The holiday season can be a really stressful time, both mentally and financially. It is difficult to maintain normalcy when there’s a number of people to think about, presents to buy, and gifts to wrap… all while life carries on around you. If you’re looking for a great way to organize all the gifts you need to buy and keep track of how much you want to spend then check out Santa’s Bag.

Santa’s Bag

Santa’s Bag

Santa’s bag is a free app that has 4.5 stars, hundreds of reviews, no ads, and plenty of helpful Christmas cheer. Once you download it you’ll understand why it’s a favorite! With a combination of big picture and person by person planning you can get through the season remembering everyone’s gifts with ease.

Santa’s Bag

Santa’s Bag

(adsbygoogle = window.adsbygoogle || []).push({});

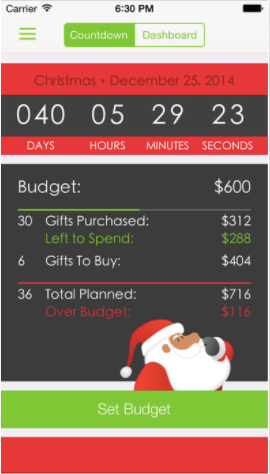

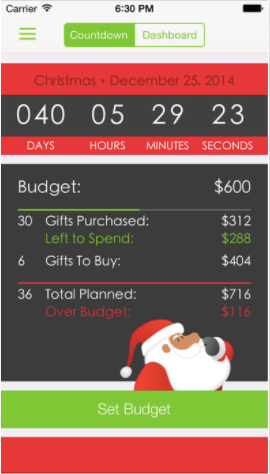

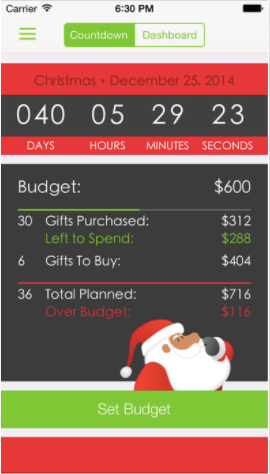

The main page is your overview. It greets you with a cheerful Santa, a Christmas Day countdown, and the breakdown of your budget. It will give you the number of gifts purchased already, the ones left to buy, and how that stacks up to your overall budget. All that is great but the main page is just the tip of the iceberg.

