Crack the Code to Financial Freedom With These Top 5 Personal Investing Apps

Everyone can always use some extra cash. There’s gotta be an easier way than working overtime or wasting your life on obscure side hustles. I’m sure you’ve had friends say, “just invest your money, bro” – if only it were that simple. With so many personal investment apps out there, it can be tough to find one that’s right for you. Whether you’re looking for a basic approach, automated investing, or sophisticated trading tools – there’s an app for everyone.

Here’s a breakdown of the top 5 personal investment apps on the market:

Robinhood: The People’s Choice

Robinhood – as the name suggests, brings investing to the people. With its sleek interface and user-friendly design, it's a breeze to use. No more scratching your head over complex financial jargon – Robinhood breaks it down in a way that even your grandma can understand. Plus, the commission-free trades make you feel like you've cracked the code to financial freedom without breaking the bank. If you're looking to trade stocks, options, ETFs, or crypto – Robinhood’s a terrific choice. However, this app doesn’t support mutual funds or fixed-income products, so it's best for beginner investors.

Acorns: The Sneaky Saver

Meet Acorns, the app that's all about micro-investing. It rounds up your everyday purchases to the nearest dollar and tosses that spare change into a portfolio. Basically, it’s the investment equivalent of finding money in your couch cushions! Acorns works best for investors looking to be hands-off. A minor downside is the pricey account management fees, especially if you’re only investing a small amount.

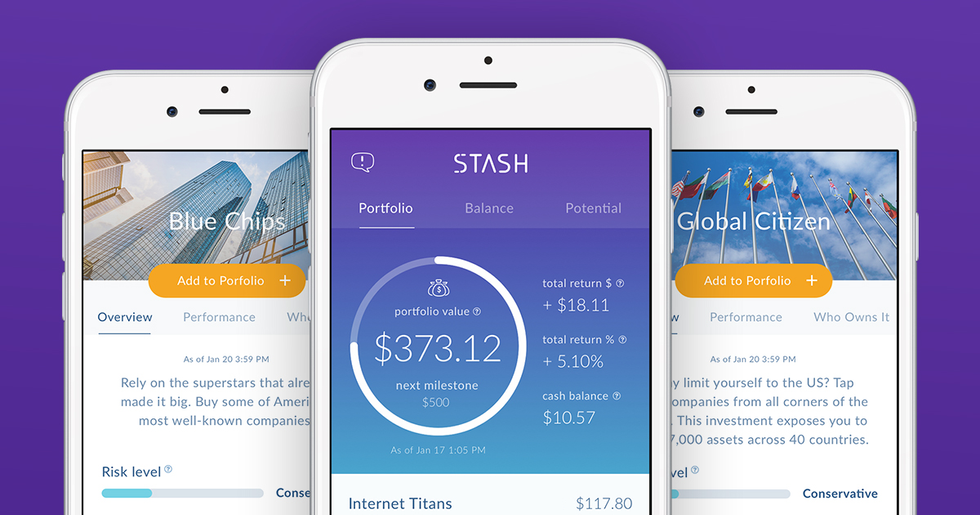

Stash: The Personalized Picker

If you've ever felt overwhelmed by the stock market's endless buffet, Stash will get you sorted. This app caters to your interests and values, allowing you to invest in themes like clean energy or your favorite tech giants. It's like choosing pizza toppings, but rather than pepperoni, you're choosing renewable energy stocks. There are small monthly fees, but it could be worth it if you want to buy fractional shares or a mixture of DIY and automated investing.

