We are currently living through one of the worst financial crises ever, but when it comes to handling money, the world is no stranger to messing things up. While the current economic situation is no laughing matter, there have been a slew of hilarious mishaps that have cost countries a bundle. From Superman’s obscenely expensive CGI-ed mouth in 2018’s Justice League, to Spain building a luxury submarine that was unable to resurface, here are some of the biggest money mistakes in history.

The ‘Walkie Talkie’ Building Melted Cars

The ‘Walkie Talkie’ Building Melted Cars

20 Fenchurch Street’s eyesore of a building was already hard to look at considering how reflective it was in the sunlight. But when Martin Lindsay returned to his new Jaguar on a hot day, the London skyscraper was actually so reflective that it had melted parts of the cars body and rearview mirror. In addition to the 946-pound payout to Mr. Lindsay for damage to his car, the building had come up with a way to give the already 200-million-pound building more sunscreen. Needless to say, the whole ordeal was quite expensive and embarrassing.

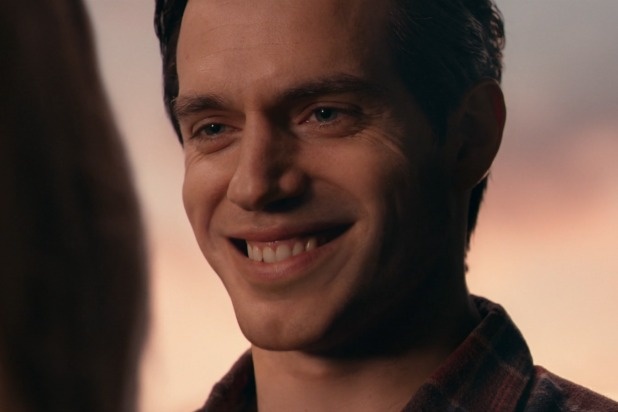

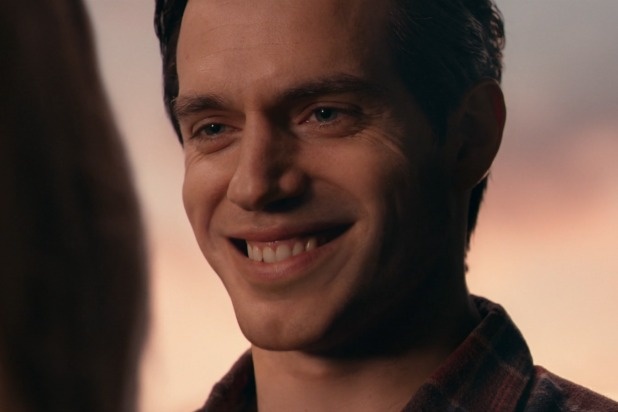

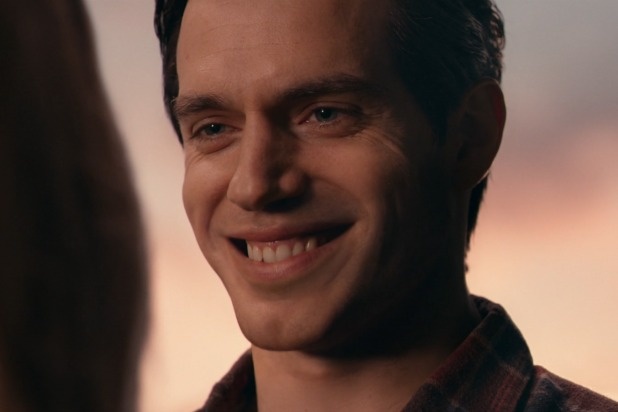

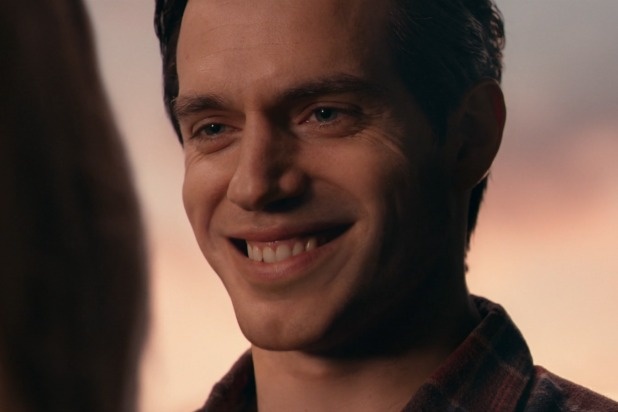

Henry Cavil’s mustache

Henry Cavil’s mustache

Tepid action actor Henry Cavil had just wrapped up filming for Justice League when he had started filming for Mission Impossible – Fallout, but Warner Brothers decided a few scenes needed to be redone for the former. Unfortunately, Cavil had worked very hard to grow out a pencil thin mustache, and the filming schedules were too set in stone for him to shave. Coordinating the reshoots, and CGI-ing out Cavil’s facial hair all cost around $25 million, and they didn’t even succeed, as fans were quick to point out how weird the actors face looked on the big screen.

