Top 5 Investing Apps for Beginners

Mar 11 | 2021

pixabay.com

If you’re savvy when it comes to apps but could use some direction in your investing game, combine the two and go from investing newbie to knowledgeable with tips you can tap into. Entering into the world of investing can be daunting, so invest your time before you invest your hard-earned dough. These 5 apps for investing beginners will lead you in the right direction. Invest with the best!

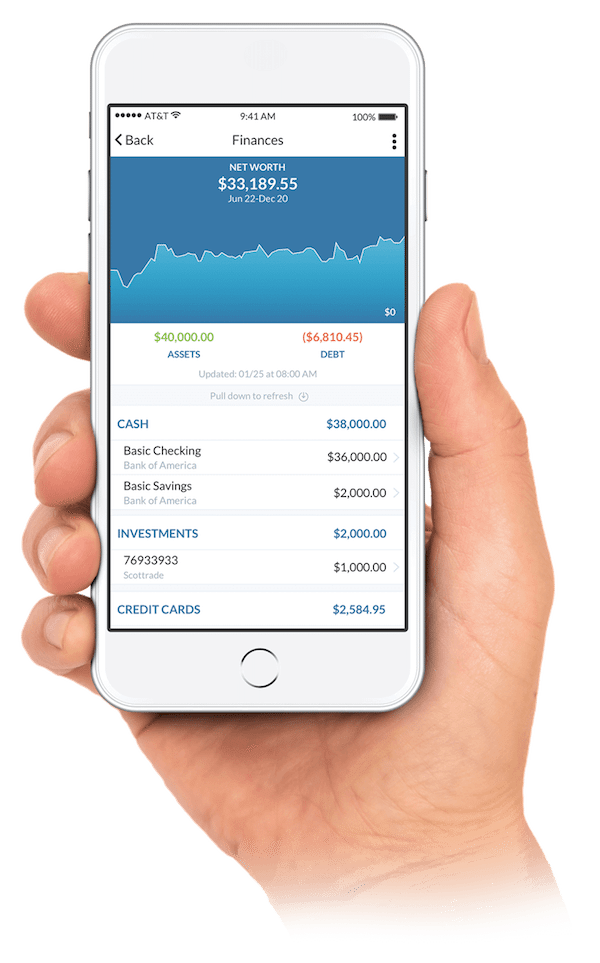

MoneyLion Plus

MoneyLion PlusVia crowdfundinsider.com

MoneyLion PlusVia crowdfundinsider.com

MoneyLion Plus is an app that is designed to help you borrow, save, reduce debt, invest, and earn. You’ll learn the basics of landing a loan, keep up to date on your credit score as you monitor your credit history and charges, and have a neat place to store all your financial information securely. With personalized financial advice and a guided investing plan, you will begin to develop your investment portfolio and allocation. Step by step, you will become tuned in to how investing works and what works for you. And now’s a great time to improve your investing know-how with MoneyLion Plus. According to Tech Crunch, “The latest version of the MoneyLion Plus app has an updated user interface to make things easier to navigate and provide faster access to the information. With its new UI, MoneyLion’s home navigation now shows swipe-able cards to provide up-to-date information, recommendations and personalized advice.” For $29 per month, this app will pay for itself… and then some.

(adsbygoogle = window.adsbygoogle || []).push({});