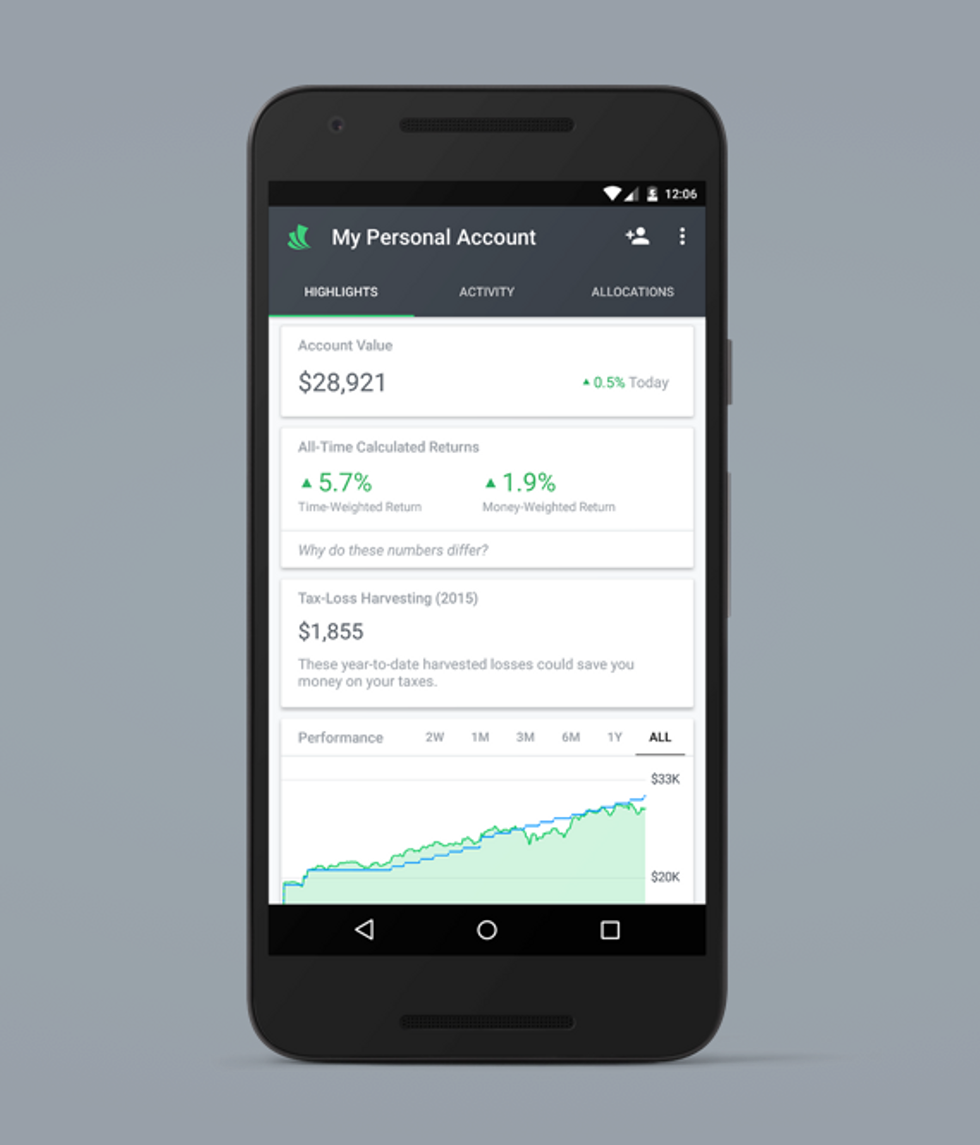

Betterment: The Hands-Free Helper

Imagine having your own personal finance Fairy Godmother. That's Betterment. This robo-advisor does the heavy lifting, making investment decisions based on your goals and risk tolerance. It's like having a financial planner, but without the awkward small talk. With their goal oriented tools and useful tax strategies, Betterment is definitely an underrated option.

E*TRADE: The OG Investor

Unlike other apps, E*TRADE has been around the block – it's the original gangster of online investing. With its roots firmly planted in the '90s, E*TRADE has weathered the dot-com bubble and the rise of smartphones. It's the app your older cousin used to trade tech stocks when the internet was still blurping and bleeping those dial-up noises. E*TRADE’s for the investor who wants a bit of tradition with a side of tech-savvy. Known for their exceptional customer support, E*TRADE also allows users to invest in futures, mutual funds, and advanced option strategies.

Who Takes the Crown?

If you're all about simplicity and love a good visual, Robinhood might be your go-to. For the saver who wants an investing habit that’s an automatic reflex, Acorns is the one. Stash appeals to the investor with a cause, while Betterment caters to those who seek a stress-free experience. And if you're looking for more advanced trading tools, E*TRADE is a good old reliable choice.

Ultimately, the smartest investment app should align with your financial goals and make you excited about growing your wealth. The best way to learn is by giving them a try!

