Tesla’s ups and downs have been a roller coaster for investors over the last few years, but Monday’s announcement that the company will be added to the S&P 500 should grab everyone’s attention.

Tesla met the criteria to join the exclusive club representing some of the most valuable public companies in the US back in September. Despite the delayed addition, the S&P Selection Committee will include the company in the benchmark index starting Monday, December 21st.

There are currently over $11 trillion in assets benchmarked to the S&P 500, including $4.6 trillion in indexed funds. With Tesla’s addition, these funds will have to buy Tesla stock and include it in their portfolios. Passive funds are expected to purchase around 95 million shares while active fund managers will need to purchase 30 million on top of that. That’s over $50 billion dollars flowing into Tesla stock as portfolios are rebalanced.

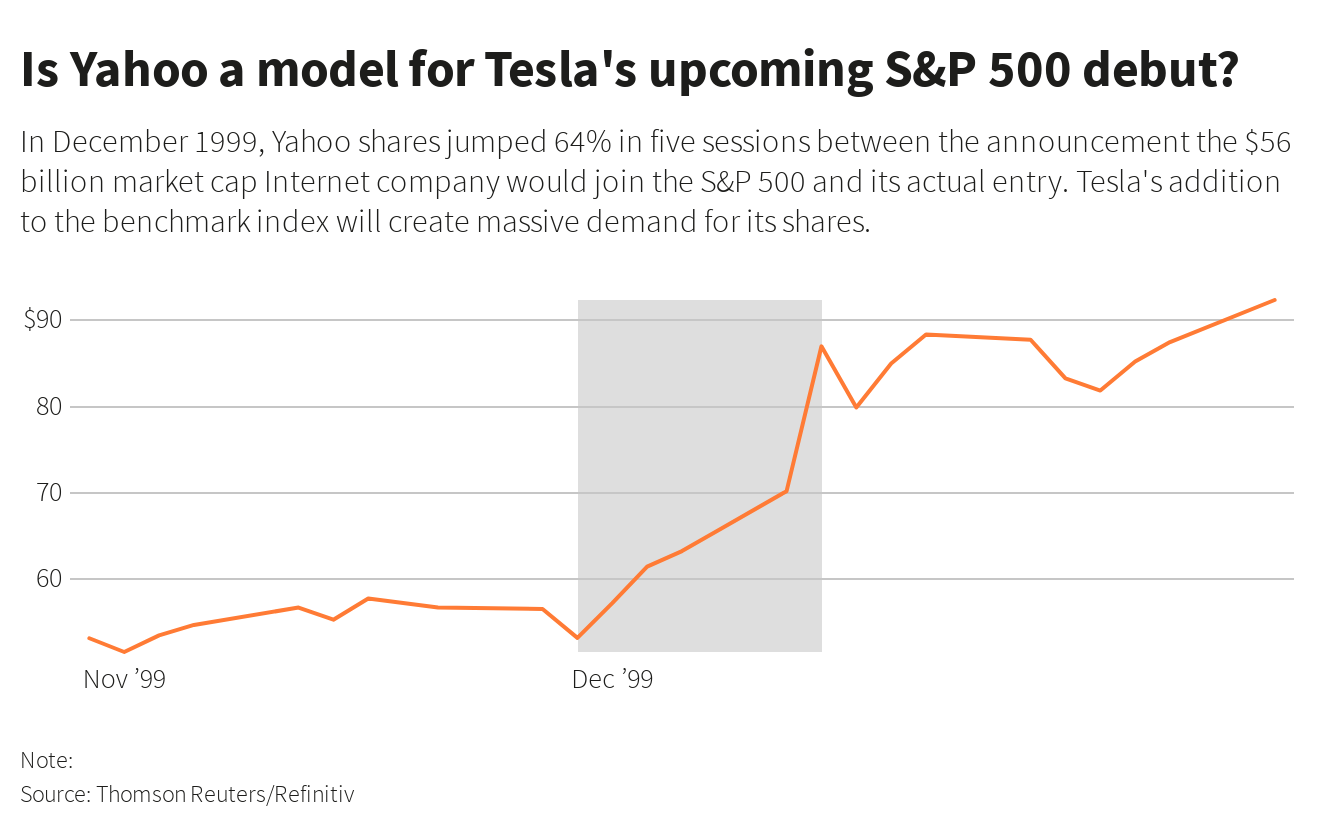

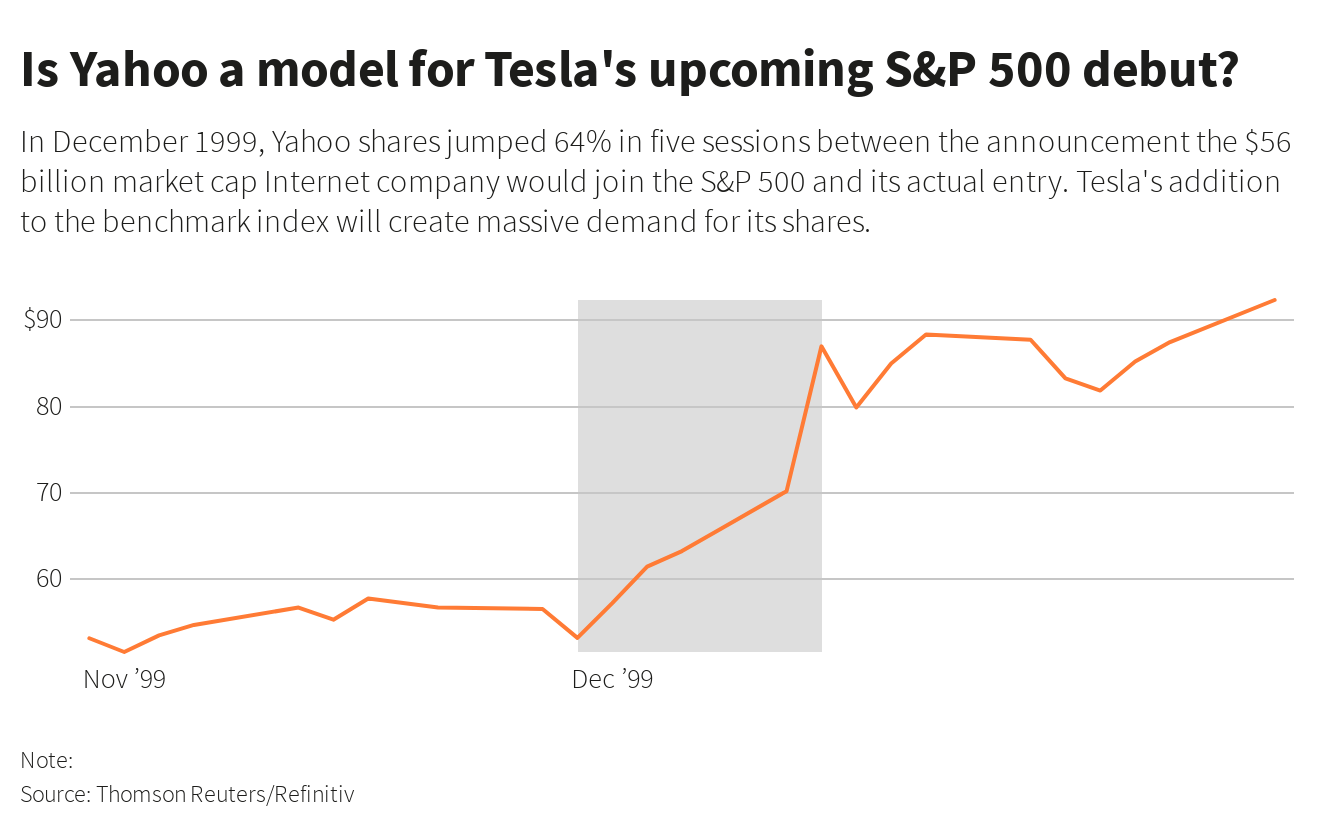

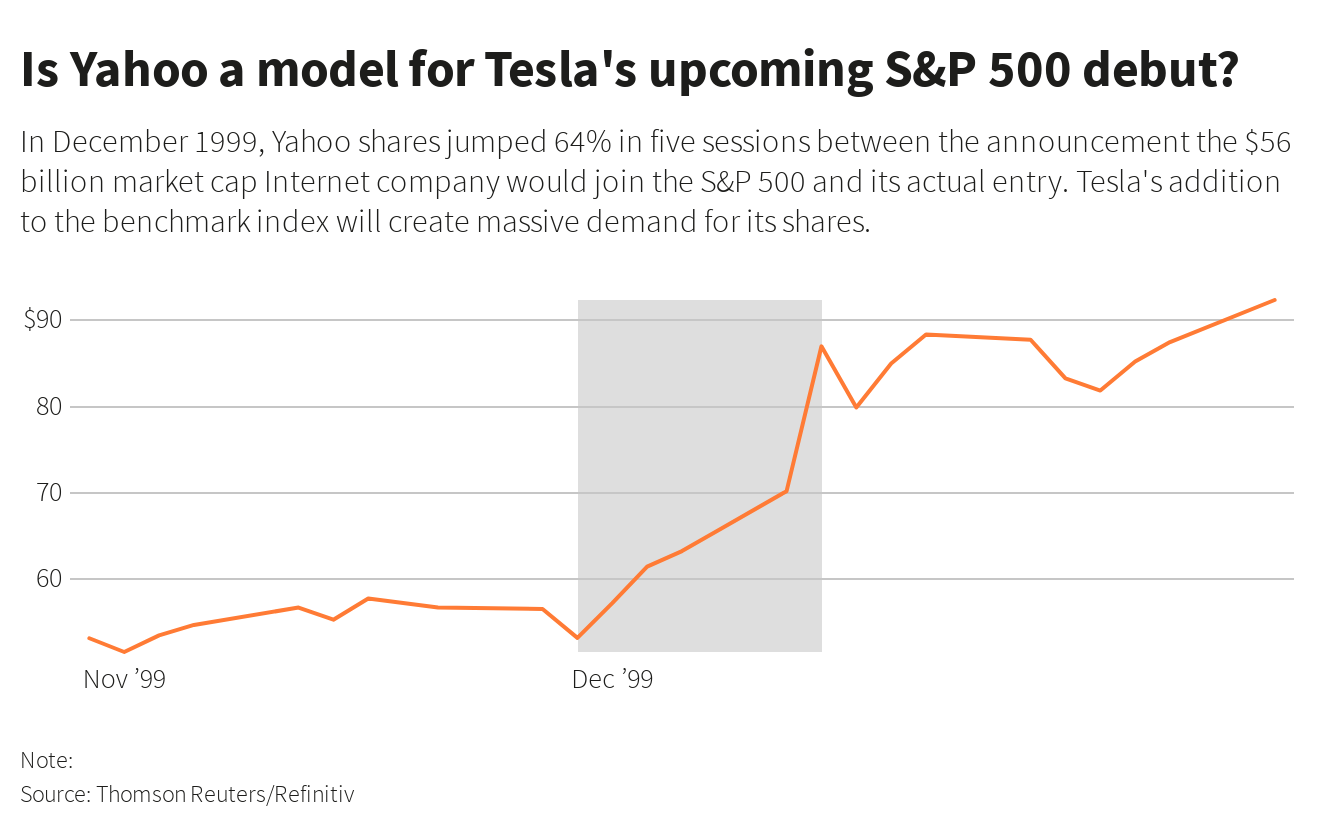

If you’ve been holding onto Tesla stock, this is great news for you as there is going to be much more demand from institutional investors forced to buy the stock. If you’ve been looking for the right time to sell, you’re going to have a lot of eager buyers this December. The stock’s jump in price after the announcement is a testament to how much value the increased demand is expected to create.

Reuters

Reuters

