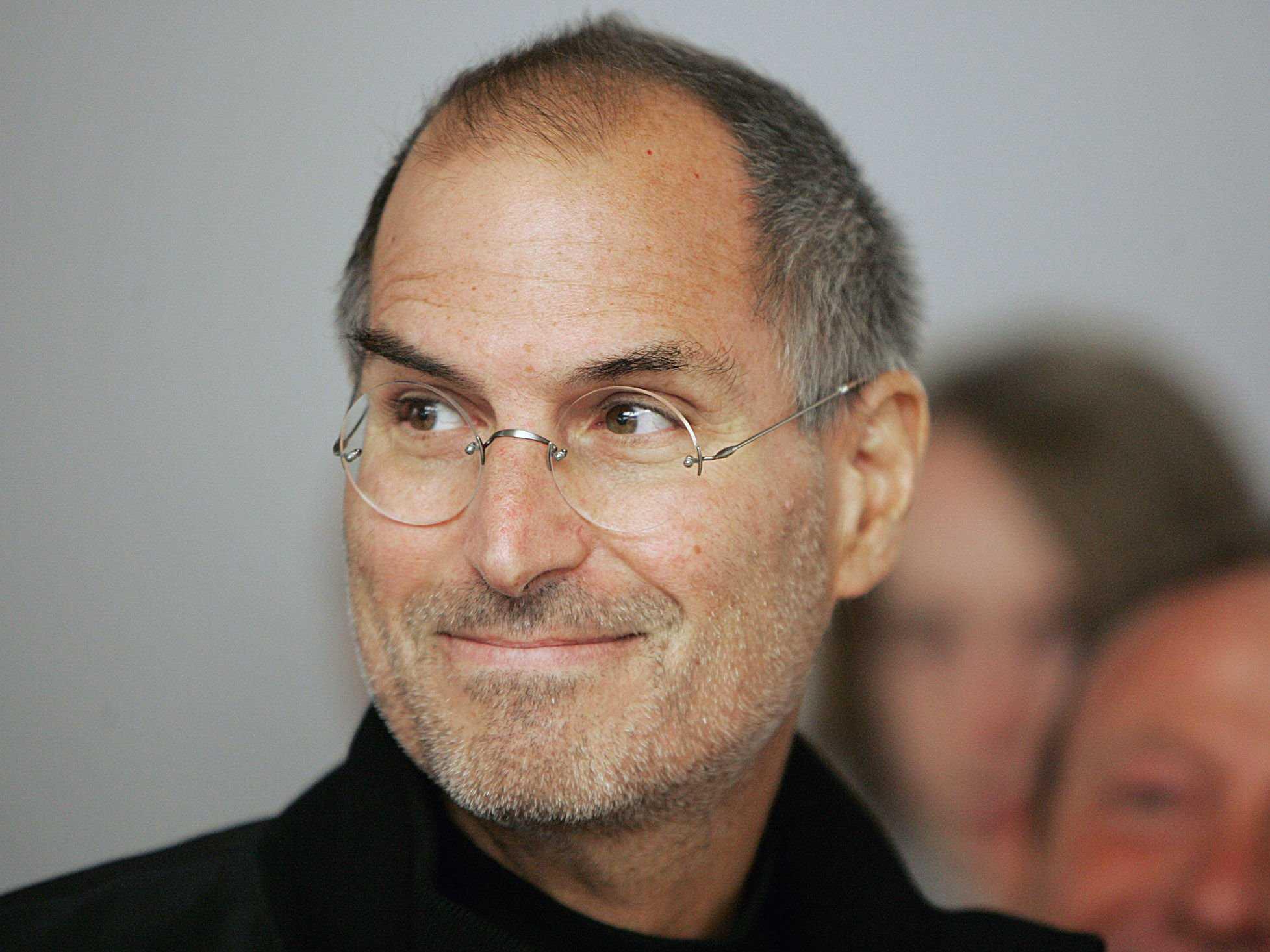

11 Steve Jobs Quotes To Blow Your Mind

Jan 10 | 2024

Steve Jobs - Md Mahdi Unsplash

Entrepreneur, businessman, inventor, and industrial designer – CEO of both Apple Inc. and Pixar – Steve Jobs was both inspiring and controversial. Polarizing and mesmerizing his impact is undeniable – Buddhist, tyrant. Genius, jerk. Always against the grain, yet always a step ahead. So what went on inside that mind of his, and what can you take from it as you set out to leave your own distinct mark? Here are 11 quotes from the man himself to blow your mind.

1. “I want to put a ding in the universe”

The things we do in this life literally echo an eternity. No matter how small, your actions have impact, and if you really swing, you too can leave a ding.

2. “Remembering that you are going to die is the best way I know to avoid the trap of thinking you have something to lose. You are already naked. There is no reason not to follow your heart.”

We’re not here forever, only our legacy. So go for it, and go big. The world needs you to shine, and when we all shine together, it’s a much brighter place.

3. “Innovation distinguishes between a leader and a follower”

Some people looks to others to find the answer, and some people look within themselves. Take what you’ve got and make what you want, because losers find excuses and winners find a way.

4. “Your work is going to fill a large part of your life, and the only way to be truly satisfied is to do what you believe is great work. And the only way to do great work is to love what you do. If you haven’t found it yet, keep looking. Don’t settle. As with all matters of the heart, you’ll know when you find it.”

If you aren’t doing what you love, you aren’t satisfied. This also means you aren’t making the greatest contribution that you can in this world. Do it for yourself, do it for us, get out there and do what you love.

5. “My favorite things in life don’t cost any money. It’s really clear that the most precious resource we all have is time.”

At the end of the day our life isn’t about what we did with our money, but rather what we’ve done with our time. What will you do with yours?

6. “You have to trust in something – your gut, destiny, life, karma, whatever. This approach has never let me down, and it has made all the difference in my life.”

Faith in the unseen. Everyone has a different name for it, but however it speaks to you and however you hear it, it’s a universal truth. Listen to that voice and you’ll never be wrong.

7. “That’s been one of my mantras—focus and simplicity. Simple can be harder than complex; you have to work hard to get your thinking clean to make it simple. I think if you do something and it turns out pretty good, then you should go do something else wonderful, not dwell on it for too long. Just figure out what’s next.”

The beauty and simplicity of something like an iPhone speak for itself. There’s a certain discipline required to maintain simplicity and not overcomplicate things, especially in an era where we’re bombarded with so much info. Nevertheless, the timeless K.I.S.S. acronym has never failed.

8. “Be a yardstick of quality. Some people aren’t used to an environment where excellence is expected.”

Don’t just set the standard high. Be the new standard. Excellence in itself is a reward.

9. “Your time is limited, so don’t waste it living someone else’s life. Don’t be trapped by dogma – which is living with the results of other people’s thinking. Don’t let the noise of others’ opinions drown out your own inner voice. And most important, have the courage to follow your heart and intuition.”

Your mind is your kingdom and yours alone to rule. Discernment is a virtue required to attain the highest levels of success, and keeping your mind free and to yourself to hear your more creative and progressive thoughts is essential.

10. “I’m the only person I know that’s lost a quarter of a billion dollars in one year…. It’s very character-building.”

Money comes, money goes, ride the tides and never let it break you. It comes back just as quickly.

11. “The people who are crazy enough to think they can change the world are the ones who do.”

How crazy are you?