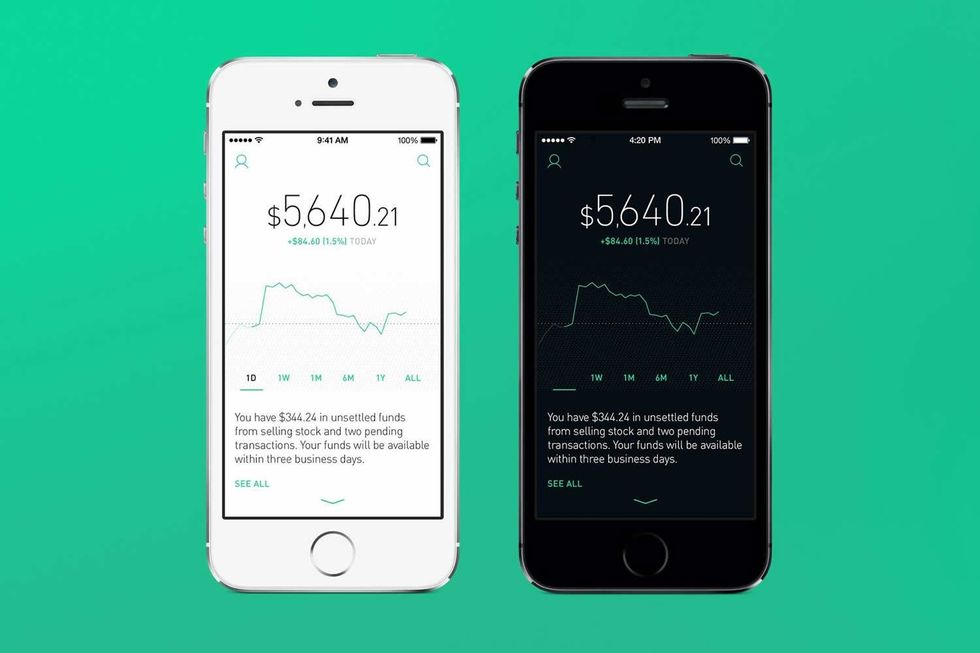

The sleek designed interface of the Robinhood app is easy to use

The sleek designed interface of the Robinhood app is easy to use The statistics and return on individual Robinhood stocks is easy to read and understand

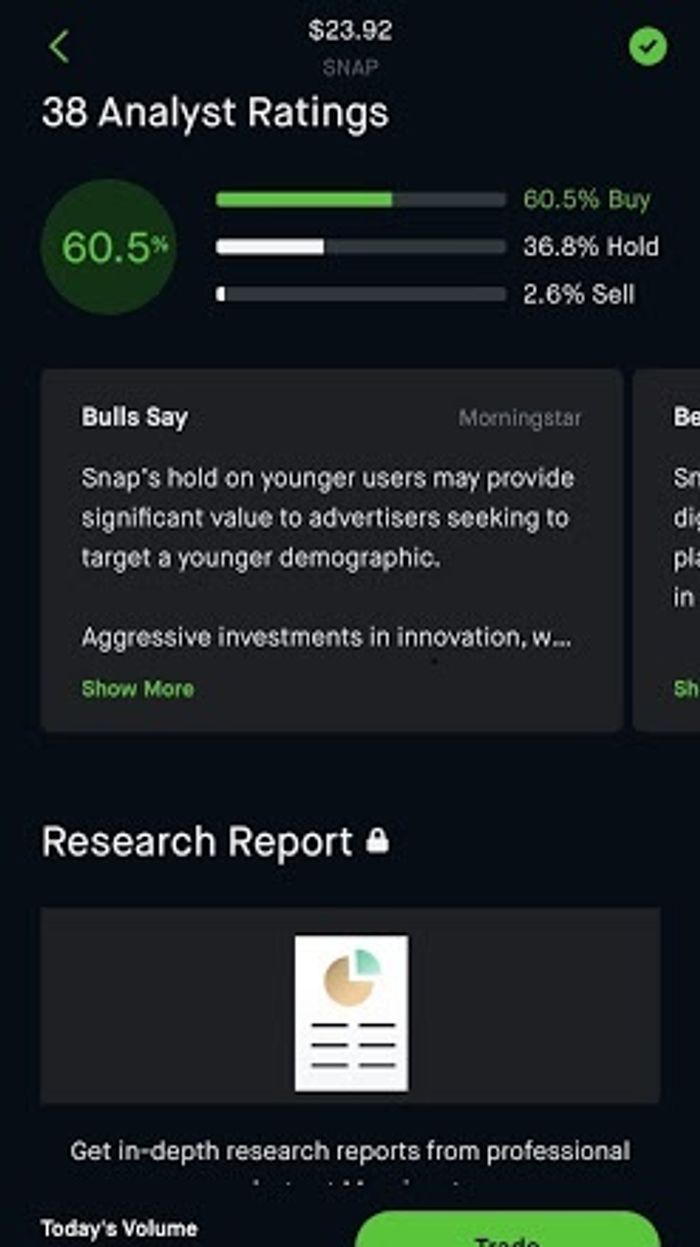

The statistics and return on individual Robinhood stocks is easy to read and understand Some of the popular stocks on Robinhood will show brief analytics, but professional research is only available to Robinhood Gold members

