How to Feng Shui Your Office For Success

Mar 29 | 2018

Feng Shui is about manipulating how energy flows through your space. By manipulating this energy you can reinvent your space. Using Feng Shui in the office is all about organizing in a way that makes you feel energized, focused, productive, and powerful. Without making big changes you can retake control. So use these Feng Shui steps to harness your offices’ chi for your success.

Step 1: Declutter Your Desk

getty images

getty images

The first thing you need to do for any Feng Shui is to declutter. If you want to manipulate your space’s energy you can’t have anything blocking or clogging it up. There’s a mentality that if you have everything on the surface you’ll find it easier but it really distracts you and slows you down. Cluttered desk = cluttered mind so take everything off the surface and organize it out of your sightline.

Step 2: Find Your Power Position

getty images

getty images

A principle of Feng Shui is that your chair should always see the door. It makes sense why that’s the command position, because you have heightened awareness of your surroundings. This isn’t typically possible for a cubicle so make your space your own by creating a barrier. You don’t want to be face to face with anyone.

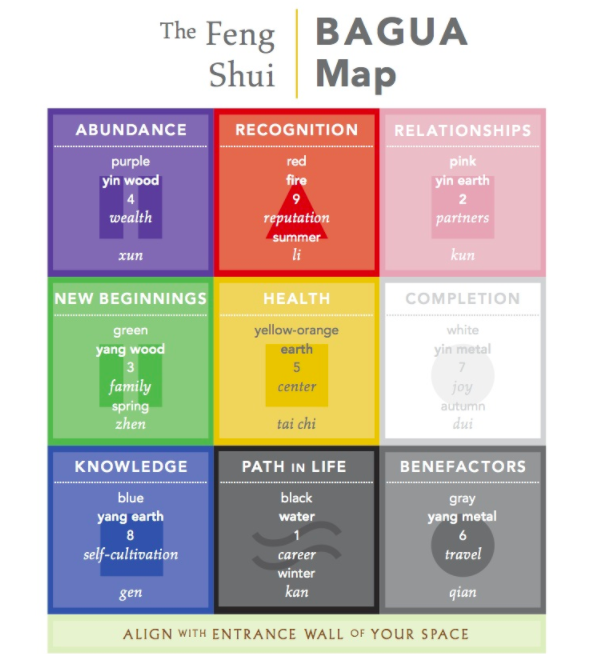

Step 3: Consult the Bagua

A bagua is an energy map that will help you organize your space by bringing the power of intention. There are two different styles so pick which one is best for you. It’s all about inviting energy into specific areas that you want to focus on in your life; ie. wealth, family, creativity etc. To use the bagua make a simple map of your space then break it up into 9 equal sections. You then place significant objects in the corresponding area. A plant can invite in wealth, a photo of a loved one can help your relationship, and it’s all about exploring what is important to you. You can do this over your entire office, or on your desk.

Step 4: Bring Nature into Your Space

getty images

getty images

Plants, running water, and elementals are a crucial part of Feng Shui. They invite life into your space and living plants help the chi flow around while also filtering out air pollutants. If you don’t think your office could sustain a plant check out this fantastic list of options. Water can be tricky and if you can’t have a fountain consider artwork that is H2O inspired.

Step 5: Make Sure There’s Balance

getty images

getty images

Balance is key so make sure that everything is in harmony with each other. To do this you should think about all different kinds of balance. The forces of yin and yang can be seen as more than darkness vs. the light and are often equated with feminine and masculine energy. The elementals wood, earth, metal, fire, and water should also be balanced in your office. Most offices start out full of fire and metal, namely the lights and your computer or filing cabinets. To balance you need to bring in elements of wood, earth, and water for a calming and focusing effect. Plants work wonders. Earth and water colors or artwork are great substitutes for real nature. Remember it’s your office, so do whatever feels right to you.

If you follow these 5 simple steps you are sure to increase the energy flow of your office, bringing in positivity and harmony. This can help you stay focused, energized, and inspired in an otherwise stifling environment. Use these tools to help you achieve your optimal Feng Shui so that you can achieve all the success you deserve.

[shortcode-anyclip-videoplayer]