It’s been nearly four years since President Trump’s election, and to make an understatement, his approach to the presidency has been unorthodox.

In an unprecedented break of presidential custom, he has refused to release his tax returns despite ongoing claims of fraud. In an administration led by one of the most recognizable names in the world, the decision to keep the president’s personal finances secret has raised many questions, the most notable being: is it possible that Trump may be making money off his presidency?

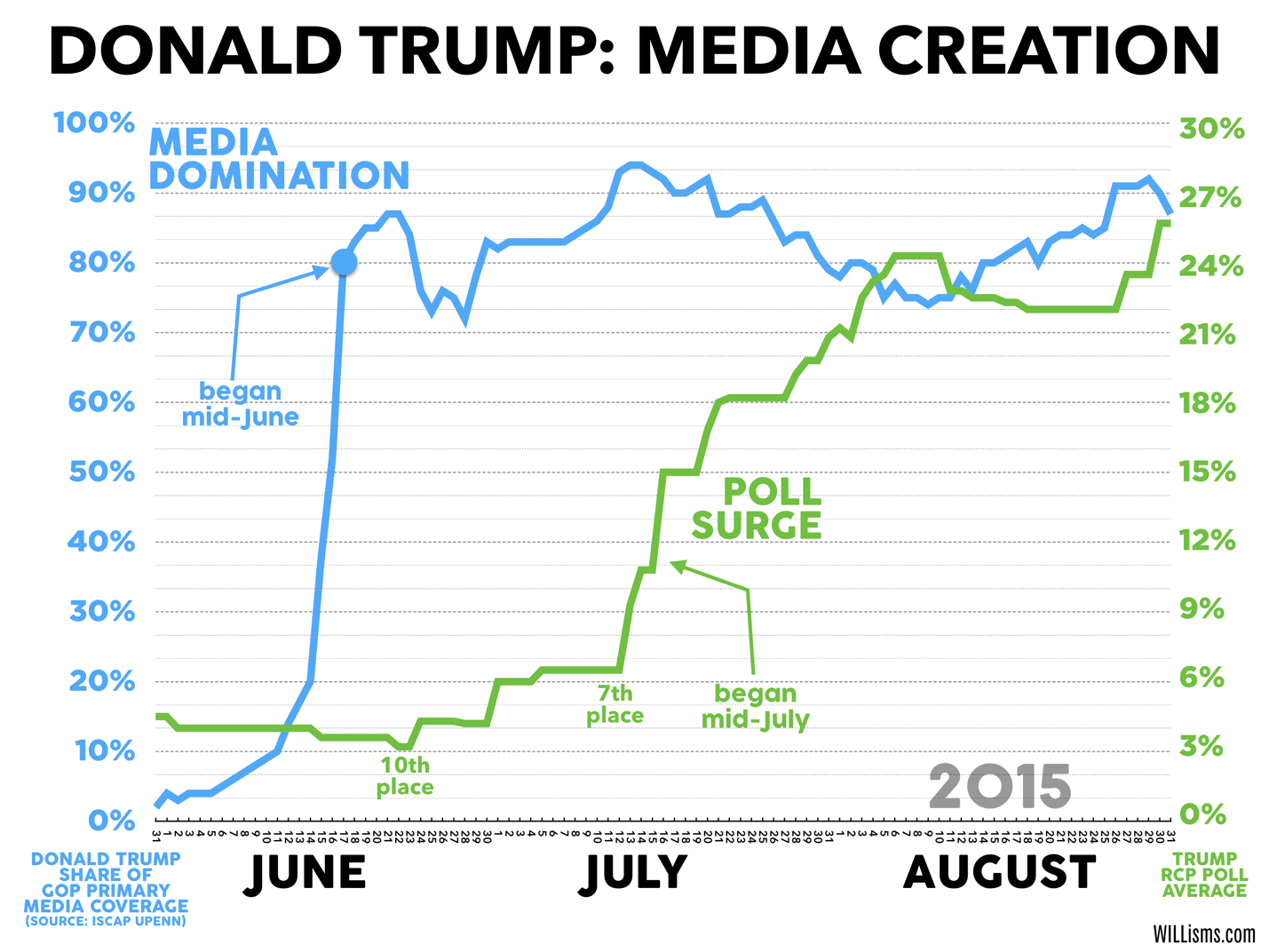

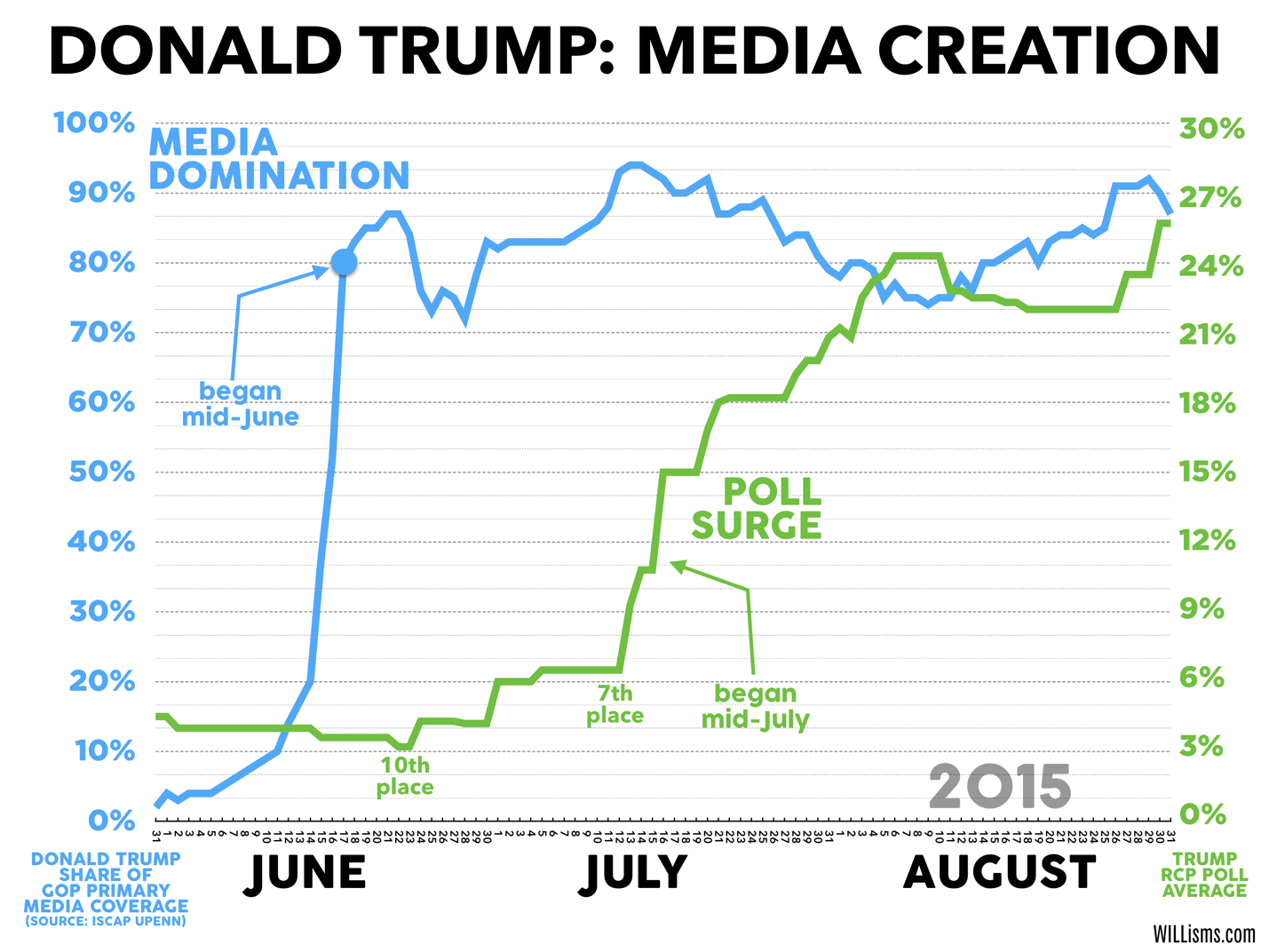

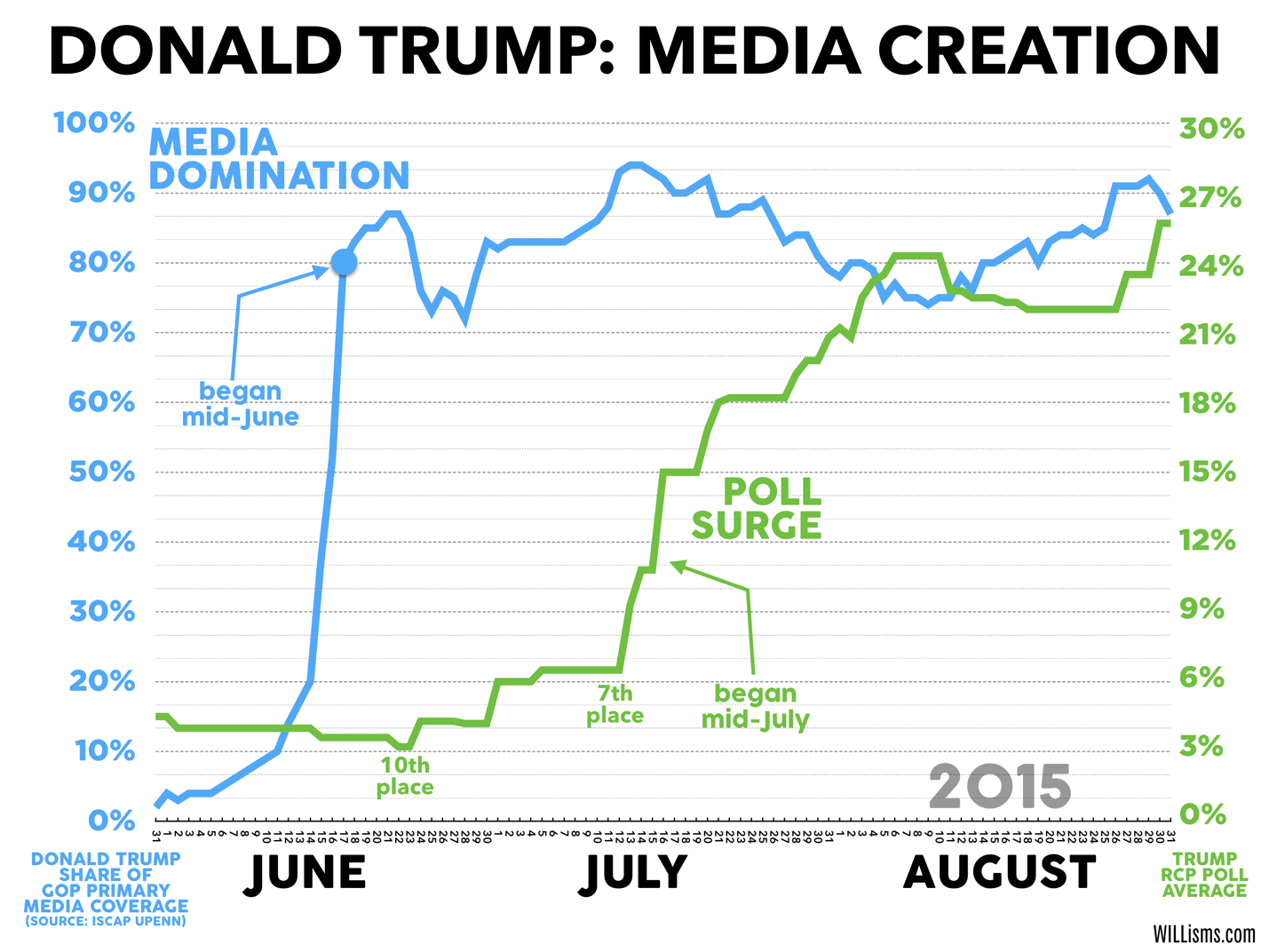

Back in 2000, Trump made that very claim: “It’s very possible that I could be the first presidential candidate to run and make money on it.” In a macro sense, this is based on the real estate mogul’s simple maxim of “all press is good press,” which the 2016 election made obvious with an estimated $2 billion of free media for Trump. Does all the additional coverage help his business like it helped win him the election?

