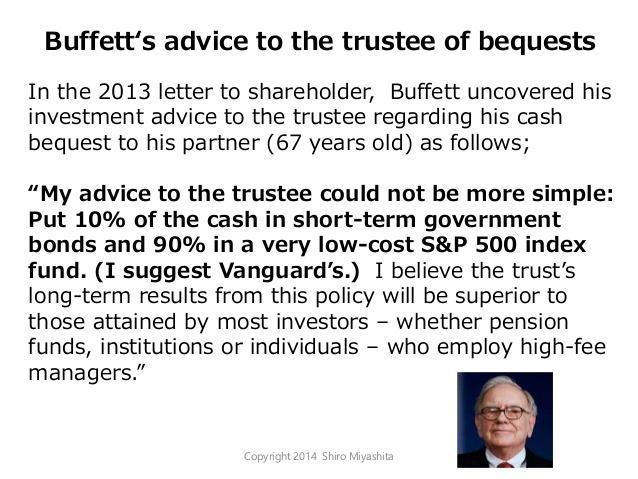

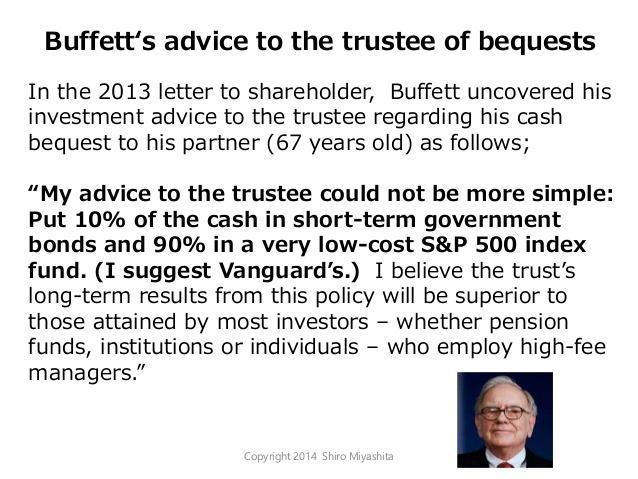

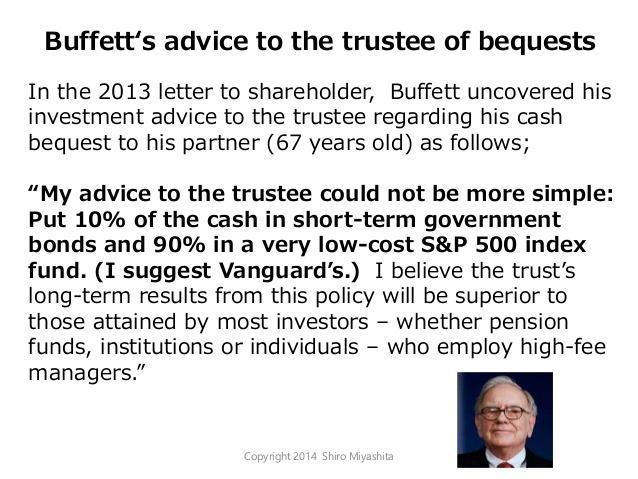

Billionaire investor Warren Buffett is known for his business savvy, his money-making prowess, and his investing wisdom. But there’s one piece of advice he has echoed that he feels has too often fallen upon deaf ears. “Invest in Index Funds” is a staple piece of Buffett investment advice. As a matter of fact, he claims that the nations’s elite have wasted an estimated “$100 billion” over the past 10 years by not heeding his advice. So what exactly are index funds? Should you be investing in them? Let us explore.

Back in 1974 Jack Bogle founded the Vanguard Group. Bogle, with the Vanguard Group would change investing forever with the Index Fund. A Princeton graduate, Bogle’s senior thesis ” The Economic Role of the Investment Company” laid the foundation for the creation of the index fund.

Started on December 31. 1975, Bogle’s initial index fund was met with widespread ridicule and derision. It was even labeled as “un-American” and viewed as “Bogle’s Folly”. As of today the Vanguard 500 index Fund – which started with a meager $11 million investment – is worth over $310 billion, with a “B”.

An index fund passively tracks a market index like the Nasdaq or S&P 500. This allows the average Joe to be able to invest in the market with way lower fees than your actively managed funds.

