3 College Majors With Significant ROI

May 26 | 2017

College is expensive, and the times are changing. In fact only about two-thirds of the current generation are opting receive bachelors degrees or higher. And for those that do pursue higher education, the price tag is higher than ever, and it’s rare that your degree doesn’t come unaccompanied by a load of debt. That means college is a business and we’ve got to start thinking like businesspeople. If you’re going to spend at least 4 years and mess up some comas, let’s look at the numbers. Here are a few college majors with pretty high ROI.

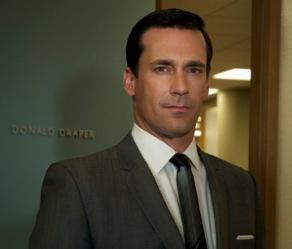

Marketing

Marketing

The American Marketing Association has defined marketing as “the activity, set of institutions, and processes for creating, communicating, delivering, and exchanging offerings that have value for customers, clients, partners, and society at large.” A four year education that costs on average $52,596 is the toll for a degree in marketing. Good news is, with an after tax salary averaging about $75-80,000 you can have those student loans paid off in as little as 5 years, and start making bank. Cue up the theme from “Mad Men”

4 years.

$52,596 cost of tuition

$74,935 after tax salary

5.3 years to pay back

$937 per month in loan payments

EngineeringIncluding works like roads, bridges, canals, dams, and buildings the Civil engineering discipline deals with the design, construction, and maintenance of the physical and naturally built environment, Civil Engineering has been around since antiquity is predated as a professional engineering career only by military engineering. Because civil engineering takes place in the public sector from municipal through to national governments, and even in the private sector from individual homeowners through to international companies, work as a civil engineer is always abundant. 4 years of schooling for about $53,000, but with a salary that maxes out near $80,000, you should have it paid back in under 8 years.

EngineeringIncluding works like roads, bridges, canals, dams, and buildings the Civil engineering discipline deals with the design, construction, and maintenance of the physical and naturally built environment, Civil Engineering has been around since antiquity is predated as a professional engineering career only by military engineering. Because civil engineering takes place in the public sector from municipal through to national governments, and even in the private sector from individual homeowners through to international companies, work as a civil engineer is always abundant. 4 years of schooling for about $53,000, but with a salary that maxes out near $80,000, you should have it paid back in under 8 years.

4 years.

$52,596 cost of tuition

$76,286 after tax salary

7.4 years to pay back

$704 per month in loan payments

Economist

Economist

Practitioners of the discipline of economics study, develop, and apply theories and concepts from economics and they also get paid to write about economic policy. Technically to be considered a major league economist you have to obtain your Ph.D., teach, and have published literature on economics. Then you’re Ben Bernake and you run the central bank of the most powerful economy on earth.

While you won’t be running the Fed or shifting the global economy with just your bachelors degree, with an average price tag of $52,000 and an average salary upwards of $90,000, we’re sure you’ll be just fine on your way to the top.

4 years.

$52,596 cost of tuition

$92,786 after tax salary

6.5 years to pay back

$785 per month in loan payments

4 years.

$52,596 cost of tuition

$76,286 after tax salary

7.4 years to pay back

$704 per month in loan payments

Economist

EconomistPractitioners of the discipline of economics study, develop, and apply theories and concepts from economics and they also get paid to write about economic policy. Technically to be considered a major league economist you have to obtain your Ph.D., teach, and have published literature on economics. Then you're Ben Bernake and you run the central bank of the most powerful economy on earth.

While you won't be running the Fed or shifting the global economy with just your bachelors degree, with an average price tag of $52,000 and an average salary upwards of $90,000, we're sure you'll be just fine on your way to the top.

4 years.

$52,596 cost of tuition

$92,786 after tax salary

6.5 years to pay back

$785 per month in loan payments

"