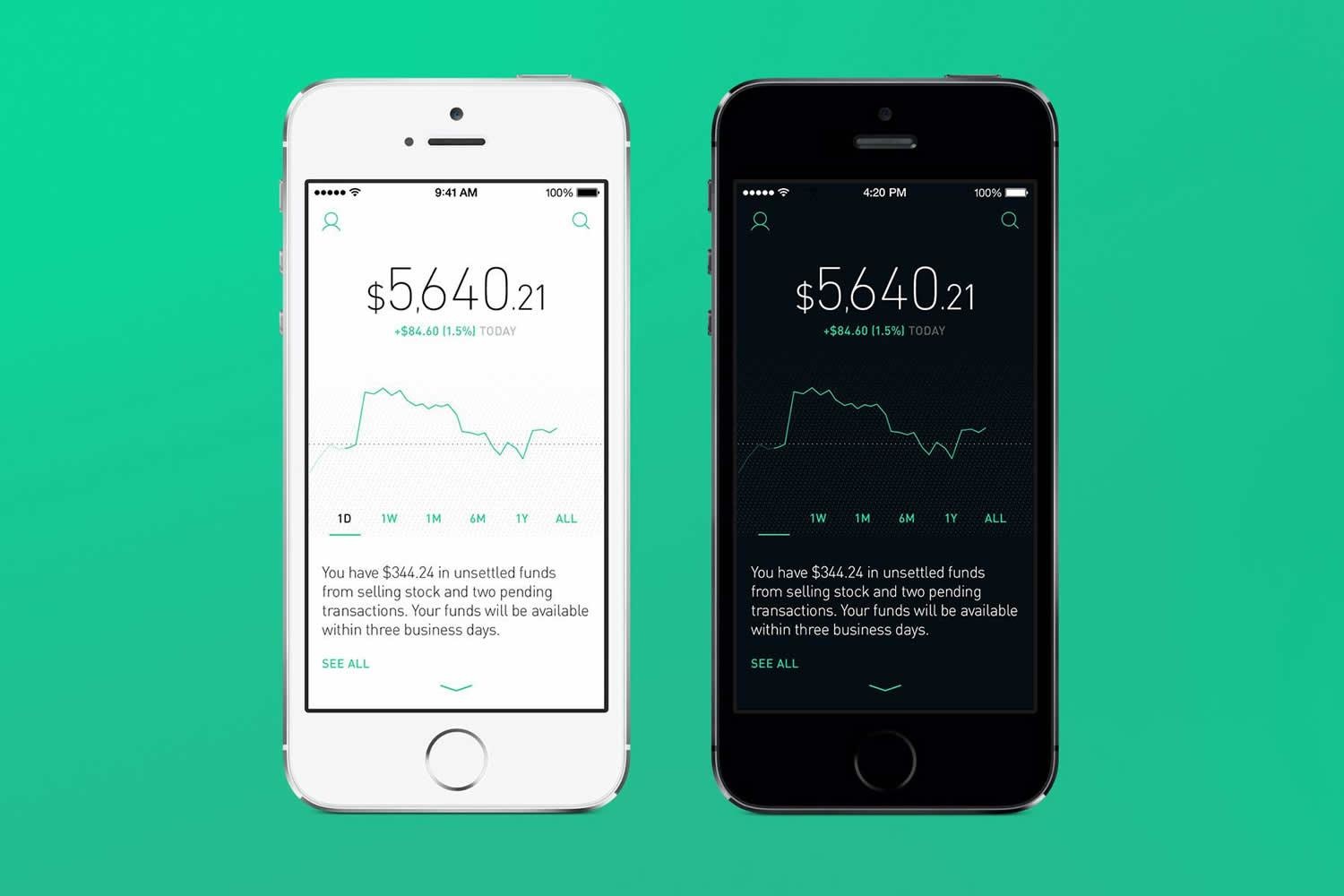

Robinhood

RobinhoodVia thefinancegenie.com

RobinhoodVia thefinancegenie.com

Learn the ins and outs of the stock market for free with the aid of Robinhoodapp. The app leads you step by step as you build your portfolio from scratch. Invest in stocks, options, and ETFs (exchange-traded funds). Their mission? “To democratize America’s financial system. Invest in stocks, ETFs, options, and cryptocurrencies commission-free.” Make instant deposits with no wait time. You can boost your account by opting for Robinhood Gold. According to Business Insider, this account, “gives you access to extra buying power, larger instant deposits, and extended trading hours.” Robinhood is easy-to-navigate helping you see market data clearly for making wise investment choices. As per The Finance Genie, “It’s fast and streamlined so you can instantly verify your bank account and check on your investments or make trades with only a few taps.” There is no account minimum to start, so what are you waiting for?