Even if you don’t hold any Tesla stock, this will affect you too. Tesla is going to be one of the largest companies ever added to the index, and that $50 billion dollars is going to have to come from somewhere. All those investment funds indexed to the S&P 500 need to sell shares of other companies in order to buy Tesla to ensure their portfolios reflect the car company’s portion of the index. This trade is expected to be so large that the S&P Dow Jones Indices is soliciting feedback as to whether Tesla should be added all at once or in two tranches to give investors more time to balance portfolios.

If you are invested in a fund that tracks the S&P, you might be excited that you are finally going to get a piece of some of the action. Come December 21st, many investors who have kept their money index funds will find themselves owning Tesla shares. If the stock continues on its upward trajectory, this is great news. However, some investors have accused Tesla stock of being a bubble and adding it at an inflated price may open investors to losses should the share price drop in the future.

string(2726) "

Tesla's ups and downs have been a roller coaster for investors over the last few years, but Monday's announcement that the company will be added to the S&P 500 should grab everyone's attention.

Tesla met the criteria to join the exclusive club representing some of the most valuable public companies in the US back in September. Despite the delayed addition, the S&P Selection Committee will include the company in the benchmark index starting Monday, December 21st.

There are currently over $11 trillion in assets benchmarked to the S&P 500, including $4.6 trillion in indexed funds. With Tesla's addition, these funds will have to buy Tesla stock and include it in their portfolios. Passive funds are expected to purchase around 95 million shares while active fund managers will need to purchase 30 million on top of that. That's over $50 billion dollars flowing into Tesla stock as portfolios are rebalanced.

If you've been holding onto Tesla stock, this is great news for you as there is going to be much more demand from institutional investors forced to buy the stock. If you've been looking for the right time to sell, you're going to have a lot of eager buyers this December. The stock's jump in price after the announcement is a testament to how much value the increased demand is expected to create.

Reuters

Reuters

Even if you don't hold any Tesla stock, this will affect you too. Tesla is going to be one of the largest companies ever added to the index, and that $50 billion dollars is going to have to come from somewhere. All those investment funds indexed to the S&P 500 need to sell shares of other companies in order to buy Tesla to ensure their portfolios reflect the car company's portion of the index. This trade is expected to be so large that the S&P Dow Jones Indices is soliciting feedback as to whether Tesla should be added all at once or in two tranches to give investors more time to balance portfolios.

If you are invested in a fund that tracks the S&P, you might be excited that you are finally going to get a piece of some of the action. Come December 21st, many investors who have kept their money index funds will find themselves owning Tesla shares. If the stock continues on its upward trajectory, this is great news. However, some investors have accused Tesla stock of being a bubble and adding it at an inflated price may open investors to losses should the share price drop in the future.

"

Reuters

Reuters