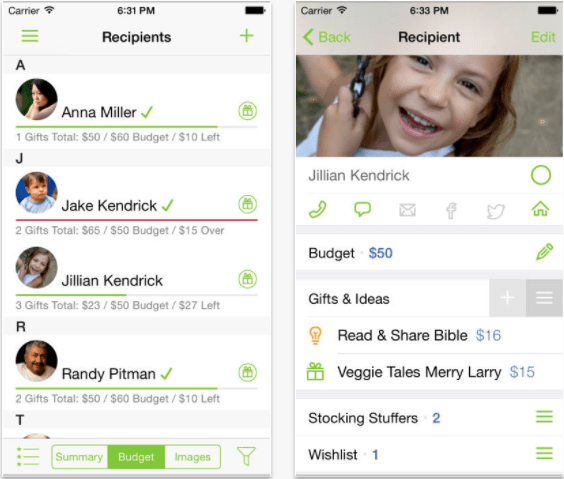

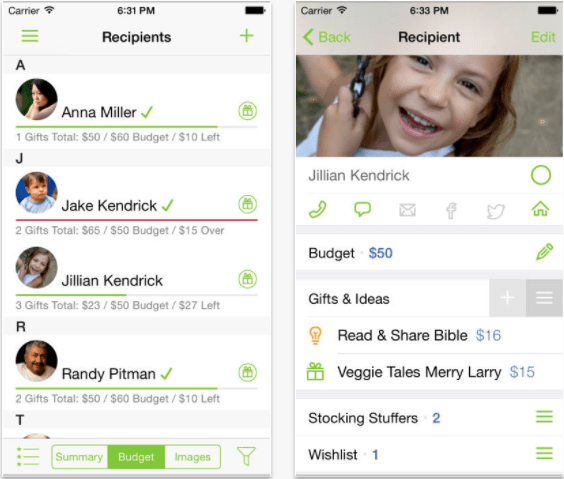

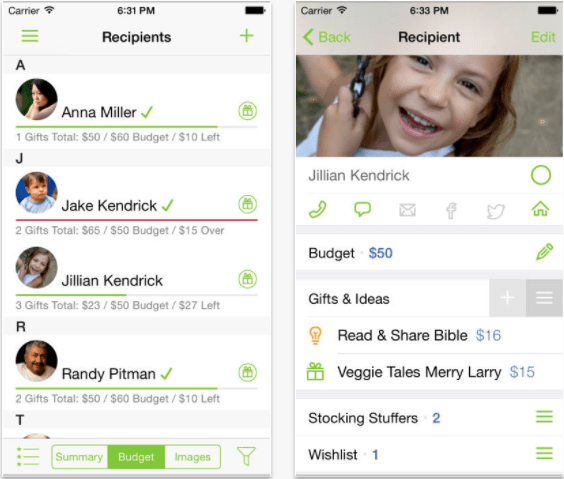

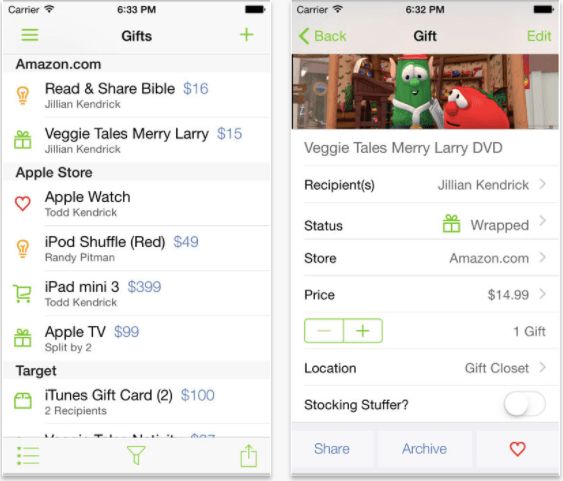

Import people from your contacts to seamlessly make your Christmas list, contact photos and all. This can make it easy to organize everyone you need to buy presents for like family, friends, and coworkers. Through contacts, you can put in budgets by person, keep track of gift ideas, the gift’s prices, stocking stuffers, and the person’s wishlist.

Santa’s Bag

Santa’s Bag

(adsbygoogle = window.adsbygoogle || []).push({});

If you’re not sure what you’re getting someone then keep track of ideas on the app to come back to later! If two or more people are sharing a gift, then no problem! You can add multiple recipients to anything. Going person by person means that you can organize properly without leaving anyone out, getting too many or too few presents, and can stay on budget.