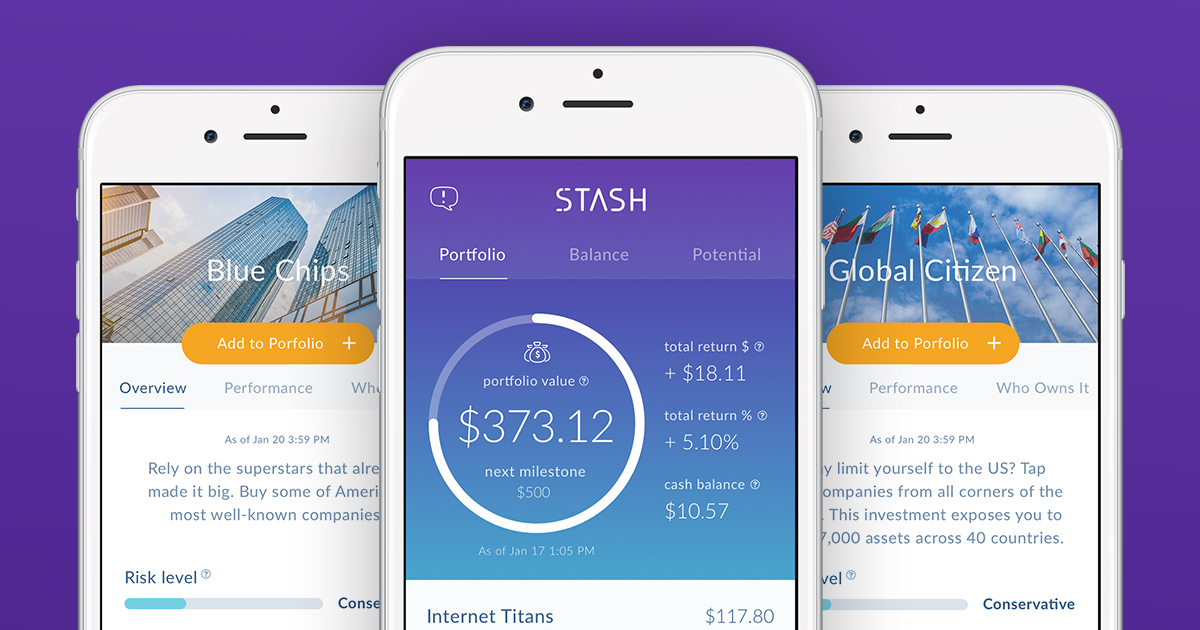

Stash

StashVia stashinvest.com

StashVia stashinvest.com

If you’ve got five bucks, you can begin your introduction to investing with Stash, anSEC registered investment adviser. Sign up is simple as you fill out your profile, and you will instantly gain access to 30+ investment options along with customized advice from your Stash Coach to help you set up your portfolio. All investments on the Stash app are carefully selected by their team. Everything is broken down and easy to digest, without unfamiliar terminology or confusion to trip you up. Their selection of ETFs is broken down by interest (activist, techie, globetrotter, trendsetter, etc.), so you can invest in companies that matter most to you. Stash’s mission, “We believe everyone should have access to financial education, technology, and services that help them achieve their life goals,” only furthers your faith in the Stash app and the knowledgeable team behind it.

Acorns

Acorns Via bankers-anonymous.com

Acorns Via bankers-anonymous.com

Acorns is great for beginners or anyone who wants to start investing now, even if they don’t have much money at the get-go. Just $1 per month will get you on your way. Acorns’ micro-investing platform is a three-step entry process – connect your banking/credit card(s), make purchases as usual, and the app will start investing your spare change left over as they round up your purchases to the dollar. 7,000 stocks and bonds are available for investing, to “improve your return while reducing risk.” You’ll create a portfolio designed in part by a Nobel Prize-winning economist to manage your investments in an organized and professional manner. With the app comes Grow Magazine, so you can continue to learn more about investing as you delve deeper into the financial world. CNBC calls Acorn, “The new millennial investing strategy.” With investors including PayPal and Ashton Kutcher, Acorn is on to something.

(adsbygoogle = window.adsbygoogle || []).push({});

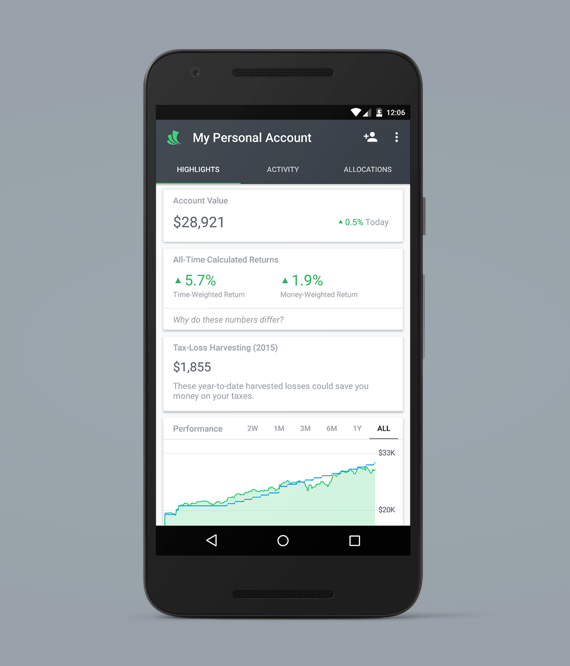

Wealthfront

Wealthfront Via blogwealthfront.com

Wealthfront Via blogwealthfront.com

Connect your financial accounts to the Wealthfront app and fill out a questionnaire, and let their expert software analyze your info to help you make the most of your finances by investing intelligently into one of their 20 portfolios. They will design a personalized plan to help you achieve your investing goals with a diversified plan from the ground up. With just a .25% annual advisory fee for accounts with a $10,000+ balance (otherwise free), you will spend a little to gain a lot. According to NerdWallet, “Wealthfront offers the kind of holistic financial advice and automated investment management that appeals to new and experienced investors alike.” With access to U.S. and foreign stocks, bonds, real estate, securities, etc., Wealthfront has a mix of options to help you invest strategically and successfully.