French Train Company Made Trains Too Big For Track

French Train Company Made Trains Too Big For Track

French train company SNCF purchased 2,000 trains in 2014 for around 15 billion euros, but they soon realized their platforms were too narrow for the new orders, a mistake which cost them an additional 50 million euros. It was all at the fault of the operator, who didn’t factor in measurements of train platforms that had been built more than 50 years ago.

(Photo by Frederick Florin/AFP/Getty Images)

Spain’s Submarine that Couldn’t Resurface

Spain’s Submarine that Couldn’t Resurface

Spain coughed up around $2.2 billion to build a luxury submarine named The Isaac Peral. But before the vessel was completed in 2013, engineers discovered that the unfinished submarine was so heavy that it probably would not resurface if placed underwater. The design flaw was fixed, but it was embarrassing when news broke.

Mizuho Securities loses $225 million dollars Due to a Typo

Mizuho Securities loses $225 million dollars Due to a Typo

In 2005 Japanese security company Mizuho lost an enormous sum when a single stockbroker mistyped some financial data. Instead of offering a single share in J-Com’s stock for about 610,000 yen (or $5,000 dollars,) he offered 610,000 shares for 1 yen. The disaster meant investors were buying out Mizuho’s stock for an insanely low amount of money, costing the company around $225 million in damages.

string(3611) "

We are currently living through one of the worst financial crises ever, but when it comes to handling money, the world is no stranger to messing things up. While the current economic situation is no laughing matter, there have been a slew of hilarious mishaps that have cost countries a bundle. From Superman's obscenely expensive CGI-ed mouth in 2018's Justice League, to Spain building a luxury submarine that was unable to resurface, here are some of the biggest money mistakes in history.

The 'Walkie Talkie' Building Melted Cars

The 'Walkie Talkie' Building Melted Cars20 Fenchurch Street's eyesore of a building was already hard to look at considering how reflective it was in the sunlight. But when Martin Lindsay returned to his new Jaguar on a hot day, the London skyscraper was actually so reflective that it had melted parts of the cars body and rearview mirror. In addition to the 946-pound payout to Mr. Lindsay for damage to his car, the building had come up with a way to give the already 200-million-pound building more sunscreen. Needless to say, the whole ordeal was quite expensive and embarrassing.

Henry Cavil's mustache

Henry Cavil's mustacheTepid action actor Henry Cavil had just wrapped up filming for Justice League when he had started filming for Mission Impossible – Fallout, but Warner Brothers decided a few scenes needed to be redone for the former. Unfortunately, Cavil had worked very hard to grow out a pencil thin mustache, and the filming schedules were too set in stone for him to shave. Coordinating the reshoots, and CGI-ing out Cavil's facial hair all cost around $25 million, and they didn't even succeed, as fans were quick to point out how weird the actors face looked on the big screen.

French Train Company Made Trains Too Big For Track

French Train Company Made Trains Too Big For TrackFrench train company SNCF purchased 2,000 trains in 2014 for around 15 billion euros, but they soon realized their platforms were too narrow for the new orders, a mistake which cost them an additional 50 million euros. It was all at the fault of the operator, who didn't factor in measurements of train platforms that had been built more than 50 years ago.

(Photo by Frederick Florin/AFP/Getty Images)

Spain's Submarine that Couldn't Resurface

Spain's Submarine that Couldn't ResurfaceSpain coughed up around $2.2 billion to build a luxury submarine named The Isaac Peral. But before the vessel was completed in 2013, engineers discovered that the unfinished submarine was so heavy that it probably would not resurface if placed underwater. The design flaw was fixed, but it was embarrassing when news broke.

Mizuho Securities loses $225 million dollars Due to a Typo

Mizuho Securities loses $225 million dollars Due to a TypoIn 2005 Japanese security company Mizuho lost an enormous sum when a single stockbroker mistyped some financial data. Instead of offering a single share in J-Com's stock for about 610,000 yen (or $5,000 dollars,) he offered 610,000 shares for 1 yen. The disaster meant investors were buying out Mizuho's stock for an insanely low amount of money, costing the company around $225 million in damages.

"

The ‘Walkie Talkie’ Building Melted Cars

The ‘Walkie Talkie’ Building Melted Cars Henry Cavil’s mustache

Henry Cavil’s mustache French Train Company Made Trains Too Big For Track

French Train Company Made Trains Too Big For Track Spain’s Submarine that Couldn’t Resurface

Spain’s Submarine that Couldn’t Resurface Mizuho Securities loses $225 million dollars Due to a Typo

Mizuho Securities loses $225 million dollars Due to a Typo