Spirituality in Business?

May 08 | 2017

It’s no secret that “New Age Thinking” or “The Consciousness Movement” is spreading. More and more people across the nation are using positive thinking to create drastic changes in their personal lives. But does this work in business? Is it possible to successfully bring your spiritual nature into your place of business?

In April 2002, the Harvard Business School published a piece entitled “Does Spirituality Drive Success?”. The piece was based on three panel sessions held during the Mobious Leadership Forum where entrepreneurs from all walks shared their thoughts on leadership, values, and spirituality in business. The prevailing sentiment from successful business leaders across the board was that they all credited their success to believing in forces greater than themselves, to injecting an attitude of mindfulness in the workplace, and to holding themselves to higher ideals and values.

To dig deeper into the subject, I reached out to Jo-Na’ Williams. Successful attorney and business/personal empowerment coach who’s had her work highlighted in Forbes, Entrepreneur, and others – Jo-Na’ specializes in helping propel creative entrepreneurs and their businesses to new heights. She has a fierce no nonsense approach that focuses on getting people to get out of their own way. Most of what holds us back – according to Jo-Na’ – are not outside influences, but rather internal blocks, that once removed, allow room for exponential growth. Many of her clients come to her expressing that good ol’ hamster in the wheel feeling – putting in the work, committing to the grind, but still not seeing the results. This is where Jo-Na’ steps in, helping clients avoid “victim mode” so that they can reclaim power over their lives. “It all starts with gratitude,” she muses. Oftentimes it’s subtle shifts and taking the time to be still, be quiet, and listen to the voice within to receive answers that the mind finds otherwise unavailable. Counterintuitive though it may seem, time and time again the results have proven that taking the time for an internal shift sets you on a path for exceptional gains.

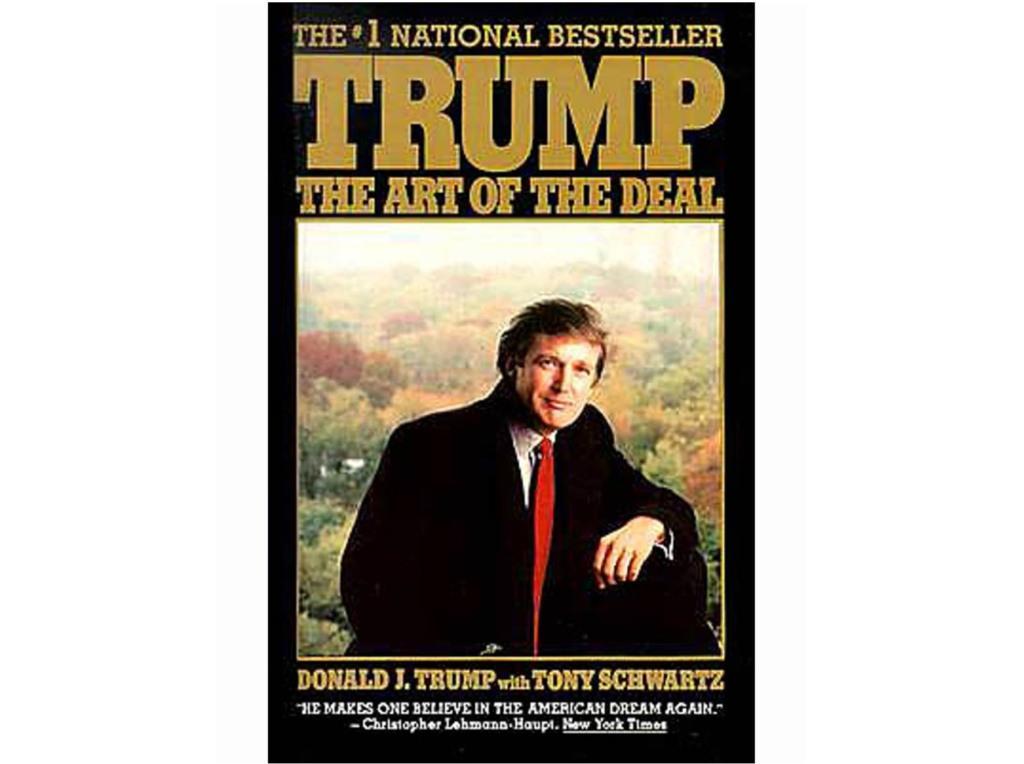

Taking the time to put your well-being and your values before the almighty dollar allows you to better enjoy your success. Tony Schwartz would attest to this. Early in his career he took an opportunity with his eyes on the dollar, that he would later regret. The book that he’d co-author with a budding real estate mogul named Donald J. Trump – “The Art of the Deal”, would go on to be a New York Times Bestseller and bring much financial success Tony Schwartz’s way. He’s gone on record on multiple occasions stating that the sacrifice of his values would prevent him from enjoying much of that success. He states that he remained unsatisfied until he discovered and operated upon his “primary values”.