The Internet of Things — maybe you’ve heard of the phrase, maybe you haven’t. Maybe you’ve heard it muttered around the workplace as your colleagues talked about their new voice-activated devices.

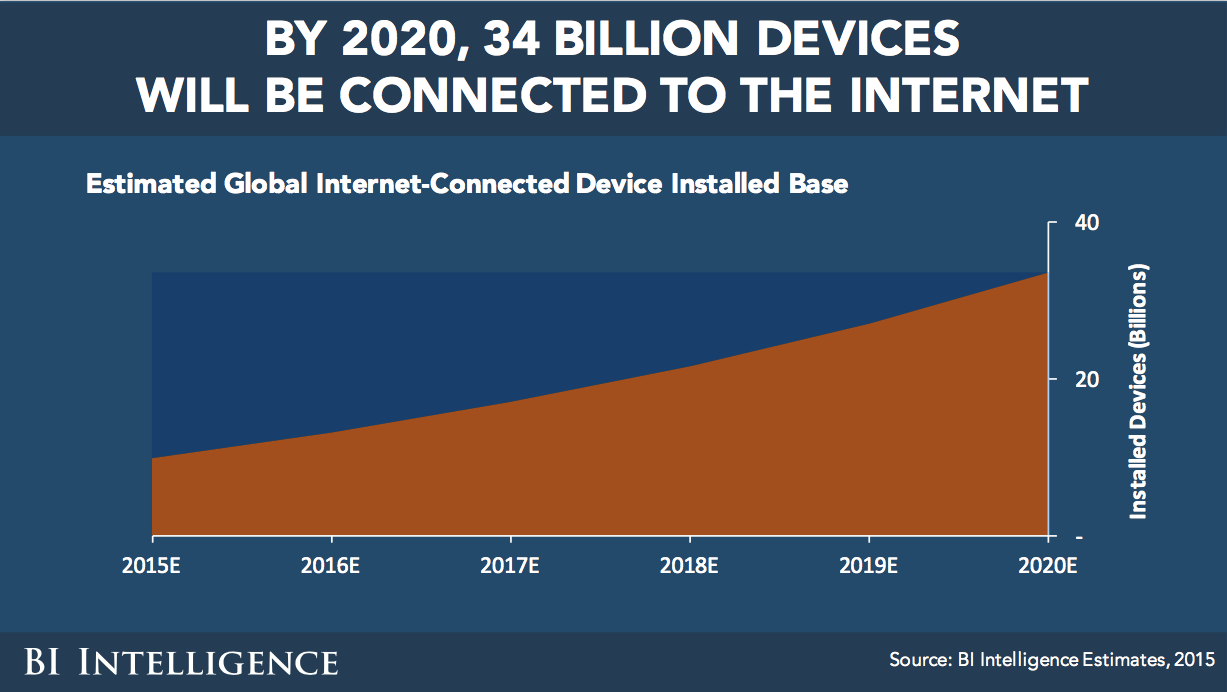

The IoT has been growing steadily since the start of PCs and smartphones. From there, we’ve come out with more interconnected devices including smartwatches and televisions — maybe you’ve heard of our little friend, Alexa? Now, it’s estimated that by 2020, there will be more than 24 billion IoT devices on the planet.