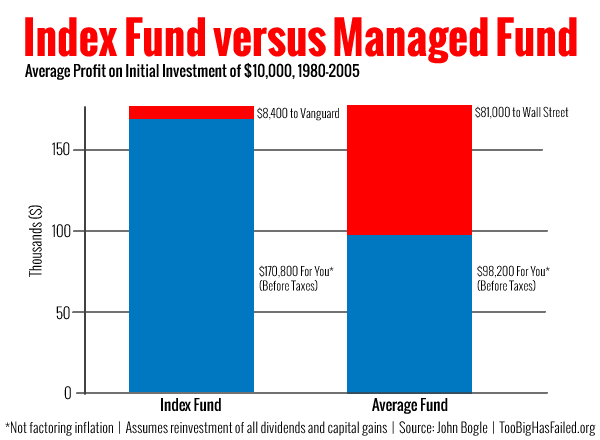

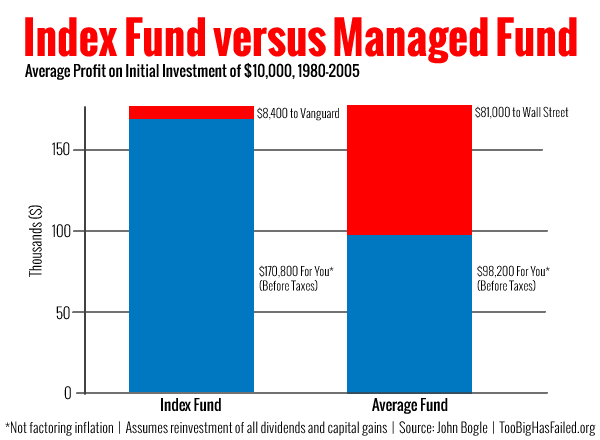

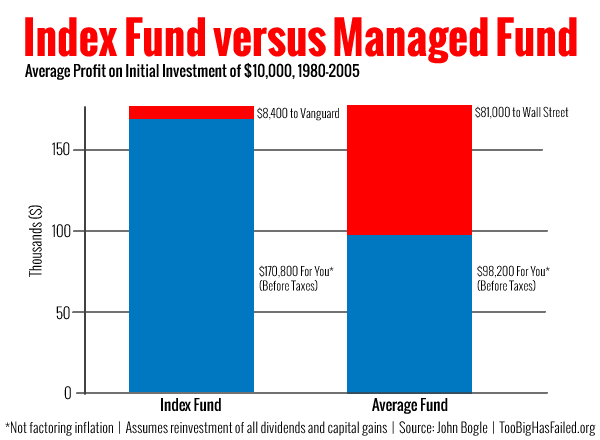

Bogle’s research indicated, and his results proved that passively managed index funds yield greater returns than actively managed funds, especially when factoring in what at times can be exorbitant management fees. Nobel Prize-winning economist Paul Samuelson stated that the index fund is in the same league as “the invention of the wheel, the alphabet, Gutenberg printing, and wine and cheese.”

Index funds exist as mutual funds and ETFs and follow preset rules to maintain tax efficiency and low cost. Currently, index funds make up for over 20% of all equity funds in the U.S.

Buffett jokes that the desire the mega-wealthy have for exclusivity and having something better than the general population has cost them billions in the process. Meanwhile, all his friends of more modest means have seen exceptional results investing in passive index funds.

As always, do your due diligence, know your risk, and make sure you’re having fun. Get out there, get investing, and as always, may the force be with you.

string(3172) "

Billionaire investor Warren Buffett is known for his business savvy, his money-making prowess, and his investing wisdom. But there's one piece of advice he has echoed that he feels has too often fallen upon deaf ears. "Invest in Index Funds" is a staple piece of Buffett investment advice. As a matter of fact, he claims that the nations's elite have wasted an estimated "$100 billion" over the past 10 years by not heeding his advice. So what exactly are index funds? Should you be investing in them? Let us explore.

Back in 1974 Jack Bogle founded the Vanguard Group. Bogle, with the Vanguard Group would change investing forever with the Index Fund. A Princeton graduate, Bogle's senior thesis " The Economic Role of the Investment Company" laid the foundation for the creation of the index fund.

Started on December 31. 1975, Bogle's initial index fund was met with widespread ridicule and derision. It was even labeled as "un-American" and viewed as "Bogle's Folly". As of today the Vanguard 500 index Fund - which started with a meager $11 million investment - is worth over $310 billion, with a "B".

An index fund passively tracks a market index like the Nasdaq or S&P 500. This allows the average Joe to be able to invest in the market with way lower fees than your actively managed funds.

Bogle's research indicated, and his results proved that passively managed index funds yield greater returns than actively managed funds, especially when factoring in what at times can be exorbitant management fees. Nobel Prize-winning economist Paul Samuelson stated that the index fund is in the same league as "the invention of the wheel, the alphabet, Gutenberg printing, and wine and cheese."

Index funds exist as mutual funds and ETFs and follow preset rules to maintain tax efficiency and low cost. Currently, index funds make up for over 20% of all equity funds in the U.S.

Buffett jokes that the desire the mega-wealthy have for exclusivity and having something better than the general population has cost them billions in the process. Meanwhile, all his friends of more modest means have seen exceptional results investing in passive index funds.

As always, do your due diligence, know your risk, and make sure you're having fun. Get out there, get investing, and as always, may the force be with you.

"