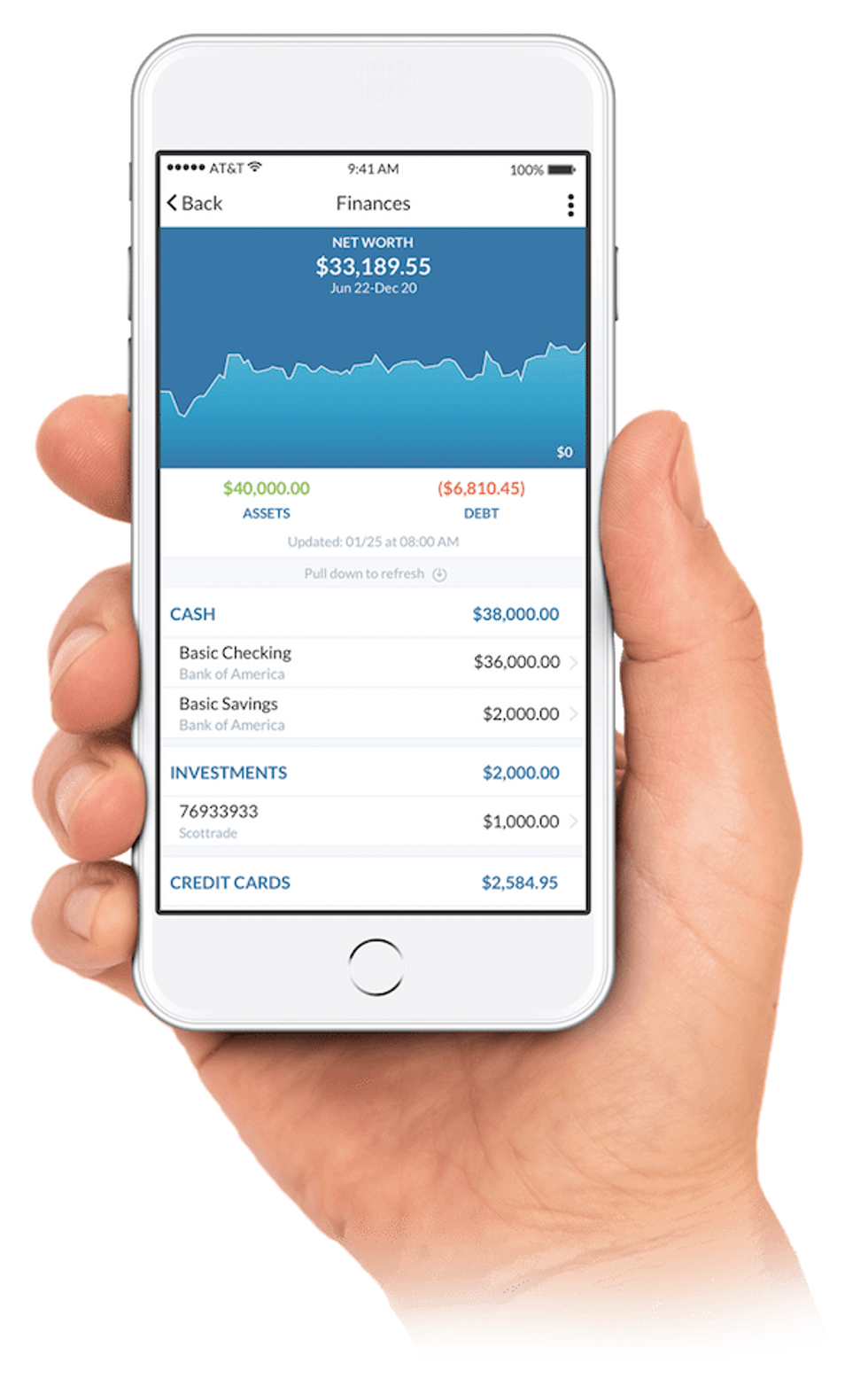

Some of the popular stocks on Robinhood will show brief analytics, but professional research is only available to Robinhood Gold members MoneyLion PlusVia crowdfundinsider.com

MoneyLion PlusVia crowdfundinsider.com RobinhoodVia thefinancegenie.com

RobinhoodVia thefinancegenie.com StashVia stashinvest.com

StashVia stashinvest.com Acorns Via bankers-anonymous.com

Acorns Via bankers-anonymous.com Wealthfront Via blogwealthfront.com

Wealthfront Via blogwealthfront.com