In the first week of Wall Street trading in January of 2021, stock in the video game retail chain GameStop (NYSE: GME) hovered at a price of around $18 per share.

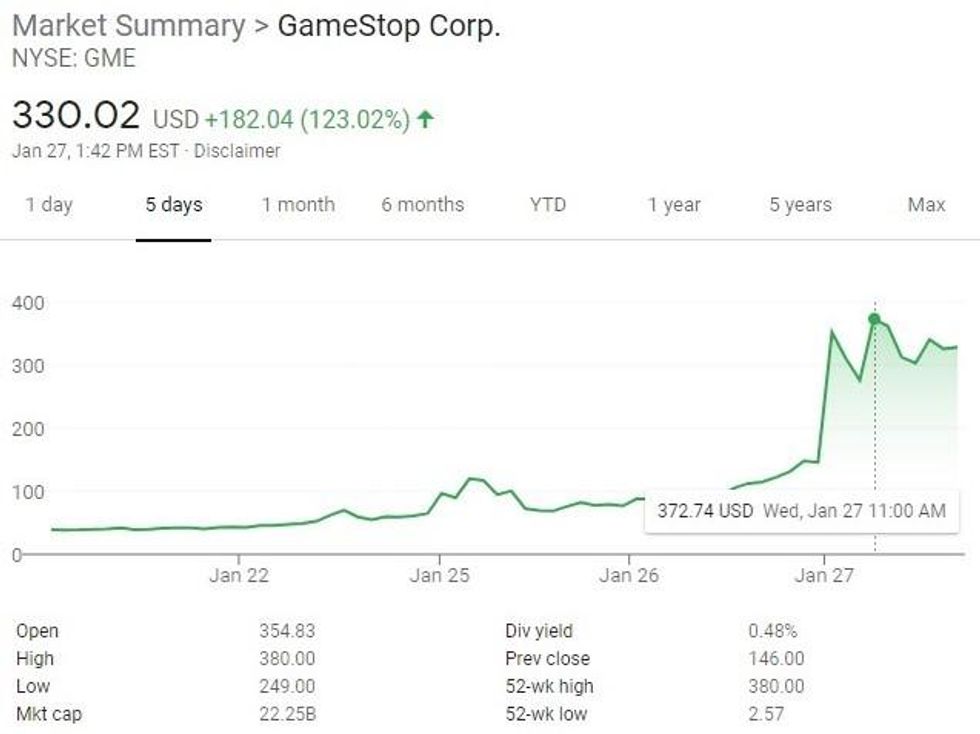

Less than three weeks later, on Wednesday morning those same shares were fluctuating wildly between $250 and nearly $400. This kind of growth is unheard of for an established, brick and mortar retail chain — especially when a pandemic is keeping people indoors.

So what did GameStop do to deserve this incredible rally? Absolutely nothing.

If anything, you could argue that the company's lackluster performance was what triggered this incredible rise, as it was the proliferation of "short" positions — bets against the company's future value — that brought the stock to the attention of the WallStreetBets subreddit.

A subsection of reddit with millions of subscribed users, WallStreetBets describes itself as, "Like 4chan found a Bloomberg Terminal." In other words, it's a place for Extremely Online and unserious hobbyists to overanalyze the absurdly complex data that professional traders use to make investment decisions in the stock market.

Generally speaking, this leads to some pretty reckless speculation that often does not pan out well for the users. They're like small-time gamblers boosting each other up to play with the high rollers, and it's not uncommon to see a post from a redditor explaining how they lost their life savings.

But in this case they managed to turn that dynamic around. Like those little dinosaurs from Jurassic Park 2, individually they are small and vulnerable, but if they work together, they can take down the big assh**es...or, medium-sized ass**les anyway. They won't be tackling T-Rex or J.P. Morgan any time soon.

But what actually happened? The answer is complex, but the basic version requires a brief explanation of the slightly sketchy practice of short selling. Also known as "shorting," short selling inverts the standard "buy low, sell high" model of trading.

When a trader identifies a stock that they think is overvalued — because of hype, fraud, or expected trends — they borrow someone else's shares and immediately sell them at the current rate, planning to buy back once the value goes down and return them to the lender with some profit left over from the original sale.

There is also the short-call option, where — for a small fee — you offer a window of time in which to buy shares at a set price above its current value. If the stock rises above that price within the time limit, you have to sell it at a loss. But if it goes down — as you expect — you can just pocket the fee, and never have to truly own the stock in the first place.

