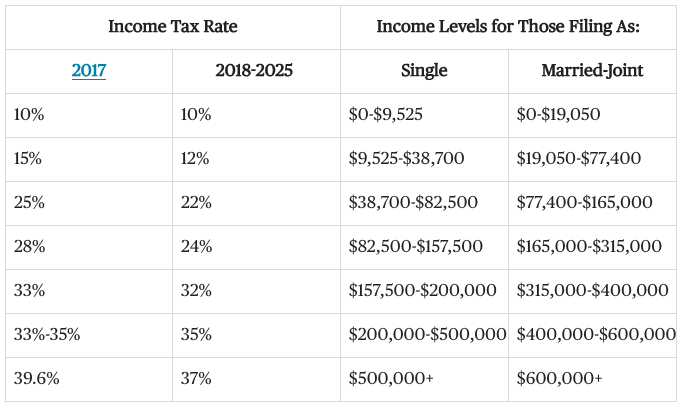

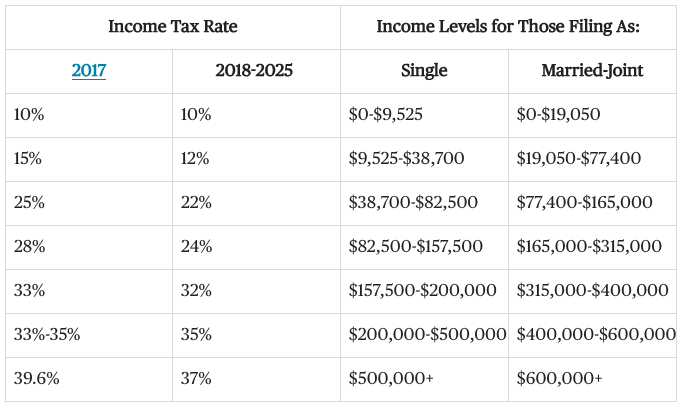

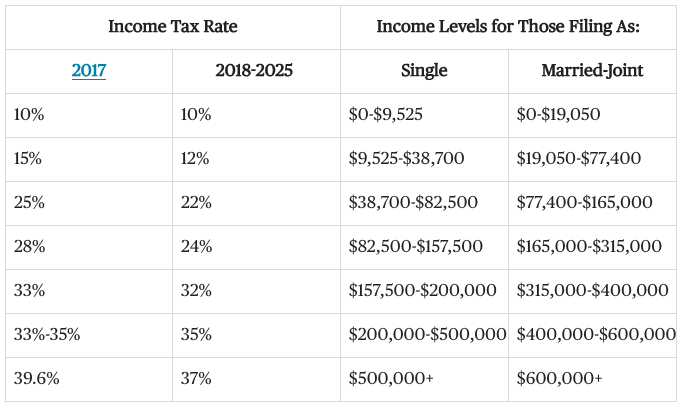

Personal Income Rates

How does this all affect you? Here’s a breakdown based on a rough estimate of your annual salary. Employees will first see changes in their February 2018 withholdings.

TheBalance.com

TheBalance.com

The Act keeps the same seven tax brackets for individuals. The 2017 rates will be reinstated in 2026 under this law. The new plan helps higher income families the most in terms of receiving the biggest tax cuts. The Tax Foundation has said that those in the 20 to 80 percent income range would receive a 1.7 percent increase in after-tax income. Meanwhile, people in the 95 to 99 percent range would receive a 2.2 percent increase.

Business Rates

The Act has more changes for business than it does for individuals. The new corporate tax rate at 21 percent is the lowest since 1939. The United States has one of the highest business tax rates in the world, but most corporations don’t pay that much. The effective rate, when you take into account deductions and loopholes, is only around 18 percent.

The Act also raises the standard deduction for pass-through businesses to 20 percent. This deduction will also expire in 2026. A pass-through business includes sole proprietorships, partnerships, limited liability companies, and S corporations. This classification also includes real estate companies, hedge funds, and private equity funds. The deductions go away for service professionals when their income reaches $157,500 for singles and $315,000 for joint filers.

