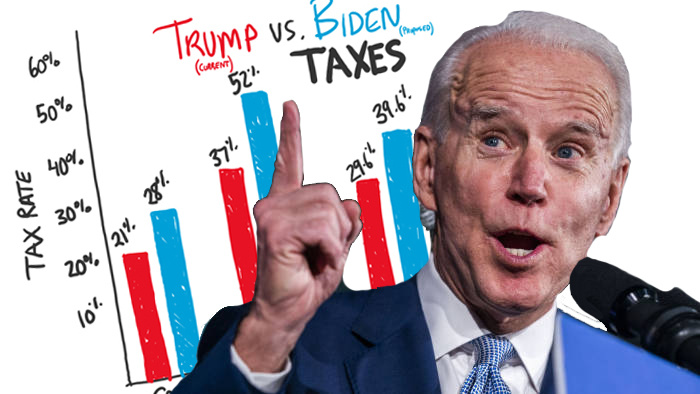

How Will the Joe Biden Tax Plan Affect Me?

Nov 10 | 2020

With the election of Joe Biden to the Presidency, you’re probably here seeking to understand how much your taxes are going to go up. The answer: most people will see no tax increases. The tax plan that Joe Biden has rolled out is targeted at individuals making more than $400,000 a year, less than 1%