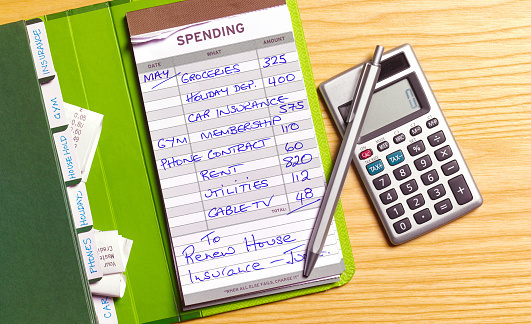

Should You Pay Your Rent While 6.6 Million Americans Are Applying for Unemployment?

Apr 02 | 2020

Blaise Sewell

Yesterday the rent was due for millions of Americans for the first time since they were put under quarantine. We are being told to remain indoors as much as possible and to maintain a safe distance from other people. For some of us, that means working from home. For millions of others, it means they