Source: BI Intelligence Estimates, 2015

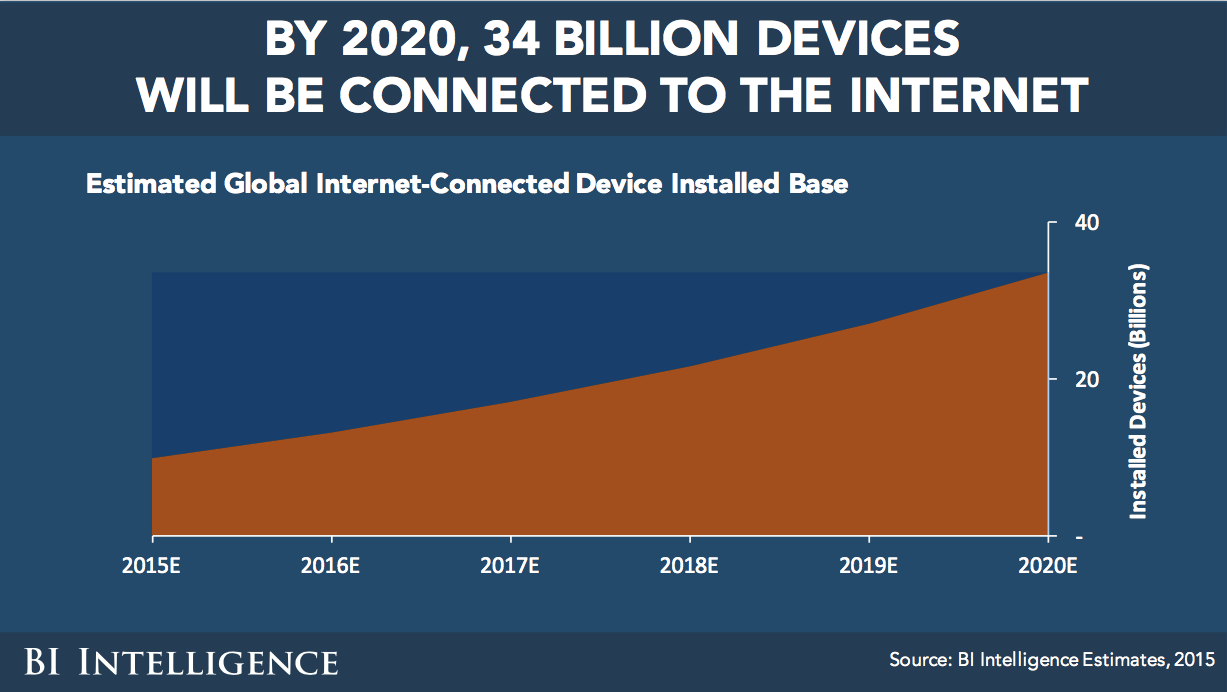

Source: BI Intelligence Estimates, 2015

However, IoT devices don’t have to specifically be computers or screens really — they come in the form of our everyday devices. Smart cameras and water bottles can aid you at the beach while smart plugs and safes can help you out in your dorm or apartment.

Thus, IoT isn’t just about the interconnection of devices anymore — it’s about the way we live and think. When you build a smart home, you’re not just using devices — you’re a part of them. You think of ways to program your lights and AC that’s not just shutting the blinds or pressing buttons on the wall.

Same with the way we learn — more and more schools now are incorporating tablets and interactive smartphone lessons into the classroom. Teachers can cut down on interruption time from transitioning, distributing and other menial tasks along with saving textbook resources.

But, how did we get here? Who decided that IoT was worth discovering and promoting?

According to 2014 Goldman Sachs and BI Intelligence Estimates, the average price of IoT hardware has been dropping and businesses will be the top investor of IoT. Also, agricultural companies, doctors, oil companies, insurance companies, retail, government and many more sectors are all increasing their use of IoT devices and sensors.

However, there are also very serious concerns about privacy and security, according to BI Intelligence. Hackers can easily get into accounts because IoT devices lack cybersecurity protections. This concern is oftentimes associated with government projects and can be possible even with self-driving cars.

But don’t worry, engineers are working on the kinks in the system. In the meantime, you can keep up with IoT news from various tech websites, but you can also consult your friends, family and acquaintances.

If you’re looking to build up your “smart life,” most IoT devices have a home base on a smartphone — so start your buildup there if you haven’t already. IoT will definitely make your life easier and better — get on board before it’s too late!

string(4002) "

The Internet of Things — maybe you've heard of the phrase, maybe you haven't. Maybe you've heard it muttered around the workplace as your colleagues talked about their new voice-activated devices.

The IoT has been growing steadily since the start of PCs and smartphones. From there, we've come out with more interconnected devices including smartwatches and televisions — maybe you've heard of our little friend, Alexa? Now, it's estimated that by 2020, there will be more than 24 billion IoT devices on the planet.

Source: BI Intelligence Estimates, 2015

Source: BI Intelligence Estimates, 2015

However, IoT devices don't have to specifically be computers or screens really — they come in the form of our everyday devices. Smart cameras and water bottles can aid you at the beach while smart plugs and safes can help you out in your dorm or apartment.

