What are the Economic Effects of Ending DACA?

Jan 26 | 2018

ktla.com

Immigration, in recent years, has been a hot-button topic in American politics.

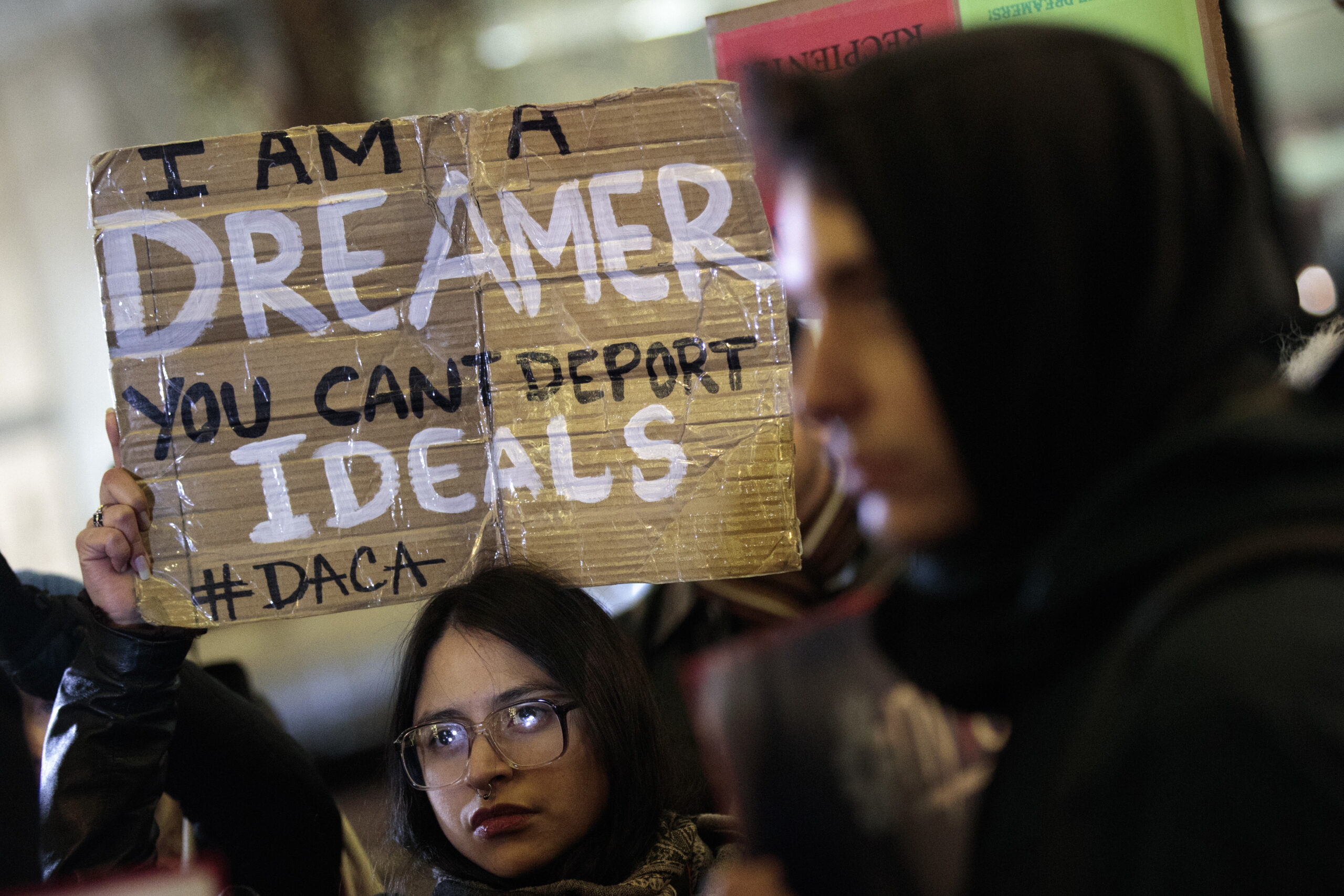

Most recently, the debate has centered around DACA, or Deferred Action for Childhood Arrivals. The three-day government shutdown in January was instigated by Democrats to push for a vote in the Senate on this issue. This program, instituted by the Obama administration, gives legal status to people who were brought into the United States illegally as children. Every two years, these people can apply for a temporary work visa. This visa gives them deportation relief and allows them to work legally in the country. This group is often referred to as “Dreamers.”

(adsbygoogle = window.adsbygoogle || []).push({});

Because this program was created through an executive order, the president has full authority to revoke it at any time. In September 2017, the Trump administration announced that it would phase out the DACA program with a six-month delay. Meaning, the deadline for Congress to act would fall on March 5, 2018. This deadline has pushed Democrats to fight for legislation that would create a program to replace DACA.

(adsbygoogle = window.adsbygoogle || []).push({});

After the government shutdown, Senate Republicans and Democrats have an agreement to debate and vote on this issue February 8. However, there are still questions of whether the vote will actually happen and what exactly they would be voting on. Or even if the same bill could pass the House afterward as well as whether Trump will sign it.

There are a lot of things up in the air when it comes to DACA. With indecision on this issue from Congress, it looks more certain that the program will be ended completely. This would leave about 690,000 immigrants to face deportation when the program shuts down. If these people were forced to leave the country or did so voluntarily, what would be the possible economic effects?

The majority of DACA recipients are students. All of those covered by the program must be enrolled in school, or have a high school degree or an equivalent. Seventeen percent are working toward an advanced degree. As they complete their education, this group will look more like the highly skilled individuals with Bachelor’s or Master’s degrees who receive H-1B visas. Dreamers are also more likely to be employed in higher-skilled jobs than immigrants who are residing in the country illegally.

But not all enrolled in DACA are students. About 55 percent are working in some capacity in a variety of service and professional jobs. Many work in retail, food services, or hospitality. Some are enlisted in the military. But many still are business managers, social workers, teachers, and health care providers.

(adsbygoogle = window.adsbygoogle || []).push({});

About 5,400 DACA recipients are practicing physicians. Without the program, these doctors will likely be forced to leave the country. According to the Assocation of American Medical Colleges, the shortage is expected to increase from 40,800 and 104,900 physicians by 2030. With the removal of DACA, the shortage could potentially worsen, especially in rural areas.

Additionally, around 20,000 enrolled in DACA are currently working as teachers nationwide. Most of them are in California and Texas. If the program is ended, all of these teachers would potentially be lost. This situation could leave many schools in limbo. Most Dreamers are also fluent in Spanish, an increasingly valuable skill in education and other fields.

That’s not even counting other economic impacts. All of the DACA recipients are spending money and participating in the economy. They buy groceries, pay rent, and own cars and fill up their tanks. Once their DACA status lapses, they could potentially lose their jobs. This loss of income would prevent them from participating in the economy in the same way. This participation even includes the $495 application fee to enroll or renew their status every two years. Losing thousands of people freely participating in the U.S. economy will have an impact, especially in states where most Dreamers are settled. Over the next ten years, projections range from $200 billion to more than $400 billion in economic growth that could be lost if the DACA program were ended.

(adsbygoogle = window.adsbygoogle || []).push({});