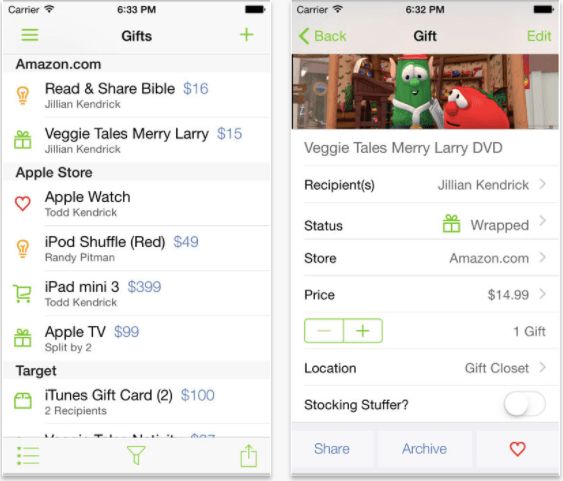

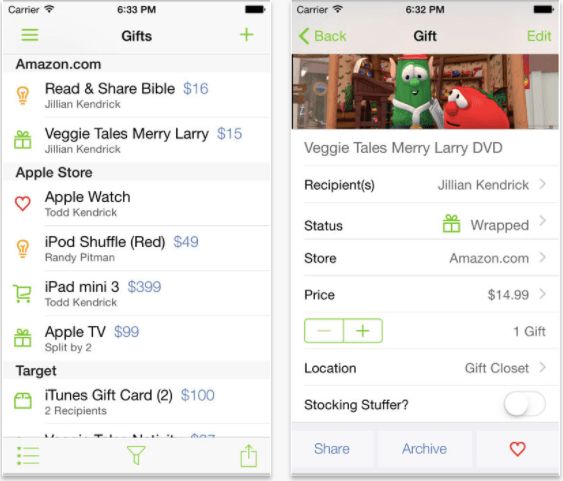

You’ve done the organizing and you know what you are getting everyone. Santa’s Bag organizes each gift through the labels ‘idea’, ‘need to buy’, ‘purchased’, ‘wrapped’, and ‘given’. That makes it easy to track each gift through the entire process.

Santa’s Bag

Santa’s Bag

Now comes the trip to the store, yikes. Nothing is worse than walking out with your bags to realize you forgot something! With Santa’s Bag, you can go to the side menu and get your Quick Lists. Shop strategically by using either the total shopping list or go under favorites to see your list store by store!

Everything is pretty much bought online these days so don’t worry, there’s an online gift tracker as well. It seems like every year there is something that comes either too early or too late in the mail and can be forgotten, make sure nothing escapes your notice! Once you label a gift as online it will give you the new options of ‘ordered’ and ‘received’.

Giphy

(adsbygoogle = window.adsbygoogle || []).push({});

Santa’s bag is here to help make everything easier this Christmas, so give it a try! It’s made my shopping a thousand times easier and it can do the same for you. Be prepared this holiday season with the best app for making the holidays organized, on budget, and stress-free.

string(5211) "

The holiday season can be a really stressful time, both mentally and financially. It is difficult to maintain normalcy when there's a number of people to think about, presents to buy, and gifts to wrap... all while life carries on around you. If you're looking for a great way to organize all the gifts you need to buy and keep track of how much you want to spend then check out Santa's Bag.

Santa's Bag

Santa's Bag

Santa's bag is a free app that has 4.5 stars, hundreds of reviews, no ads, and plenty of helpful Christmas cheer. Once you download it you'll understand why it's a favorite! With a combination of big picture and person by person planning you can get through the season remembering everyone's gifts with ease.

Santa's Bag

Santa's Bag

(adsbygoogle = window.adsbygoogle || []).push({});

The main page is your overview. It greets you with a cheerful Santa, a Christmas Day countdown, and the breakdown of your budget. It will give you the number of gifts purchased already, the ones left to buy, and how that stacks up to your overall budget. All that is great but the main page is just the tip of the iceberg.

Import people from your contacts to seamlessly make your Christmas list, contact photos and all. This can make it easy to organize everyone you need to buy presents for like family, friends, and coworkers. Through contacts, you can put in budgets by person, keep track of gift ideas, the gift's prices, stocking stuffers, and the person's wishlist.

Santa's Bag

Santa's Bag

(adsbygoogle = window.adsbygoogle || []).push({});

If you're not sure what you're getting someone then keep track of ideas on the app to come back to later! If two or more people are sharing a gift, then no problem! You can add multiple recipients to anything. Going person by person means that you can organize properly without leaving anyone out, getting too many or too few presents, and can stay on budget.

You've done the organizing and you know what you are getting everyone. Santa's Bag organizes each gift through the labels 'idea', 'need to buy', 'purchased', 'wrapped', and 'given'. That makes it easy to track each gift through the entire process.

Santa's Bag

Santa's Bag

Now comes the trip to the store, yikes. Nothing is worse than walking out with your bags to realize you forgot something! With Santa's Bag, you can go to the side menu and get your Quick Lists. Shop strategically by using either the total shopping list or go under favorites to see your list store by store!

Everything is pretty much bought online these days so don't worry, there's an online gift tracker as well. It seems like every year there is something that comes either too early or too late in the mail and can be forgotten, make sure nothing escapes your notice! Once you label a gift as online it will give you the new options of 'ordered' and 'received'.

Giphy

(adsbygoogle = window.adsbygoogle || []).push({});

Santa's bag is here to help make everything easier this Christmas, so give it a try! It's made my shopping a thousand times easier and it can do the same for you. Be prepared this holiday season with the best app for making the holidays organized, on budget, and stress-free.

"