Another feature of the Act will allow companies to repatriate the $2.6 trillion they collectively hold in foreign cash stockpiles. They will pay a one-time tax rate of 15.5 percent on cash and 8 percent on equipment. Most famously, Apple holds $252 billion in foreign cash. This new tax rate will allow the company to bring it back to the US without a substantial tax hit. A similar “tax holiday” in 2004 provided little boost to the economy, according to the Congressional Research Service. The repatriated cash was distributed to shareholders over employees.

Changes To Deductions

The standard deduction for individuals has been doubled. Meaning, you can claim many more deductions that you could in the past. A single filer’s deduction increased from $6,350 to $12,000. Married and joint-filer deductions increased from $12,700 to $24,000. These will also revert back to the 2017 level in 2026.

The Act also eliminates personal exemptions and most itemized deductions. This usually includes moving expenses, except for members of the military. Someone paying alimony can no longer deduct the payments, but those receiving them can. Deductions for charitable contributions, retirement savings, and student loan interest remain unchanged. But you can’t take these as well as the standard deduction. The new law limits deductions on mortgage interest to the first $750,000 of the loan. Taxpayers can also deduct up to $10,000 in state and local taxes, but must choose between property taxes and income or sales taxes. The Act repeals the Obamacare tax for people without insurance in 2019.

string(5465) "

On December 22, 2017, President Donald Trump signed the Tax Cuts and Jobs Act into law. Most of the new provisions go into effect on 2018's taxes. So you will file your 2017 taxes with little or no changes.

The new tax plan cuts the corporate tax rate from 35 percent to 21 percent beginning in 2018. Additionally, the top individual tax rate will drop to 37 percent. The law overall cuts income tax rates, doubles the standard deduction, and eliminates personal exemptions. The corporate tax cuts are permanent but the new individual rates will expire at the end of 2025.

Personal Income Rates

How does this all affect you? Here's a breakdown based on a rough estimate of your annual salary. Employees will first see changes in their February 2018 withholdings.

TheBalance.com

TheBalance.com

The Act keeps the same seven tax brackets for individuals. The 2017 rates will be reinstated in 2026 under this law. The new plan helps higher income families the most in terms of receiving the biggest tax cuts. The Tax Foundation has said that those in the 20 to 80 percent income range would receive a 1.7 percent increase in after-tax income. Meanwhile, people in the 95 to 99 percent range would receive a 2.2 percent increase.

Business Rates

The Act has more changes for business than it does for individuals. The new corporate tax rate at 21 percent is the lowest since 1939. The United States has one of the highest business tax rates in the world, but most corporations don't pay that much. The effective rate, when you take into account deductions and loopholes, is only around 18 percent.

The Act also raises the standard deduction for pass-through businesses to 20 percent. This deduction will also expire in 2026. A pass-through business includes sole proprietorships, partnerships, limited liability companies, and S corporations. This classification also includes real estate companies, hedge funds, and private equity funds. The deductions go away for service professionals when their income reaches $157,500 for singles and $315,000 for joint filers.

Another feature of the Act will allow companies to repatriate the $2.6 trillion they collectively hold in foreign cash stockpiles. They will pay a one-time tax rate of 15.5 percent on cash and 8 percent on equipment. Most famously, Apple holds $252 billion in foreign cash. This new tax rate will allow the company to bring it back to the US without a substantial tax hit. A similar “tax holiday" in 2004 provided little boost to the economy, according to the Congressional Research Service. The repatriated cash was distributed to shareholders over employees.

Changes To Deductions

The standard deduction for individuals has been doubled. Meaning, you can claim many more deductions that you could in the past. A single filer's deduction increased from $6,350 to $12,000. Married and joint-filer deductions increased from $12,700 to $24,000. These will also revert back to the 2017 level in 2026.

The Act also eliminates personal exemptions and most itemized deductions. This usually includes moving expenses, except for members of the military. Someone paying alimony can no longer deduct the payments, but those receiving them can. Deductions for charitable contributions, retirement savings, and student loan interest remain unchanged. But you can't take these as well as the standard deduction. The new law limits deductions on mortgage interest to the first $750,000 of the loan. Taxpayers can also deduct up to $10,000 in state and local taxes, but must choose between property taxes and income or sales taxes. The Act repeals the Obamacare tax for people without insurance in 2019.

"