How India is Emerging as a Global Super Power

May 17 | 2017

The effects of colonialism and inner corruption almost drove this nation into the depths of poverty, but sweeping social and economic reform, innovation, work ethic, and sheer numbers have pushed India to emerge on the global stage as a super-power.

The Indian subcontinent is self-sustaining and produces enough water and natural resources to supply its robust population. Located along Eurasian and Afro-Asian sea-trade places India in profitable position. India’s pivotal location leaves it poised to significantly advantage from the global shift to renewable energy. Located between the Tropics of Cancer and Capricorn place it in what’s known as the Sunny Tropical Belt, and as the technology and infrastructure assimilate to solar energy, India will greatly benefit.

India has 17.9% of the world’s population, and what’s more is that due to its high birth rate, roughly 65% of India’s population is under 35 years of age. That means its 400 million plus strong workforce is greater than the population of America and Brazil combined. Across the world, there are 35 million people, and in total India makes up for the largest English speaking/understanding population, even greater than America.

As of 2015, India boasts the world’s fastest growing economy. India is one of the world’s leading producers of food – second only to China. Food production alone accounts for USD $69.4 billion of the Indian economy. It’s currently ranked as the global #3 in terms of real GDP and with a growing manufacturing sector, some experts expect India to be #1 as soon as 2050.

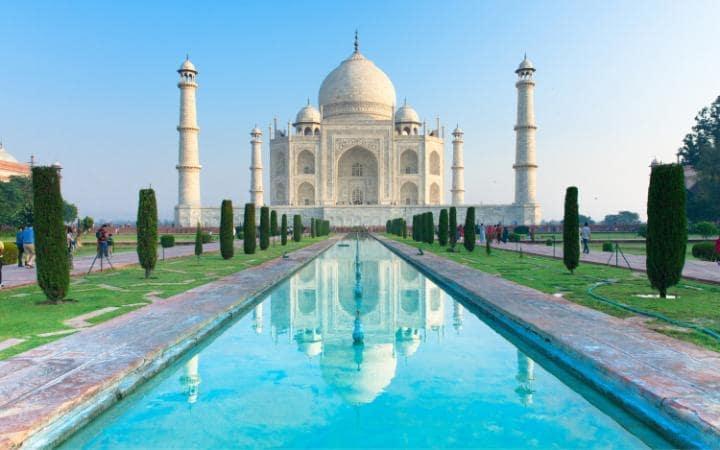

India boasts a world-class IT sector that many feel makes India a definite global technological super-power, and a tourism sector that is starting to outperform the best of them worldwide. Its combination of culture, history, and innovation makes it an attractive destination. It also has an inexpensive, yet world-class medical system that attracts thousands of patients a year from all over the world. With armed forces at 2.5 million, India has the 3rd largest defense force, making it a formidable and influential power on the world stage.

While there is still a long way to go, if India’s productivity rate continues to catch up with its population and its innovation, it is almost an inevitability that India will emerge as a world leader and a super-power.