Thus, IoT isn't just about the interconnection of devices anymore — it's about the way we live and think. When you build a smart home, you're not just using devices — you're a part of them. You think of ways to program your lights and AC that's not just shutting the blinds or pressing buttons on the wall.

Same with the way we learn — more and more schools now are incorporating tablets and interactive smartphone lessons into the classroom. Teachers can cut down on interruption time from transitioning, distributing and other menial tasks along with saving textbook resources.

But, how did we get here? Who decided that IoT was worth discovering and promoting?

According to 2014 Goldman Sachs and BI Intelligence Estimates, the average price of IoT hardware has been dropping and businesses will be the top investor of IoT. Also, agricultural companies, doctors, oil companies, insurance companies, retail, government and many more sectors are all increasing their use of IoT devices and sensors.

However, there are also very serious concerns about privacy and security, according to BI Intelligence. Hackers can easily get into accounts because IoT devices lack cybersecurity protections. This concern is oftentimes associated with government projects and can be possible even with self-driving cars.

But don't worry, engineers are working on the kinks in the system. In the meantime, you can keep up with IoT news from various tech websites, but you can also consult your friends, family and acquaintances.

If you're looking to build up your "smart life," most IoT devices have a home base on a smartphone — so start your buildup there if you haven't already. IoT will definitely make your life easier and better — get on board before it's too late!

"

Source: BI Intelligence Estimates, 2015

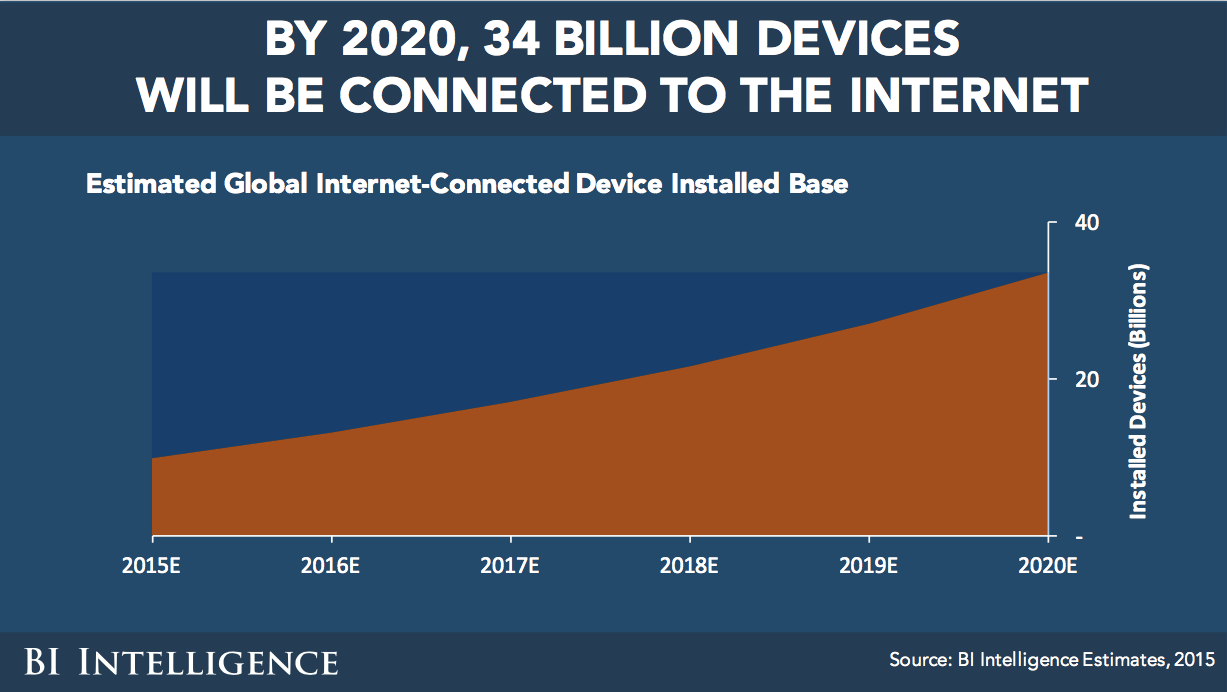

Source: BI Intelligence Estimates, 2015