Regarding Trump’s many properties, the answer appears to point that way.

Although declining prices have likely hurt its worth, Trump’s 11,000-square-foot penthouse in Trump Tower is now essentially a national monument and is positioned to sell for an additional $10 million simply because of an increase in the value of its main tenant.

(adsbygoogle = window.adsbygoogle || []).push({});

Trump Hotels have also seemed to benefit, as President Donald Trump frequently uses his luxury properties for government business and leisure, prompting ethics concerns over a president appearing to promote his private enterprise at public cost. Government officials in Kuwait canceled a major event they had planned at the Four Seasons Hotel and switched their venue to Trump’s hotel in D.C. under alleged pressure. The same luxury hotel has emerged as a political power hub and is at the center of a court case about presidential emoluments.

Regarding the president’s infamous Mar-a-Lago resort, it has seen its membership fee double to $200,000 since Trump took office. Shortly after the fee hike was revealed, Barack Obama’s former ethics lawyer said the increase is a “not very subtle exploitation of the fact that the club’s figurehead is now president of the U.S.” Forbes estimates the “winter White House” is now worth $160 million, $10 million more than pre-election.

Some of the profiteering is even more direct: Trump immediately launched his reelection campaign on the day he assumed office. Donor money has continually flowed since then, and America’s first billionaire president turned more than $900,000 into personal revenue.

And we can’t forget Trump’s signature 2017 tax reform legislation, which will also clearly benefit the president. Forbes says Trump could save about 10% on business income, which based on his leaked 2005 tax return, could mean as much as $11 million annually.

Aerial view of Mar-a-Lago, the estate of Donald Trump, in Pa

Aerial view of Mar-a-Lago, the estate of Donald Trump, in Pa

However, becoming president has had its drawbacks for the businessman.

