Is Tai Lopez a Scammer?

Sep 28 | 2023

Tai Lopez

Tai Lopez net worth

Tai Lopez scam

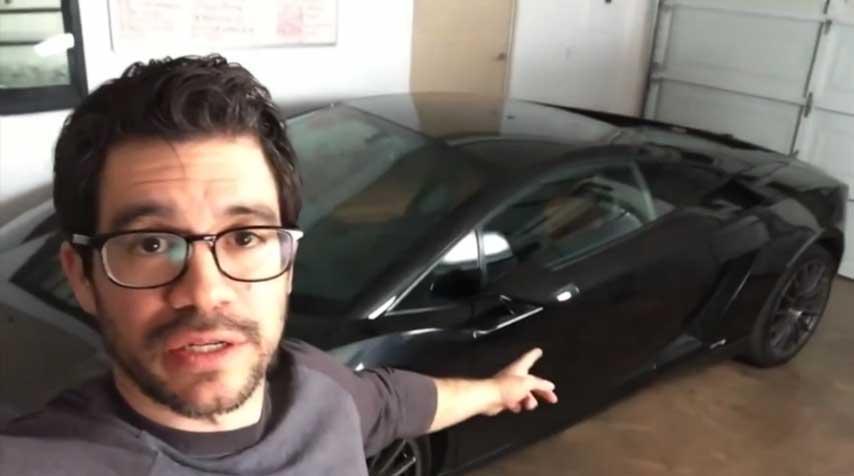

Those are the top 3 Google searches for Tai Lopez. You know the guy, in his garage, with his Lamborghini. You’ve seen his sponsored videos flood your times, your feeds, and pop up right before your favorite Youtube video.

So who is Tai Lopez, is he real or a scam?

[shortcode-1-In-Article-Banner-728×60]

With no official Wikipedia page, this was going to take some digging.

A classic rags to riches story, spiced with flash and pizzaz. Tai dropped out of college but maintained an obsession with learning and knowledge. Former GE Capital employee and Hollywood nightclub business owner, Tai cut his teeth in the financial world and built a cash pile mentoring, motivating and marketing businesses. Over 20 multi-million dollar companies have used his services.

He has also offered a plethora of courses, his most recent being the 67 steps program that is designed to help you rebuild your habits over the course of 67 days. He has another where he teaches you how to generate income by operating social media for large companies.

What truly gained him notoriety is his feverish social media pace. 150 snaps a day, over 200 million Youtube views, ads running daily on Facebook and Instagram and even dispersed across the web. You can’t turn on your internet and not see this guy, especially if you’re a male aged 18-35 interested in cars, women, and money.

(adsbygoogle = window.adsbygoogle || []).push({});

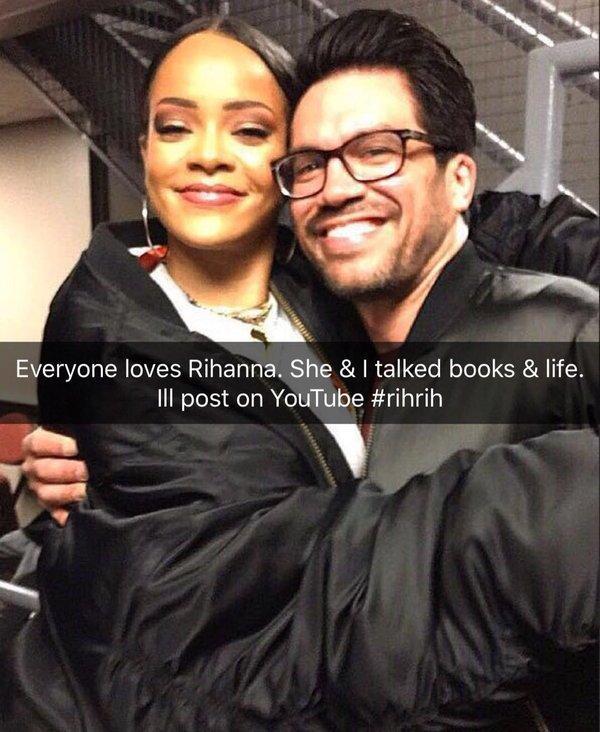

What you also find is high-quality, highly engaging content on all his social channels. He gives away cars and stacks of cash on his Instagram page, constant bits of wisdom and advice on Facebook, and interviews celebrities and titans on Youtube. He won me over with the video of him and music megastar Rihanna discussing books.

It’s a combination of flash and pizzaz, wisdom and motivation, fueled by a relentless work ethic that has set this jetsetting millennial millionaire ahead of the pack. Forbes has articles praising him as one of the best influencers on Instagram and SnapChat. He’s mastered crafting story via social media and making bank in the process.

After dealing with a period of being broke and frustrated, Tai describes deciding to start at the end, figuring out exactly who he wanted to be, and the lifestyle he desired. He then built his life around that. And let us not forget the books. An avid reader, Tai’s greatest boast is not of his Beverly Hills mansion, or his collection of exotic cars, but rather his library. Tai promotes reading daily and has an impressive and ever-expanding book collection. It’s this lifestyle and its dichotomy that make for such engaging content. Call it edu-tainment, but Tai’s unique approach will have you renewing your Barnes & Noble membership, and taking out a lease on a sports car.

(adsbygoogle = window.adsbygoogle || []).push({});

Interestingly enough, for a face that’s become so well known, Tai also maintains an air of mystery and many details of his personal life remain private. It’s another sign of his mastery of the Digital Age. One thing is for certain, with a wide breadth of credible features, a social media house firing on all cylinders, and happy customers who are making money using the material from his coursework, it’s safe to say, Tai Lopez is no scammer.