In both scenarios you're relying on the idea that the company's perceived value will go down. But the truly sinister aspect is that — when a lot of these bets are being made against a company — it's often taken as a bad sign, leading traders to sell off their stock, driving the value down.

It's a sort of self-fulfilling prophecy that destroys businesses and small-time traders to the benefit of multi-billion-dollar hedge funds. It's the kind of trading that accelerated the financial crisis of 2009 while raking in billions for the scavengers. But if the stock's value just keeps going up — for whatever reason — the hedge fund can end up on the hook for some truly staggering losses.

Investor Chamath Palihapitiya: The GameStop story is pushback against Wall Street establishmentwww.youtube.com

So when WallStreetBets users noticed the overwhelming amount of betting against GameStop, they decided to intervene on the company's behalf — and to make some money for themselves while screwing over some big investors. Never mind that one of the subreddit's official rules prohibits market manipulation. It's for a good cause — kind of.

From there a strange and powerful feedback loop took hold. As more and more redditors bought shares in GameStop, driving the price above $60 over the course of a week, the incentive to treat the stock as overvalued increased — after all, there was nothing in the company's performance to justify the higher price.

Investors poured an additional $2.75 billion into Melvin Capital — one of the biggest short sellers — to cover the losses until the trend turned around. But the short sellers' dismissive attitude toward the early growth actually helped to inflate the price and spurred on the weirdos at WallStreetBets.

With some encouragement from Tesla CEO Elon Musk — who hates short sellers and generally holds a weird amount of petty grudges for a man whose 2020 earnings were literally higher than the GDPs of most countries on Earth — they drove GameStops share prices even higher. And as media coverage (hi there) spread news of this absurd battle — and the dire situation a bunch of weird hobbyists had created for Melvin Capital — the hype only grew, driving the price even higher.

By Wednesday morning, Melvin Capital and Citron Capital — another major proponent of shorting GameStop — had both announced that they were abandoning their short selling positions and swallowing the losses...but WallStreetBets doesn't buy it. Suspecting the investment firms of attempting to let the air out of the story so they can finally profit as the inflated stock collapses back to a reasonable value, redditors have continued pumping up the stock.

But as crazy as all of this is, on some level it serves to expose the insanity that was already there. The stock market is all based on speculation and hype and speculation about the trends in hype — all operating at degrees of removal from the economic realities of the companies involved.

Is GameStop's share price artificially inflated? Absolutely.

But so are a thousand other companies that have spent tax cuts and government bailouts on stock buybacks, rather than paying their workers a fair wage or investing in new ventures. It may make for a more dramatic story — and will probably end up inspiring more regulatory pushback — but is the game they're playing worse than the short sellers themselves working to depress stock prices?

For so long we have been taught to treat the stock market as an index of our nation's whole economy. Perhaps that's why, in 2020, the one area where the government wasn't stingy with its support was in propping up the financial sector.

As a result, the Dow Jones Industrial Average quickly recovered from an early COVID crash and ended up increasing in value by 10% over the course of the year. At the same time we saw record-breaking unemployment, endless lines at food banks, and thousands upon thousands of businesses folding as a result of the protracted half-measures of our noncommittal COVID lockdown.

More than any flash crash or high-frequency middlemen, some weirdos working together on Reddit have helped to expose how unreal the whole system is. The stock market is not the economy. It's just a weird, artificial, predatory game our billionaire overlords play with the economy. And at the moment, some regular nerds are outplaying them — and potentially making millions in the process.

There's no way of knowing quite how high GameStop's stock will rise, or what will happen to the company when it eventually crashes back to Earth — there's not really a precedent for this. But hopefully the whole ordeal will serve as a lesson for the hedge funds, investment banks, and other bloated parasites thriving in a hellish economy — that every now and then, the little guys can bite back.

As of Wednesday afternoon, the hype is still going, with the phrase "to the moon" trending on Twitter, and WallStreetBets continuing to inflate the share price of GameStop along with AMC and Blackberry — whose stocks were similarly targeted by short sellers.

- GameStop's Coronavirus Response Proves It's Time to Close ... ›

- Tesla's BTC Billions: Why a Car Company Invested in Crypto - Popdust ›

Nara Smith@NaraAzizaSmith via TikTok

Nara Smith@NaraAzizaSmith via TikTok