How to Avoid Getting Scammed on eBay

Mar 14 | 2017

EBay is one of the most widely known peer-to-peer selling websites. You can get massive deals on various merchandise, but how do you avoid paying into a scam? Sometimes you don’t know the item you’re paying for is fake until you receive it. Yes, eBay has administrators, tools and their money-back guarantee to combat these situations. But dealing with all of that can be quite a hassle. It’s probably much easier to just get the item you’re paying for in the first place, right? Here are a few ways to avoid paying for a rip-off on eBay and other selling websites.

1. Check the seller’s rating

1. Check the seller’s rating

EBay has its own seller rating system. The better reviews the seller gets from people they buy from and sell to, the better their rating will be. You might feel confident in buying an item from a seller with a 100% rating — but take it with a grain of salt. There are even scams around inflating a seller’s rating on the website. Take a look at the seller’s history and read some of the reviews about them.

You should also consider the age of their account. If they just recently made their eBay account to sell a popular item, it could mean they’re trying to misrepresent the product. But if they’re been around awhile, it’s likely they’re a more reliable seller. Of course, there are untrustworthy sellers with old accounts and good sellers with new accounts. This is just one thing to keep in mind.

2. Examine the product picture

2. Examine the product picture

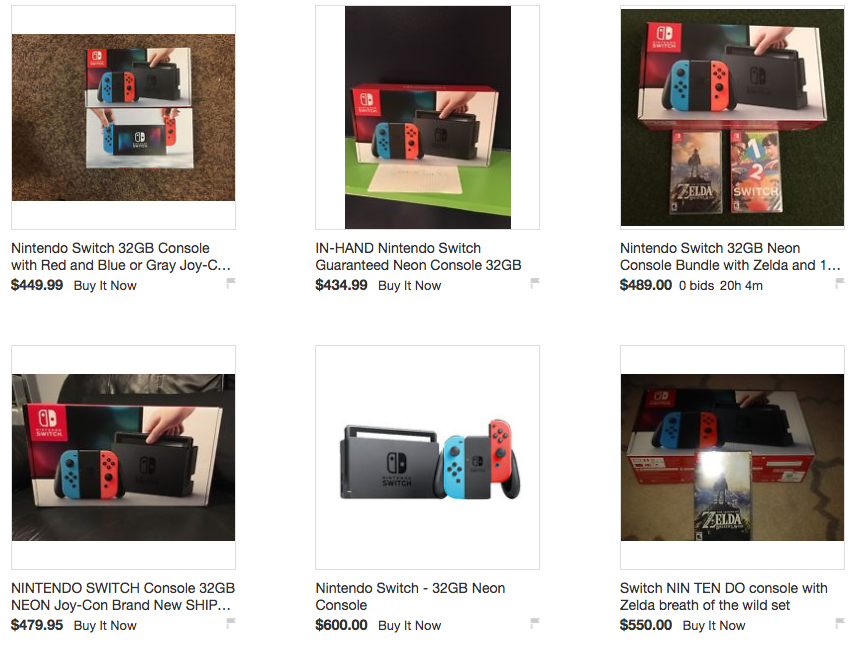

Probably the fastest way to spot something fishy is by the picture, especially if they’re reselling a brand new product. If the seller has uploaded an official picture released by a big company, be wary. That picture does nothing to prove that the seller actually has the product they’re selling. You want to look for a picture of the box or item in their home or in another location than what was advertised by official retail outlets. It might seem counterintuitive, but a poorer quality picture is probably a good sign the seller actually has the product on hand. (Can you spot the possibly fishy photo above? Hint: it’s the middle one on the bottom row.)

If there are a lot of listings for the same thing, compare the product pictures between posts. Sometimes sellers will even steal a picture from someone else who genuinely has the item. Other times, a single seller will use the same exact picture on multiple auctions. Maybe they were too lazy to take multiple pictures and upload them, but this could also mean that they’re trying to scam you.

3. Don’t be afraid to talk to the seller

3. Don’t be afraid to talk to the seller

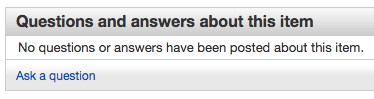

Any genuine seller will usually be happy and willing to answer questions about the item and their selling policies. It might take some time for them to reply, but they generally won’t hold back about anything. If a seller is particularly cagey with you or reluctant to answer questions, that’s probably a bad sign. Be wary if they also avoid answering your question and focus on the selling points of an item. Don’t take their word on a “new” and “unopened” item without the proper proof.

Even after you do purchase the item or win the auction, keep talking to the seller. Ask about a ship date and tracking information. Once you receive the item, even if everything is all good, go ahead and send them another message thanking them. It’ll help your own score on eBay and will foster goodwill if you decide to buy from them again.

4. Always use PayPal to fund purchases

4. Always use PayPal to fund purchases

Never, never, never agree to pay over a wire transfer. If a seller asks for that, it’s a sure sign of a scam. Once the money is transferred via wire, it’s practically impossible to get it back. For safety and simplicity, just use PayPal. PayPal protects your card information and insures your payments. If you can, use a credit card in conjunction with PayPal. Credit card payments offer more protections than debit cards do.

Also, especially if you’re purchasing an item with a high price tag, make sure the purchase is covered by the eBay money back guarantee. This guarantee will cover the cost of your purchase if you don’t end up getting what was advertised — even if the seller refuses to give the money back.