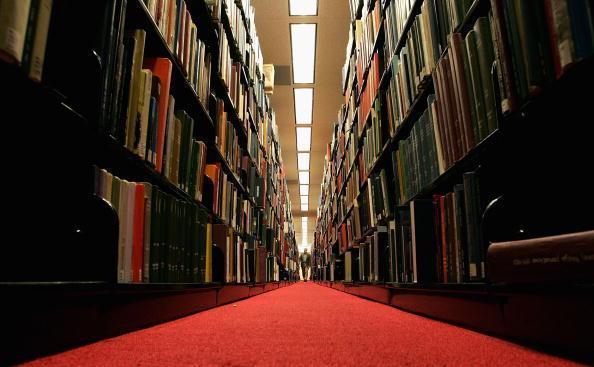

5 Financial Books for Your 20s

May 02 | 2017

The finance books every young adult should read: Personal Finance in Your 20s For Dummies Eric Tyson The clearest and most extensive explanation of everything you need to know about personal finance. If you need to learn what a credit score is, when you should use a checking or savings account, or any other first