While his 2016 campaign’s controversial marketing strategy helped Trump leverage media coverage to benefit his commercial properties and projects, Forbes reports that, so far, mixing politics and business has hurt him more than it has helped.

By some calculations, Trump’s net worth has dropped from $4.5 billion in 2015 to $3.1 billion in the last two years, dropping the president 138 spots lower on the Forbes 400. In regards to Trump Tower, the net operating income dropped 27% between 2014, the year before Trump announced his run for president, and 2017, his first year in the White House.

(adsbygoogle = window.adsbygoogle || []).push({});

In refusing to divest his tax returns, Trump has set himself up to be accused of perpetual conflicts of interest that may or may not be true. Forbes’ suggests that Trump would be $500 million richer if he had liquidated his assets, paid capital gains tax on his fortune and created a blind trust to invest it all in the stock market.

At the end of the day, Trump has made money off the pedestal he’s been given. However, he may have made more—and been better perceived—if he had thrown in the towel altogether.

Joshua Smalley is a New York-based writer, editor, and playwright. Find Josh at his website and on Twitter: @smalleywrites.

string(7567) "

It's been nearly four years since President Trump's election, and to make an understatement, his approach to the presidency has been unorthodox.

In an unprecedented break of presidential custom, he has refused to release his tax returns despite ongoing claims of fraud. In an administration led by one of the most recognizable names in the world, the decision to keep the president's personal finances secret has raised many questions, the most notable being: is it possible that Trump may be making money off his presidency?

Back in 2000, Trump made that very claim: "It's very possible that I could be the first presidential candidate to run and make money on it." In a macro sense, this is based on the real estate mogul's simple maxim of "all press is good press," which the 2016 election made obvious with an estimated $2 billion of free media for Trump. Does all the additional coverage help his business like it helped win him the election?

Regarding Trump's many properties, the answer appears to point that way.

Although declining prices have likely hurt its worth, Trump's 11,000-square-foot penthouse in Trump Tower is now essentially a national monument and is positioned to sell for an additional $10 million simply because of an increase in the value of its main tenant.

(adsbygoogle = window.adsbygoogle || []).push({});

Trump Hotels have also seemed to benefit, as President Donald Trump frequently uses his luxury properties for government business and leisure, prompting ethics concerns over a president appearing to promote his private enterprise at public cost. Government officials in Kuwait canceled a major event they had planned at the Four Seasons Hotel and switched their venue to Trump's hotel in D.C. under alleged pressure. The same luxury hotel has emerged as a political power hub and is at the center of a court case about presidential emoluments.

Regarding the president's infamous Mar-a-Lago resort, it has seen its membership fee double to $200,000 since Trump took office. Shortly after the fee hike was revealed, Barack Obama's former ethics lawyer said the increase is a "not very subtle exploitation of the fact that the club's figurehead is now president of the U.S." Forbes estimates the "winter White House" is now worth $160 million, $10 million more than pre-election.

Some of the profiteering is even more direct: Trump immediately launched his reelection campaign on the day he assumed office. Donor money has continually flowed since then, and America's first billionaire president turned more than $900,000 into personal revenue.

And we can't forget Trump's signature 2017 tax reform legislation, which will also clearly benefit the president. Forbes says Trump could save about 10% on business income, which based on his leaked 2005 tax return, could mean as much as $11 million annually.

Aerial view of Mar-a-Lago, the estate of Donald Trump, in Pa

Aerial view of Mar-a-Lago, the estate of Donald Trump, in Pa

However, becoming president has had its drawbacks for the businessman.

While his 2016 campaign's controversial marketing strategy helped Trump leverage media coverage to benefit his commercial properties and projects, Forbes reports that, so far, mixing politics and business has hurt him more than it has helped.

By some calculations, Trump's net worth has dropped from $4.5 billion in 2015 to $3.1 billion in the last two years, dropping the president 138 spots lower on the Forbes 400. In regards to Trump Tower, the net operating income dropped 27% between 2014, the year before Trump announced his run for president, and 2017, his first year in the White House.

(adsbygoogle = window.adsbygoogle || []).push({});

In refusing to divest his tax returns, Trump has set himself up to be accused of perpetual conflicts of interest that may or may not be true. Forbes' suggests that Trump would be $500 million richer if he had liquidated his assets, paid capital gains tax on his fortune and created a blind trust to invest it all in the stock market.

At the end of the day, Trump has made money off the pedestal he's been given. However, he may have made more—and been better perceived—if he had thrown in the towel altogether.

Joshua Smalley is a New York-based writer, editor, and playwright. Find Josh at his website and on Twitter: @smalleywrites.

"

Aerial view of Mar-a-Lago, the estate of Donald Trump, in Pa

Aerial view of Mar-a-Lago, the estate of Donald Trump, in Pa